Benefits of High Market Capitalization to Common Equity

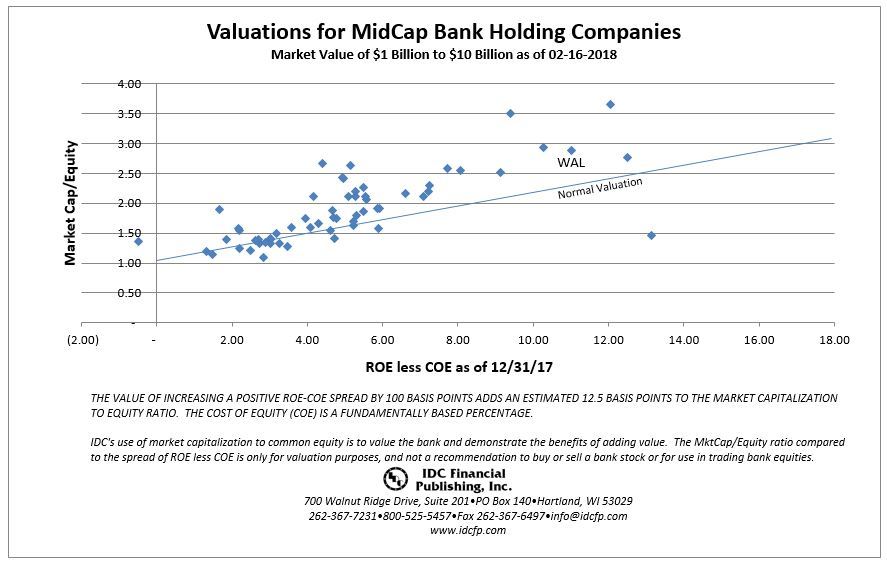

The benefits of a high market capitalization to common equity are twofold. As an example, one benefit is Western Alliance Bancorp (WAL) sells at a market value equal to 2.9-times equity due to a spread of ROE less COE of 11.0%. The second benefit is a high ROE generates a high reinvestment rate or growth in common equity, thereby increasing market value at the reinvestment rate.

Western Alliance Bancorp demonstrates a simple business model stressing loans and deposits with a limited number of branches. Their customers tend to be a diverse cross section of all business and individuals. The bank, with $20 billion in assets, has a very clean balance sheet and very low non-interest expense when compared with its peers. Although heavily weighted in commercial real estate loans, Western Alliance Bancorp has been able to maintain low levels of non-performing assets. They also prefer to avoid high-risk derivatives. All of these characteristics with a high ROE provided earnings growth, which led to increasing share values. Western Alliance Bancorp share value, as of 2/16/2018, increased 1,638% since its low point in December of 2009 and outperformed its peers.

For further information or to view other products and services please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.