True Bank Cash Flow Profitability Versus Bank Estimated Stockholder ROE

Banks were required by accounting boards to increase loan loss reserves in the beginning of 2020. The advent of Covid-19 allowed the banks to estimate the losses and, therefore, additionally increase the loan loss reserve to compensate for the estimated future losses.

While IDC Financial Publishing (IDCFP) reports “stockholders return on equity” we also calculate “Net Operating After-Tax Return on Equity” (NOPAT ROE). Stockholder ROE is simply after-tax profits divided by stockholder tangible equity. IDCFP’s NOPAT ROE is a cash flow based ROE. The numerator equals NOPAT profits plus the change in the loan loss reserve (loan loss provision less net charge offs). The denominator equals the stockholder tangible equity plus the loan loss reserve.

IDC Financial Publishing (IDCFP) measures relative profitability of bank holding companies by comparing the IDCFP return on tangible equity (NOPAT ROE) to our definition of the cost of equity (COE). Margin between ROE and COE (included in the “M” in IDCFP’s unique CAMEL analysis) is a key measure of management.

The Traditional ROE Equation

The traditional ROE equation simply divides net income by the average of common stockholder’s tangible equity capital. The stockholder ROE, as a bottom-line measure of profitability, fails to reflect the true nature of asset quality. In addition, the traditional components of this ROE ratio – net interest margin, net income return on assets (ROA), and resulting stockholder ROE – confuse the source of net income by subtracting cost of funding so early in the analysis. Managers are unable to separately compare operating and financial returns with their peers. Also, use of the loan loss provision, and not adjusting net income for the increase in the loan loss reserve, fails to reflect the true cash flow to earnings.

Our NOPAT ROE Equation

In contrast, the NOPAT ROE equation expresses ROE as a sum of two components. First is the return on earning assets (ROEA). This equals the after-tax return that the bank earns before any interest expense on the debt funds it has invested in loans, securities, cash equivalents, and other earning assets. ROEA focuses on operating strategy, which identifies returns from investments, loans and noninterest income sources. The second component is the bank’s return on financial leverage (ROFL). This reflects both the degree to which the bank uses debt funds to finance its operating strategy and the after-tax cost of these debt funds.

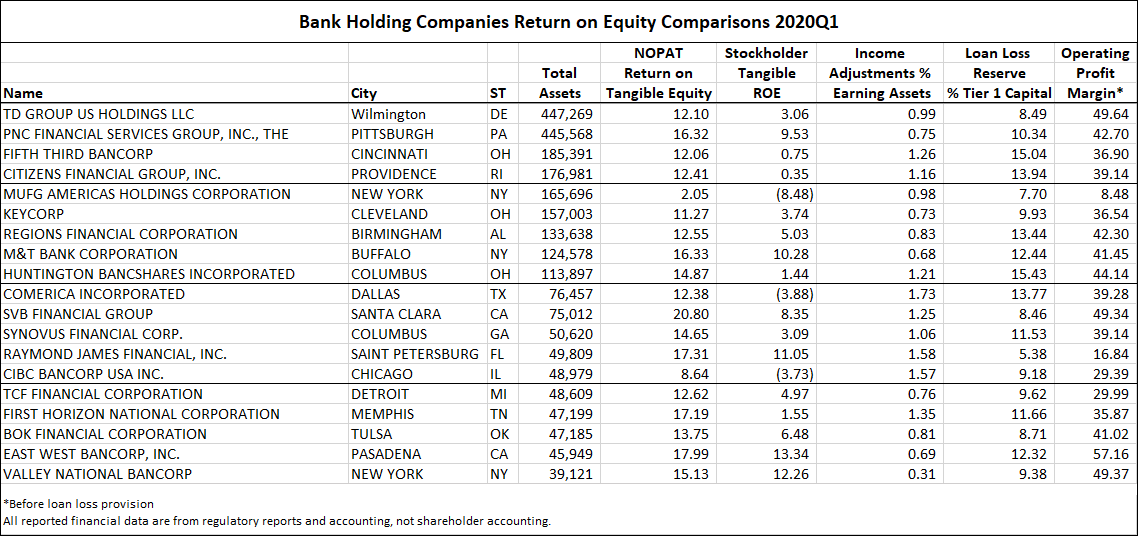

As an example, JP Morgan Chase & Co. reported a stockholder ROE of 5.3% for the first quarter of 2020. Our NOPAT ROE was 16.60%. The difference was mostly due to an income adjustment of loan loss provision less net charge-offs of 0.84% of earning assets. The operating profit margin before loan loss provisions remained a high 38% (see Table I).

The 25 bank holding companies in Table I are a sample of large banks to smaller regional banks with operating profit margins from 57.2% to 8.5%, Tier I capital from 15.4% to 7.3%, and total assets from $3,139 to $39.1 billion.

Table I

Future Comparisons

A bank is allowed the loan loss provision adjustment to project future losses on profitability. IDCFP, on the other hand, computes the true cash flow NOPAT ROE that the bank earns. While the difference is large in the first quarter of 2020, second quarter ROE comparisons, to be reported in August 2020, will tell the story of actual cash loss, and NOPAT ROE compared to the banks estimated stockholder ROE.

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director