Earnings Returns Forecast a Banking Crisis

IDC Financial Publishing, Inc. (IDCFP) uses the acronym CAMEL and its component financial ratios to evaluate the safety and soundness of commercial banks and savings institutions. This article explains how IDCFP uses “E” earnings returns as a component of its CAMEL ranking system and why it is valuable and important to monitor.

The separation of Earnings in ROE between Earnings from ROEA and ROFL provides insight into management’s operating and financial decisions and management style. Good management strives to increase Return on Equity (ROE) above IDCFP’s definition of Cost of Equity (COE). Success in raising ROE greater than COE is demonstrated by the commensurate higher levels of stock price to book value (a consistent linear relationship as presented by IDCFP each quarter).

ROEA is defined income from operations before funding costs (income from loans, investments and non-interest income, less operating expenses and applicable taxes and the change in the loan loss reserve, as a percent of earning assets) to reflect operation of a bank or savings institution, as if equity and loan loss reserves were total liabilities and capital.

ROFL is defined as income from financial operations. It reflects the degree to which a bank or savings institution uses deposits and debt to finance its operating strategy based on the after-tax cost of these deposit and debt funds. ROFL consists of leverage spread (return on earning assets less cost of adjusted deposits and debt, both after-tax) times the leverage multiplier (the ratio of adjusted debt to equity plus the loan loss reserve). Adjusted debt equals earning assets (before the loan loss reserve) less equity capital and loan loss reserves.

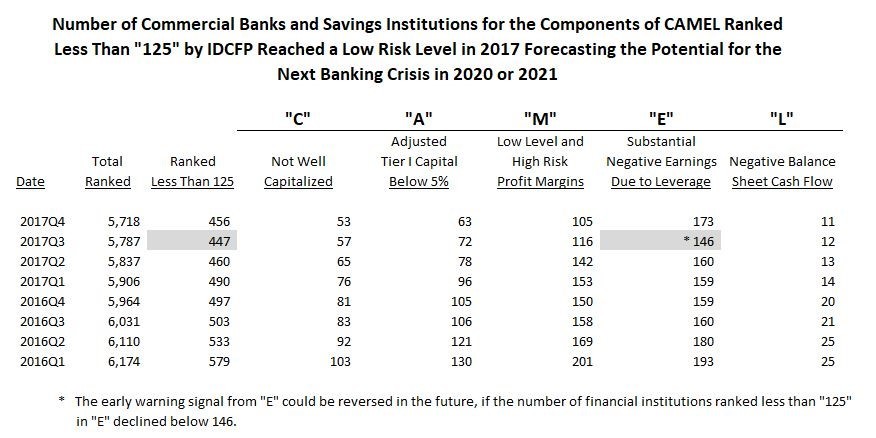

Commercial Banks and Savings Institutions with ROE less than COE and Negative Return on Financial Leverage (ROFL) are so Deficient in Profitability to Receive an IDCFP Rank Below “125” (300 the Highest and 1 the Lowest)

ALERT

The “E” Component of CAMEL, as Well as, the Total of Banks Ranked Less Than “125”, Indicates Risk from our Early Warning System of a Future Financial Crisis in 2020 or 2021.

The low risk level in the number of banks and savings institutions of 146 ranked less than “125” in “E” in the 3rd quarter 2017, caused a low for all institutions ranked less than “125” of 447 in the 3rd quarter of 2017 (see Table I).

The risk in a bank or savings institution is a negative ROE, which destroys equity capital. The risk is amplified, however, to the institution’s safety and soundness, when ROFL is negative. The operating earnings ratio (ROEA) is low or negative and the cost of adjusted deposits and debt exceeds ROEA, causing a negative leverage spread, and then, times financial leverage, creates an even greater loss, as reflected in ROFL. Currently, a negative ROFL has been exhibited in smaller banks. As the Federal Reserve raises the fed funds rate by 1% to 1.5% in the next two years, the low levels of operating returns (if not corrected) accompanied with rising costs of funding, create continuous future losses in net income for these 173 firms and, potentially, more financial institutions. Given Reported and Continuing Future Losses, Recent Tax Reductions Fail to Assist These Institutions.

Table I

All 5 categories of rank, C-Capital, A-Adequacy of Capital, M-Margins as a Measurement of Management, E-Earnings from Operations and, separately, Earnings from Financial Leverage, and finally, L-Liquidity all together provide a timely indication of risk and potential failure. Additional components of CAMEL, however, are required to increase in the count of banks under “125” in other CAMEL components to confidently forecast the severity of the coming banking crisis.

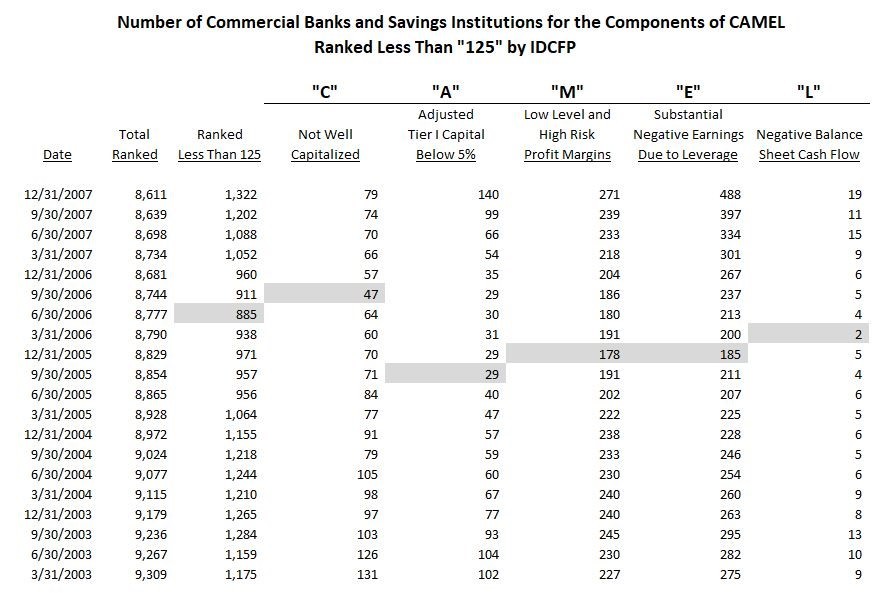

Early Warning Indicators in 2005 and 2006 (see Table II)

The low in the number of commercial banks and savings institutions ranked below the industry standard as investment grade “125” occurred in the 2nd quarter of 2006, two years before the banking crisis in 2008. Most important, however, is that all but 1 of the 5 components of CAMEL reached a low in their number of institutions from the 3rd quarter of 2005 through the 1st quarter of 2006 – prior to the low count for all institutions ranked less than “125” in the 2nd quarter of 2006.

As seen in Table II below, commercial banks and savings institutions not well capitalized (“C” in CAMEL) reached a low of 47 in the 3rd quarter of 2006. Financial institutions measuring adequacy of capital with adjusted Tier 1 capital below 5% (Tier 1 capital adjusted for bad and delinquent loans net of the loan loss reserve), the “A” in CAMEL, reached a low count of 29 in the 3rd quarter of 2005. Banks and savings institutions with a lack of profitability or low and unstable margins, the “M” in CAMEL, reached a low of 178 in the 4th quarter of 2005. The commercial banks and savings institutions with severe negative “Earnings due to Leverage” (the “E” in CAMEL) reached their low of 185 in the 4th quarter of 2005, two quarters before the total number of institutions ranked below “125” reached its low in the 2nd quarter of 2006. Finally, institutions with high loan delinquency and negative balance sheet cash flow – the “L” in CAMEL – reached their low of 2 in the 1st quarter of 2006.

Table II

Components of CAMEL Forecast Banking Crisis in 2005, up to Three Quarters Before the Total Ranked Below “125” in June of 2006

IDCFP has been helping CD brokers and investors, insurance companies, federal agencies, numerous state governments and a host of other institutions make better decisions using its unique and proprietary CAMEL rating methodology since 1985. For more information on CAMEL go to www.idcfp.com or call 1-800-525-5475.