Mortgage Purchase Applications Increase Fuels Growth in Brokered Deposits

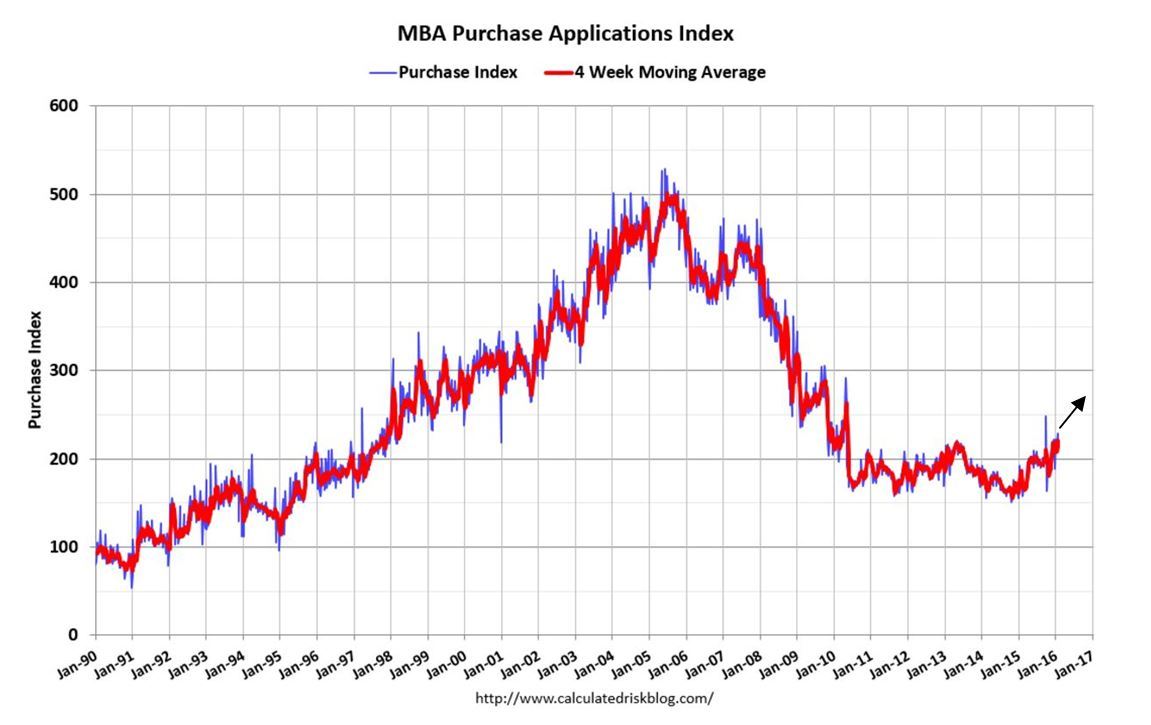

The Mortgage Bankers Association (MBA) reported on January 29, 2016 that the week’s results for the MBA Purchase Applications Index were 17% higher than the same week one year ago after a flat pattern of no growth over many years. The index of MBA Purchase Applications should accelerate in 2016 toward a level of 270 (see chart below).

The current breakout in MBA Purchase Applications could set the stage for multi-year double digit growth in mortgages, which in turn could increase substantially the growth in community bank lending. The issuance of brokered certificates of deposit (CDs) could be an alternative to raising rates or obtaining advances from the Federal Home Loan Bank to attract new deposits. A large number of banks utilize the brokered CD market to satisfy their funding requirements. As mortgage applications continue to accelerate, there will most likely be a corresponding increase in brokered deposits.

IDC Financial Publishing, Inc. (IDC) took a look at banks with loan growth greater than 8% a year to compare institutions issuing brokered CDs with those not issuing brokered CDs. Of the 663 banks that issue brokered CDs, the median bank had loans of $322 million (14.5% annual growth) and deposits of $352 million (9% annual growth). The loan to deposit ratio was 91.5% and the annual growth in brokered deposits was 18.7%. Of the 1,133 institutions that didn’t issue brokered CDs with assets greater than $100 million, the median bank had loans of $154 million (12.8% annual growth) and deposits of $200 million (5% annual growth). The loan to deposit ratio was only 77% and the annual growth in brokered deposits was only 1%. IDC’s research indicates loan to deposit ratios above 84% generate an acceleration in brokered deposits. IDC believes that as community bank mortgage lending accelerates, those banks not issuing brokered CDs could benefit from the advantages of using this form of funding.

In general, brokered deposits supply higher rates of return to depositors than those offered directly by banks, which are called core deposits. Banks access brokered deposits when their ability to attract deposits directly is limited, or when they are willing and able to make more loans than their existing core deposits can support.

High levels of brokered deposits were a contributing factor in both the savings and loan crisis of the late 1980s and by 2 savings and loans in the most recent financial crisis. As a result, some investors view high levels of brokered deposits as indicating weak or overly aggressive banks. This is not necessarily the case, however, since many banks have chosen to access deposits through brokers, as a means of reducing the internal expenses associated with direct marketing or due to a lack of availability of core deposits in their market area.

IDC’s quarterly deposit database contains data on loans, assets, and total deposits, as well as types of deposits such as, savings, MMDA, demand, time, and brokered deposits. The data is sortable and, when used in conjunction with IDC’s rating system, gives the best picture of an institutions capacity for different types of funding.