How ROE Greater than COE Adds Value

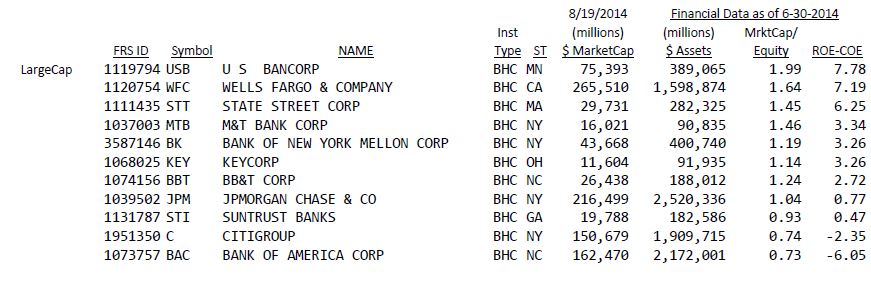

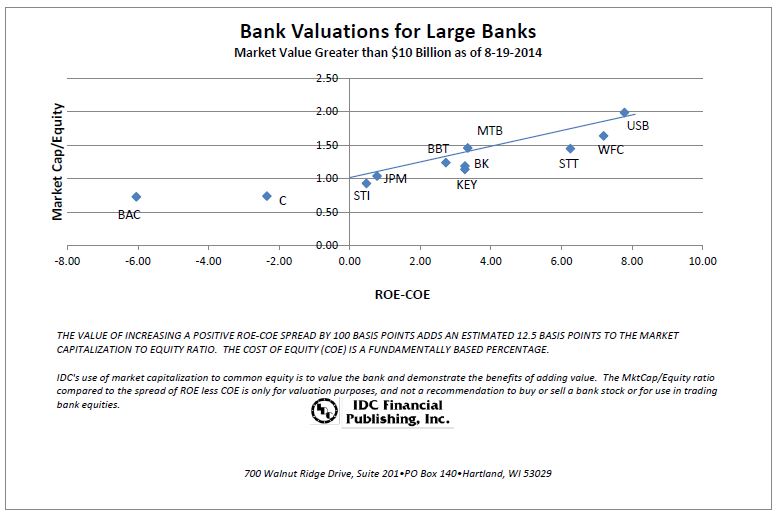

Large capitalized banks continue to price equity market capitalization to book value of common equity relative to IDC’s return on equity (ROE) less IDC’s cost of equity capital (COE) in a straight line (see chart).

US Bancorp (USB) with a ROE greater than COE (a difference of 8 percentage points) sells at 2 times book value. Each dollar of growth in USB’s common equity translates into two dollars of incremental market value. Banks add value with ROE above COE with price greater than book value. Banks increasing ROE above COE, or the spread, add even more value.