Assessing Adequacy of Capital to Determine Risk

Covid-19 and a second quarter 2020 short-term recession have created major risk in the banking system. Reports on bank financial conditions to be released in May (2020Q1) and August (2020Q2) will detail this risk. Subscribe to IDC Financial Publishing’s online portal to receive updates.

Forecasting the Next Banking Crisis

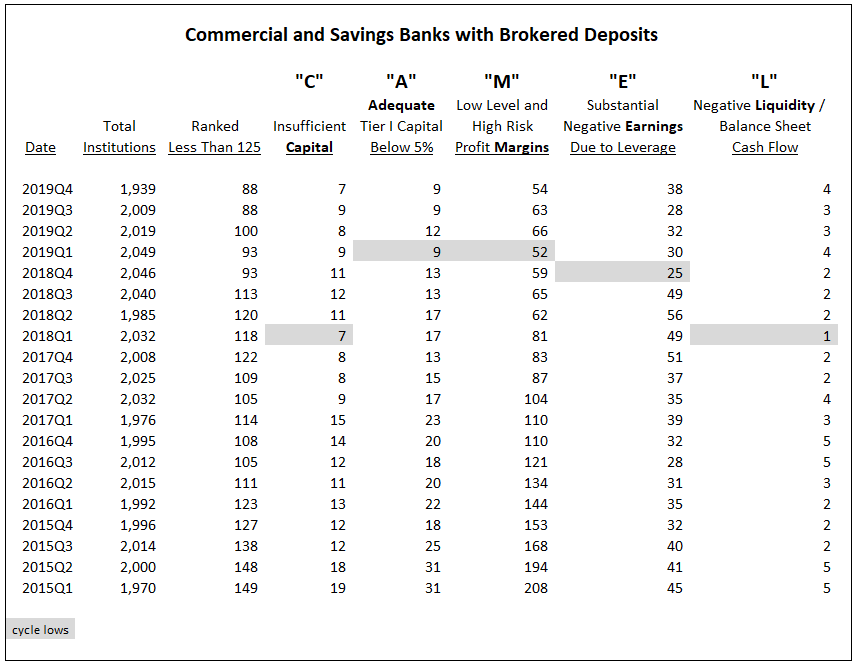

Out of the 1,939 institutions with brokered deposits, we have identified 88 ranked less than 125 in the fourth quarter of 2019, which is unchanged from the previous quarter. When we see the number of these poorly rated banks reach a low and begin to rise, both in the total institutions ranked and by CAMEL component, this indicates the potential for a future crisis.

The acronym CAMEL represents the financial ratios we use to evaluate the safety and soundness of commercial banks, savings institutions and credit unions. Adequacy of Capital in institutions, represented by the “A” component in our CAMEL Rating, measures the amount of adjusted Tier 1 capital.

Tier 1 capital is adjusted by subtracting the amount of loan delinquencies (loans that are 90 days past due, non-accrual loans, plus repossessed assets) in excess of loan loss reserve. An adjusted Tier 1 capital ratio below 5% indicates insufficient capital and loan loss reserves to cover loan delinquencies and can result in an IDCFP rank less than 125.

Our CAMEL ratings range from 300 (the top grade attainable) to 1 (the lowest). From the early 1990’s, through today, institutions using our safety ranks determined that ratings lower than 125 were deemed below investment grade.

Under our CAMEL analysis, only the number of banks ranked below 125 with “substantial negative earnings due to leverage” and “negative liquidity” have risen, while the numbers under other CAMEL components are again in decline or remain unchanged (see Table I). An increase in the total number of commercial and savings banks ranked under 125 in a future quarter would indicate a future banking problem. Banks ranked below investment grade by each component of CAMEL would also be required to advance in number.

A Specific Category of Banks Creates a Superior Forecast

At IDC Financial Publishing, (IDCFP), we focus on commercial and savings banks with brokered deposits as the best indicator of risk in the banking industry. Historically, institutions with brokered deposits* held the majority of all domestic liabilities and equity capital. This was the case in the years prior to the 2008-2009 banking crisis and remains the case today. This universe of banks is the best for statistical analysis and measure of potential financial crisis because of these characteristics:

- Control most of all domestic liabilities and capital, equal today to 91% of all bank holdings.

- High loan and deposit growth.

- Require brokered deposits over and above their core deposits.

Table I

The Warning Signs Before a Financial Crisis

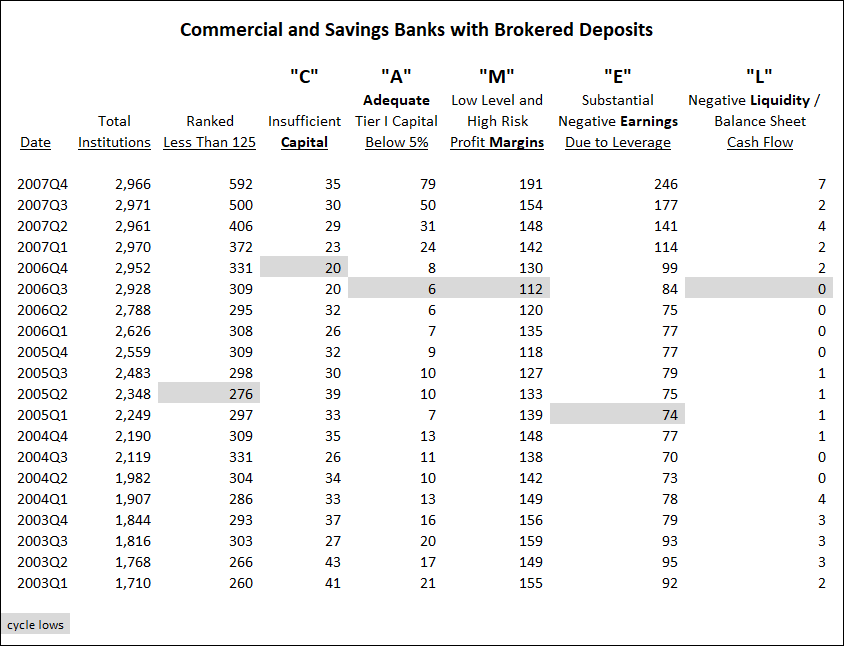

At-risk banks with brokered deposits began to rise in 2005. The number of banks with brokered deposits ranked less than 125 by IDCFP, or below investment grade, reached its low of 276 in the second quarter of 2005, then rose above that level, accelerating in 2007. This rise in banks ranked below investment grade by IDCFP signaled the financial crisis with a 3-year lead time (see Chart I and Table II).

Rise in at-risk banks with brokered deposits under each component of the CAMEL rank also began in 2005. Table II shows how each component of IDCFP’s CAMEL ranks reached cycle lows in the number of institutions ranked under 125 and subsequently rose to higher numbers well in advance of the financial crisis (see Table II).

- The earliest warning came from the E in CAMEL falling to 74 in the first quarter of 2005.

- In the third quarter of 2006, the A, M and L also reached lows.

- In the fourth quarter of 2006, the C in CAMEL reached its low 18 months before the financial crisis.

After reaching lows in number of at-risk banks, note that both the number of total banks and components of CAMEL subsequently accelerated through 2007.

Table II

As seen in history, the increase in the number of financial institutions with an IDCFP CAMEL rating below 125, or below investment grade, forecast the bank financial crisis a few years later. Our ranks are critical for investors to monitor financial institutions and prepare for potential risk.

*Brokered deposits exclude reciprocal deposits in this analysis due to changes in reporting requirements on reciprocals that distort history.

To view all our products and services please visit our website www.idcfp.com. For more information about our CAMEL ratings, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director