IDC Investment Grade Banks

The National Bureau of Economic Research has listed the last recession as lasting from December, 2007 until June, 2009, a period of 18 months. During that time period, banks faced problems with accelerated levels of delinquent and non-accrual loans, foreclosed assets, and an inability to generate sufficient income to maintain a strong capital base. During and immediately after this “Great Recession” banks worked diligently to shore up capital and improve their balance sheets.

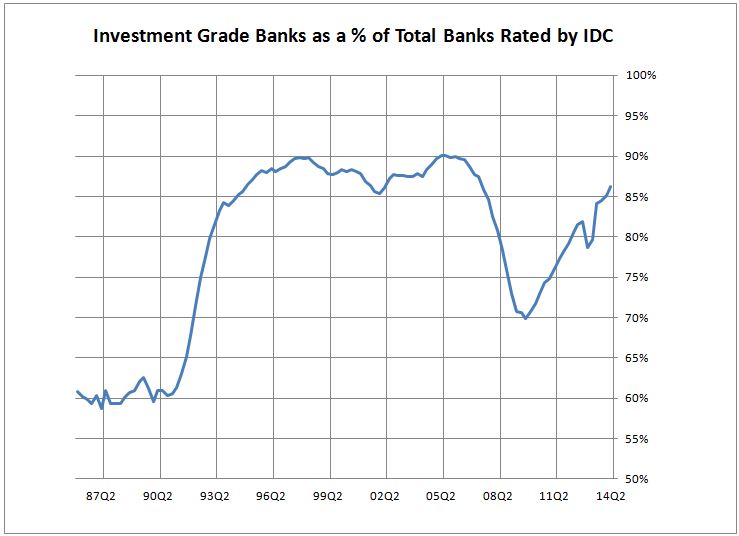

IDC Financial Publishing, Inc. (IDC) ranks banks using its unique CAMEL methodology which provides a one number summary rank from 1 (the lowest) to 300. IDC’s lowest ranks range from 1-74 followed by a below average ranking of 75-124. Ranks from 125-164 (average), 165-199 (Excellent), and 200-300 (Superior), round out the categories of IDC rankings. IDC considers banks rated greater than “124” to be “investment grade”. The graph below indicates the IDC “investment grade” banks as a percent of the total banks rated for the period from December 1985 through June 2014. The percentage of “investment grade” banks remained fairly steady through the years 1994 to 2006. The 3 year period from 2007 through 2009 saw this percentage drop precipitously followed by its current recovery in 2010 to 2014. Banks have more to improve to reach the 90% level of 7 years ago.