Insured Brokered CDs to Accelerate 84% to $800 Billion by Year-End 2022

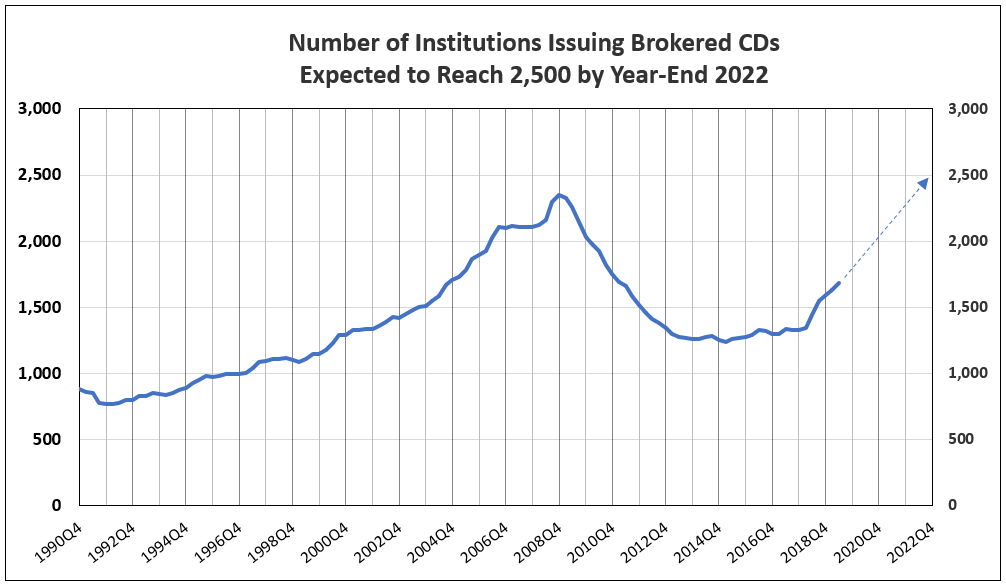

The Number of Financial Institutions Issuing Brokered CDs Continues to Accelerate

The number of institutions issuing brokered CDs has grown at an accelerated rate in recent quarters. Banks, savings institutions and credit unions rose from a plateau of 1,300 in 2017 and increased to reach 1,686 in the 2nd quarter of 2019. At IDC Financial Publishing (IDCFP), we project this trend to continue, and forecast the number of banks and credit unions to reach 2,500 by the end of 2022 (see Chart I).

Chart I

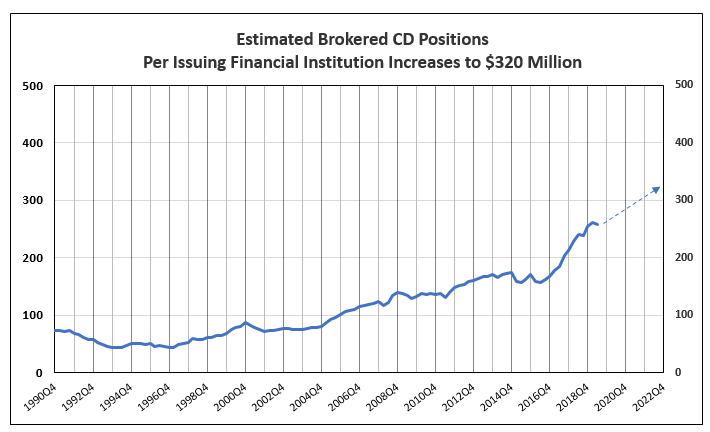

The Value of Brokered CDs per Institution is Also Accelerating

The value of brokered CDs issued per financial institution grew exponentially over the last two decades, from an average of $65 million in 1998 to $257 million in the 2nd quarter of 2019. This growth was due to an increase in government insured levels to $250K, bank mergers, and strong growth in loans for those core banks and credit unions issuing brokered CDs.

Each quarter, IDCFP divides the total reported brokered CDs less than $250K by the total number of financial institutions issuing these CDs. This determines the average value of insured brokered CDs per financial institution. In the 4th quarter of 2008, the average value peaked at $140 million, and then fell to $129 million in 2009 during the banking crisis. Since then, the value per institution has risen, accelerating in the last 2 years to reach a record average of $257 million in the 2nd quarter of 2019 (see Chart II). The increase in value of brokered CDs per institution was $4.3 million per quarter over the past year. We forecast this dollar growth will be $4.5 million per institution per quarter to year-end 2022, to reach a record average of $320 million (see Chart II).

Chart II

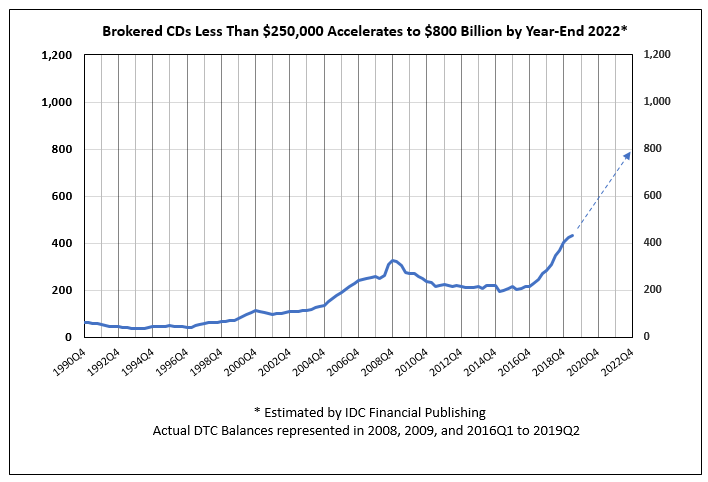

Growth in Outstanding DTC Brokered CDs Forecast at $26 Billion a Quarter

As tax cuts, deregulation, infrastructure spending, and other government initiatives drive increased spending, GDP growth is expected to expand 2.5% to 3% a year. This, in turn, will create bank lending and cause an increased number of financial institutions to issue more CDs. Currently, outstanding brokered CDs account for 25% of time deposits, up from 14.7% in the 4th quarter of 2008. This percentage of outstanding brokered CDs to time deposits has grown on trend from 2008 to 2018 and is projected to reach 31.6% by year-end 2022.

Combining the forecasts above indicates two things: One, the number of banks, thrifts, credit unions and foreign institutions with outstanding brokered CDs will exceed 1,700 by the end of the 3rd quarter of 2019 and rise to 2,500 by year-end 2022. Two, we estimate the average of brokered CDs less than $250,000 per issuing financial institution will rise about $4.5 million a quarter and reach $320 million by the end of 2022.

Our estimate of DTC brokered CDs outstanding will increase 84% from $433 billion at 2nd quarter-end 2019, to reach $800 billion by year-end 2022 (see Chart III); An average increase of $26 billion per quarter, up from $21.8 billion per quarter in the past year.

Chart III

For further information or to view our products and services please visit our website www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director