Brokered CDs Outstanding Forecast to Accelerate 58% to $445 Billion by Year-End 2019, Up from a Reported $282 Billion in the 4th Quarter of 2017

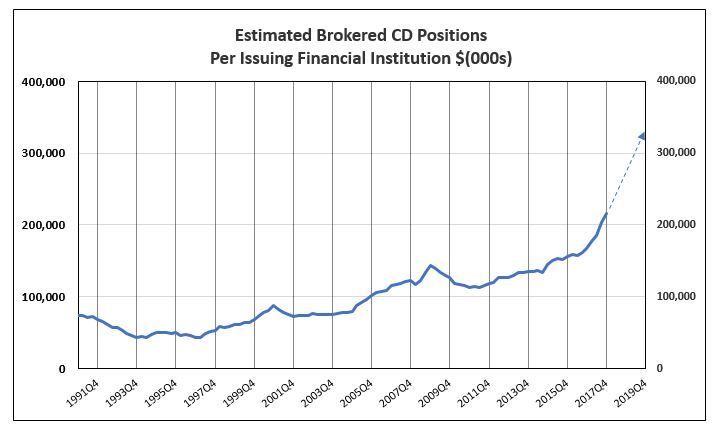

The growth in brokered CDs increased in the average brokered CDs per issuing financial institution from $44 million in 1997 to $216 million in 2017. The growth was due to the increase in insurance levels to $250,000 in July 2010, mergers of banks issuing brokered CDs, and strong growth in loans and deposits and, therefore, time deposits for the core banks issuing brokered CDs. Using estimates of brokered CDs outstanding, IDCFP divided the estimate each quarter by the number of financial institutions with brokered CDs outstanding. The level of brokered CDs per issuing institution peaked at $143 million in the 4th quarter of 2008. The per bank brokered CD outstanding average fell to under $116 million in 2010. Since then, the balance of brokered CDs per institution has risen to a record $216.4 million in the 4th quarter of 2017. The growth in brokered CDs per issuing bank rose from $2.6 million a quarter in 2016 to $13.2 million in the 4th quarter of 2017, and an estimated $15 million in the 1st quarter of 2018 to an estimated average balance of $231.4 million, as of March 31, 2018.

The number of banks, thrifts and credit unions with outstanding brokered CDs was 1,304 in the 4th quarter of 2017. As tax cuts, deregulation, infrastructure spending, and other government initiatives drive rising spending, GDP growth will expand 3% or more a year, causing bank lending to grow (as does the volume of time deposits) and more financial institutions to issue more brokered CDs. Brokered CDs outstanding are now 21.5% of their respective time deposits, up from 15.1% in the 4th quarter of 2008. The proportion of outstanding brokered CDs as a percent of time deposits of banks issuing CDs has grown consistently each quarter from 2008 to 2017, and is projected to reach 25% by year-end 2019.

IDCFP estimates brokered CDs per issuing financial institution will rise to $330 million by 2019 (see chart below). The number of financial institutions with outstanding brokered CDs could expand to 1,350. Estimated brokered CD balances would then rise to $445 billion in 2019, a 58% increase from the 4th quarter of 2017 reported balance of $282 billion.