Reflation Trade Offers New Risks and Rewards

Reflation trade continues to affect the outcomes in the investment market, as the nominal yield on the 5-Year T-Note is projected to rise to 4% by June 2020. Investors should consider both risk and reward with the increase in yields.

- Yields on U.S. Treasury securities are rising to levels that were realized in the period from 2003 to 2006. These higher yields allow banks to increase lending rates, favoring the performance of bank stocks.

- With the 5-Year T-Note projected to rise to 4%, the increase in yields creates price risk, as pricing on existing notes decline to accommodate higher yields.

- During periods of rising yields, ladders of CD maturities should remain short term to capture the higher yields available with rising rates over the next 2 years.

The Floor Became the Ceiling

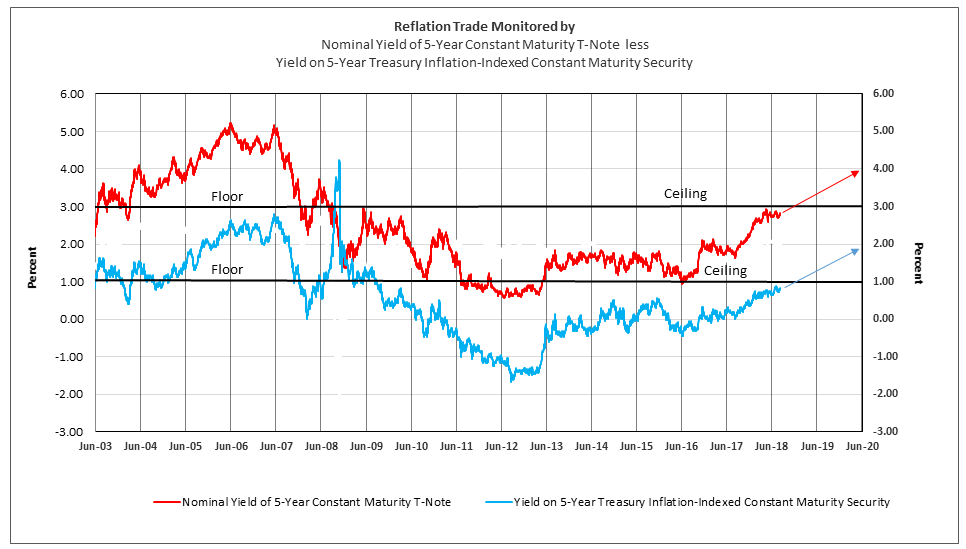

In the period from 2003 to 2007, marked by modest inflation and strong economic growth, the nominal 5-Year T-Note yield (Chart I, red line) fell to a low, or floor, of 3% and rose to a high of over 5%. In the subsequent period of deflation and limited economic growth from 2009 to 2017, yields remained well below the ceiling of 3% (previously the floor). Similarly, the yield on the 5-Year inflation-indexed security (Chart I, blue line) experienced a floor around 1% from 2003 to 2007. Subsequently from 2009 to 2017, the yield remained well below a ceiling of 1%.

Chart I

Current Economic Growth Forecast a Breakout to Higher Yields

Strong economic growth in 2018 and increases in the Federal Funds rate to 2.25% raised nominal yields on the 5-Year T-Note to a 3% ceiling and 1% yield for the inflation-indexed security (see Chart I). Given the ongoing strength of the economy, low unemployment, increased inflation and a rising Federal Funds rate, the 5-Year T-Note yield is forecast to breakout of the 3% ceiling and rise to 4% by June 2020. Likewise, the inflation-indexed 5-Year T-Note yield is expected to breakout and rise from 1% to 2% in the same time frame. In addition, the Wall Street Journal reported recently that 10-Year Treasury yields have room to go higher.

By year-end 2019, the Fed Funds rate is projected to be 3.0% or higher. Investing in a long term (3-5 year) CD today limits your ability to earn the maximum interest possible in the future. Keeping maturity lengths of CD ladders short term allows investors to capture higher yields as they rise. Given the forecast increase in yield of the 5-Year T-Note to 4% and short-term interest rates above 3%, savers, mostly seniors, are expected to benefit from more favorable returns on their investments.

To view all our products and services please visit our website www.idcfp.com.

For more information on our Reflation Trade analysis, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director