IDCFP Estimates Brokered CDs Less Than $250,000 To Continue to Outpace DTC Levels, But Decline to $350 Billion in September

For years, brokers, investment advisors, consultants, and others, relied on the Depository Trust and Clearing Corporation (DTCC) to provide monthly balances of qualifying brokered CDs. Since 2014, however, the level of brokered CDs under $250,000 computed by IDC Financial Publishing (IDCFP) as part of brokered deposits, continues to outpace the levels reported by the DTCC.

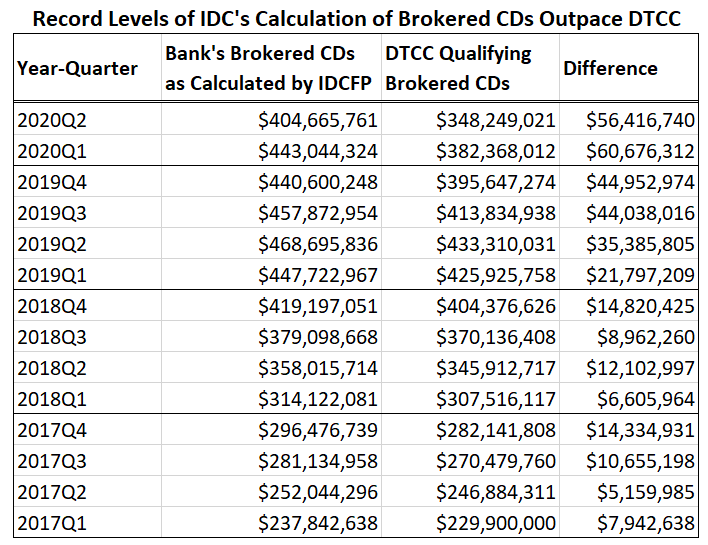

As illustrated in Table I, IDCFP calculated value decreased to $404.7 billion in the second quarter of 2020, while DTCC reported qualifying brokered CDs less than $250,000 of $348.2 billion, a difference of $56.4 billion. Up until 2019, however, the two values were nearly equal.

The difference between the two values remained minimal through 2018. As of March 31st, 2018, the difference was only $6.6 billion, with IDCFP calculating $314.1 billion and DTCC reporting $307.5 billion. From March 2018 to the peak in CDs in June 2019, IDCFP calculated a $154 billion increase to $468 billion, compared to a DTCC gain of $126 billion to $433 billion.

Both values declined in the past year due to an inverted yield curve in 2019 and Covid-19 in 2020. IDCFP estimates fell $64 billion, while DTCC declined $85 billion. The difference grew exponentially from March 2018 to March 2020, going from $6.6 to $60.6 billion. In the last quarter this difference receded to $56.4 billion (see Table I).

Table I

Our calculation uses reported total brokered deposits, less reciprocals and uninsured brokered CDs. We then require an increase in the remainder (insured brokered deposits) to be less than the change in time deposits, in order to qualify as a brokered CD less than $250,000. IDCFP remains confident of its calculation given the many quarters our CD values closely approximated the DTCC reports in history.

IDCFP believes the difference is due to Issuing Paying Agents (IPA) replacing the custodian function of DTCC. IPAs have been in existence for some years at Deutsche Bank, GE Bank, Synchrony, among others. It is likely some banks issuing brokered CDs have switched from DTCC to IPAs. IDCFP welcomes your input on the difference in our calculations of brokered CDs less than $250,000 and the eligible CDs reported by DTCC.

Forecast for Insured Brokered CDs

DTC eligible brokered CDs declined from $348 billion in June, to $327 billion in July, and to $312 billion in August, with the prospect of $300 billion by September 30th. Given a $50 billion difference between our estimates and DTCC reports, IDCFP estimates insured brokered CDs to reach $350 billion at the end of September 2020.

A steepening yield curve and stronger loan growth increases the demand for brokered CDs. A recovery in brokered CDs requires a stronger economy forecast for 2021 and 2022 and would allow brokered CDs to reach $500 billion by year-end 2022.

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director