How IDCFP Forecasts the Next Banking Crisis

Brokers of CDs and investors in CDs, as well as insurance companies, federal agencies, state governments, interbank lending, and a host of other institutions rely on IDC Financial Publishing’s (IDCFP’s) CAMEL rankings to make better business decisions. Our unique and proprietary methodology provides early warning signs of the next potential banking crisis.

This article summarizes the components of CAMEL, and how this approach is used to forecast the next potential banking crisis. The period of growing bank risk seen in 2005-2006 signaled the crisis of 2008-2009. We use that history and note the trends in our CAMEL analysis today that mimic the growing risk seen in the past.

Too Early to Call

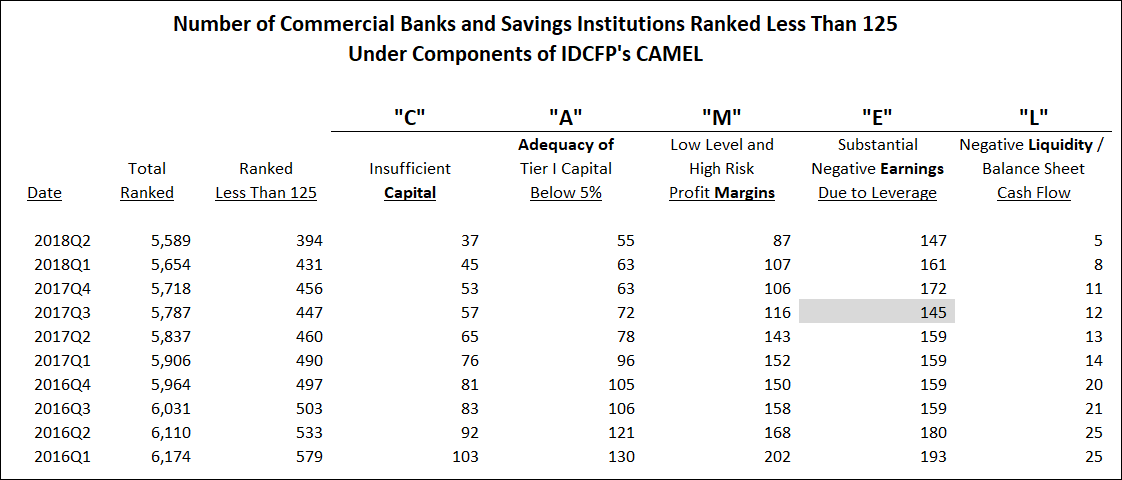

Of the 5,589 banks rated by IDCFP, the total number of banks ranked less than 125 continues to decline, but one component of our CAMEL rating exhibited a change in direction. As shown in Table I column “E,” more banks began exhibiting negative returns on financial leverage (ROFL*) in 2017 Q4. While the banks ranked less than 125 in column “E” rose in late 2017, this number retreated to 147 in the 2nd quarter of 2018, slightly above the 2017 low of 145.

*ROFL = operating returns on earning assets minus the cost of funding as a percent of adjusted debt (both after tax) multiplied by leverage.

The other 4 components of IDCFP’s CAMEL continued to decline in the 2nd quarter to new lows, indicating some time before a reversal. “C” or number of institutions with capital that is deemed insufficient is still declining, currently at 37. “A” or institutions measuring adequate Tier 1 Capital adjusted for loan delinquency fell to 55. The “M” in CAMEL, or profit margins as a measurement of management, fell to 87. Finally, “L” or institutions with negative liquidity in balance sheet cash flow is also still declining, currently at a level of 5 institutions (see Table I).

Table I

The Effect of Rising Interest Rates in a Strong Economy

The Federal Reserve raised interest rates twice in 2018 to a decade high of 2%. The Fed is expected to increase rates 2 more times in 2018 and up to 4 times in 2019, given the strength of the economy and lows in unemployment.

Banks have operated in a low interest rate environment for many years. For profit margins to remain strong or increase, banks are required to charge higher loan rates to compensate for the rise in funding costs. With a 10-year T-Note yield of 4% or higher in coming years, banks will be able to raise interest rates on loans.

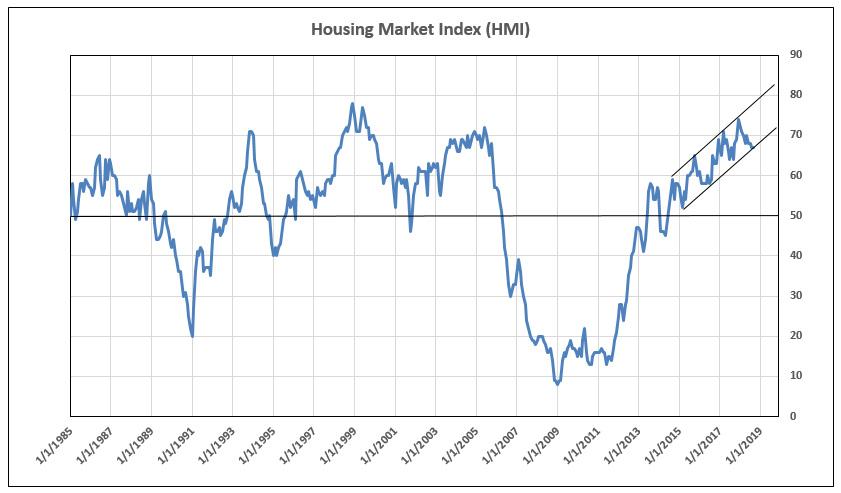

Loan delinquency primarily impacts the “A” and “L” in IDCFP’s CAMEL rating, keeping these components repressed. However, following a robust economy in 2018, 2019 or 2020, a recession in the housing market is possible in 2021. With bank lending highly focused on home loans, bank loan delinquencies could accelerate as a result. IDCFP monitors the Housing Market Index (HMI), which measures home buying confidence and traffic, and uses this index as a leading indicator of a housing downturn and potential rise in home loan delinquencies. The HMI at 67 in September 2018 continues the trend upward and remains substantially above an indication of recession reading of 50 (see Chart I).

Chart I

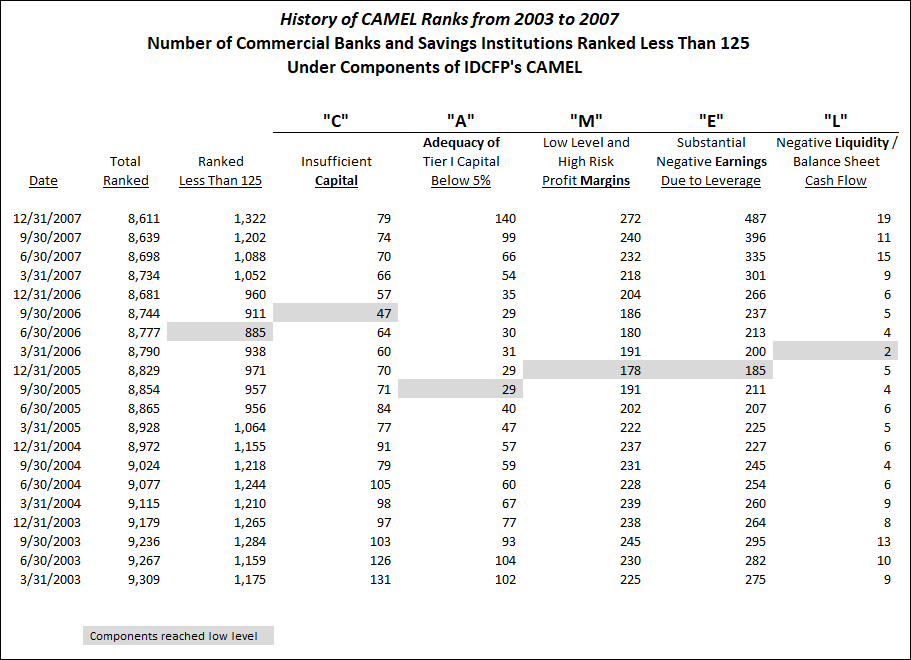

History of Early Warning Indicators

The number of commercial banks and savings institutions ranked below 125 reached a low in the 2nd quarter of 2006, two years before the banking crisis in 2008. More importantly, leading up to this point, 4 out of the 5 components of CAMEL also reached lows from the 3rd quarter of 2005 through the 1st quarter of 2006, and then began to rise.

As seen in Table II below, commercial banks and savings institutions with insufficient capital reached a low of 47 institutions in the 3rd quarter of 2006. Financial institutions measuring adequate Tier 1 capital, adjusted for delinquency below 5%, reached a low count of 29 in the 3rd quarter of 2005. Banks and savings institutions with a lack of profitability, or low and unstable margins, reached a low of 178 in the 4th quarter of 2005. The commercial banks and savings institutions with severe negative earnings due to leverage reached their low of 185 in the 4th quarter of 2005. Finally, institutions with high loan delinquency and negative balance sheet cash flow, or negative liquidity reached their low of 2 in the 1st quarter of 2006.

Additionally, in June 2005 the Housing Market Index peaked, and then declined for the remainder of that year. In late 2006 and early 2007, the HMI declined significantly, dropping to 50, confirming a housing recession and rise of bank loan delinquencies.

Table II

As seen in history, the increase in the number of financial institutions with IDCFP’s CAMEL ranks below 125, or below investment grade, forecast the bank financial crisis years later. IDCFP’s ranks are critical for investors to monitor financial institutions.

To view all our products and services please visit our website www.idcfp.com.

For more information about our CAMEL analysis, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.