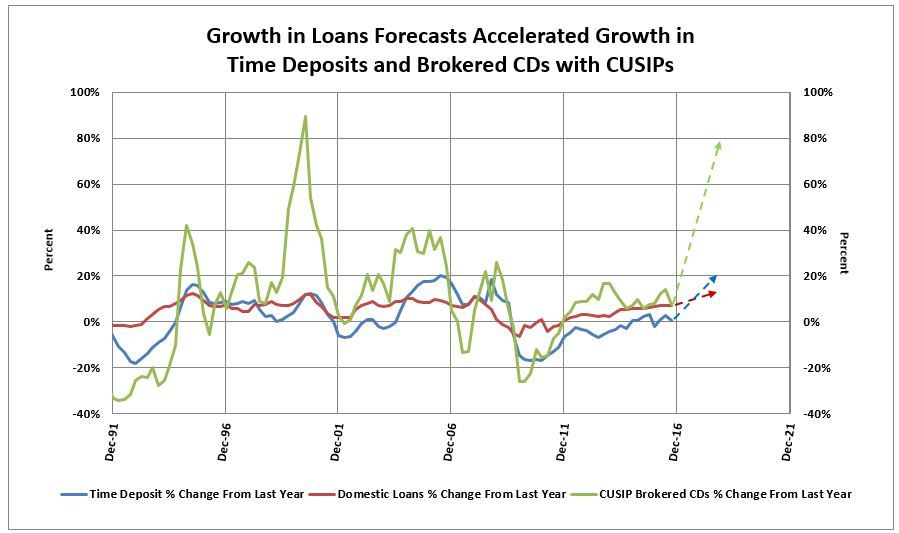

Annual Growth in Brokered CDs Could Reach 80% in 2017-18 As Loan Growth Accelerates to 15%

Growth in estimated brokered CDs (brokered deposits excluding reciprocals and sweep accounts) is highly cyclical, reaching as high as 40% to 90% growth, during periods of 10% or more growth in loans with up to 20% growth in time deposits.

Loan growth is currently 8%, but under Trump economics in the next few years, could accelerate to 15% or more.

Time deposit growth remains near zero, as ample liquidity from growth in demand deposits and MMDAs support current loan growth. Under Trump economics and tighter liquidity from the Fed, time deposit growth is expected to accelerate to 20% in coming years (see blue line in Chart I).

Brokered CDs, estimated by brokered

deposits less reciprocal and sweep accounts, continue to grow at 8% plus, as

experienced in recent years. An

acceleration in loan and time deposit growth in 2018 creates the opportunity

for 80% growth in brokered CDs (see green line in Chart I).

Chart I