The Coming Bull Market in Bank Stocks

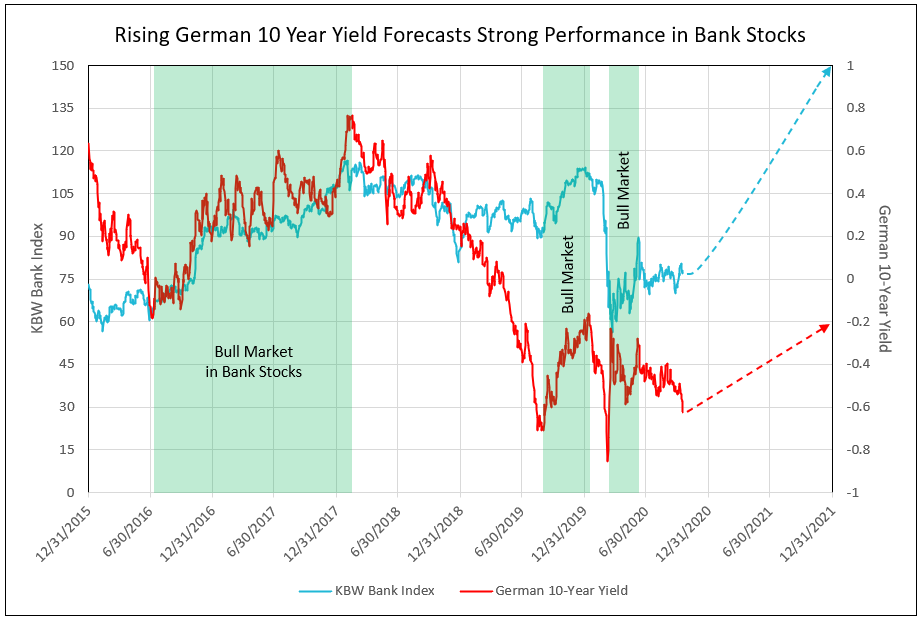

Rising German 10-Year yields, historically, have been the best indication of absolute performance of U.S. bank stock prices.

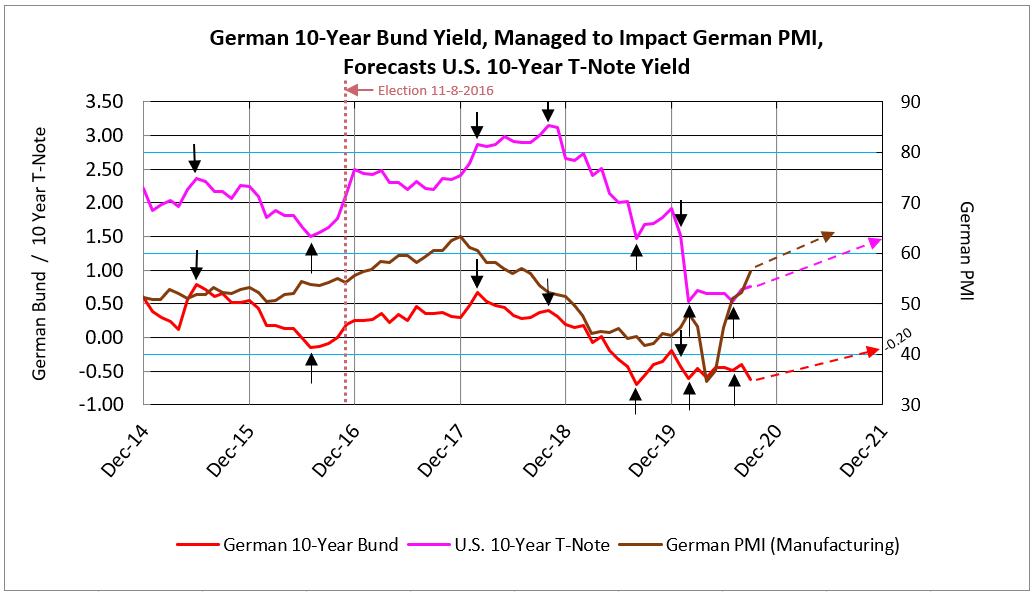

Chart I

Recently, the German 10-year yield declined to levels below -0.62%. Historically, low spikes in this yield led to a reversal, such as on 6/30/2016, 8/30/2019 and late March in 2020. Each low led to major rallies in U.S. bank stocks. A recovery to -0.20% creates the opportunity for a major rise in U.S. bank stocks into 2021.

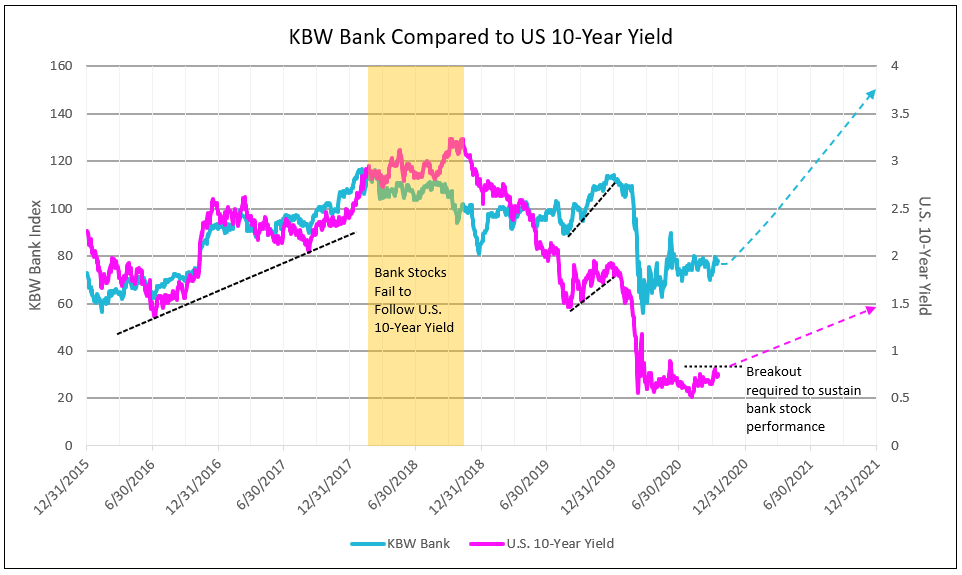

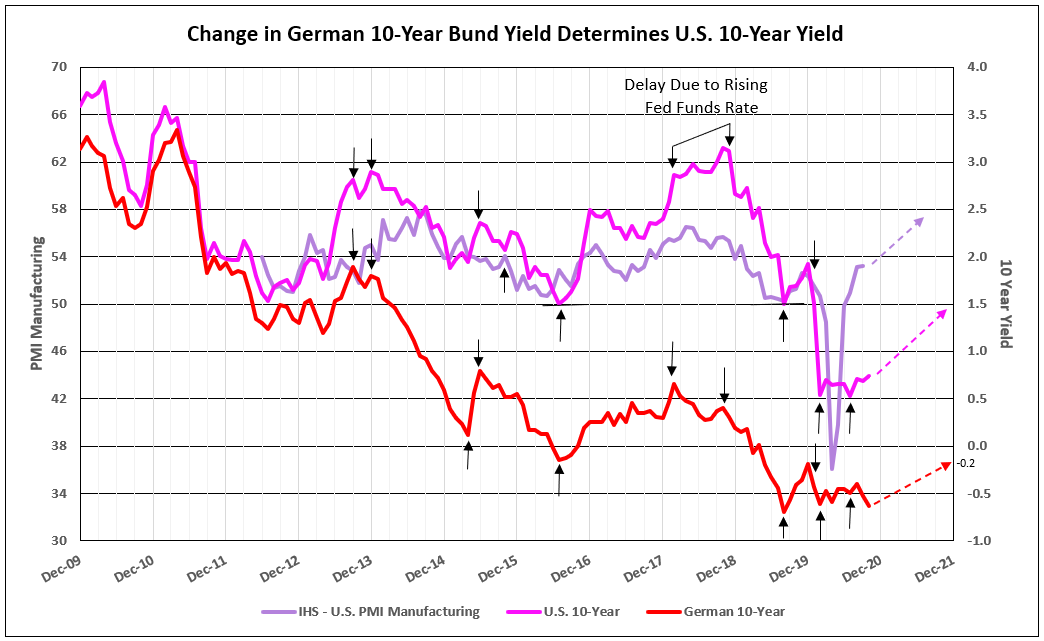

Chart II

The change in the U.S. 10-Year yield mainly reflects the change in the German yield, but sometimes diverges, as in 2018. The U.S. 10-Year is typically a good predictor of bank stocks, but the divergence in 2018, with the U.S. 10-year yield continuing to rise while the German 10-year declined, resulted in a decline from 118 to 80 in the KBW Bank Index.

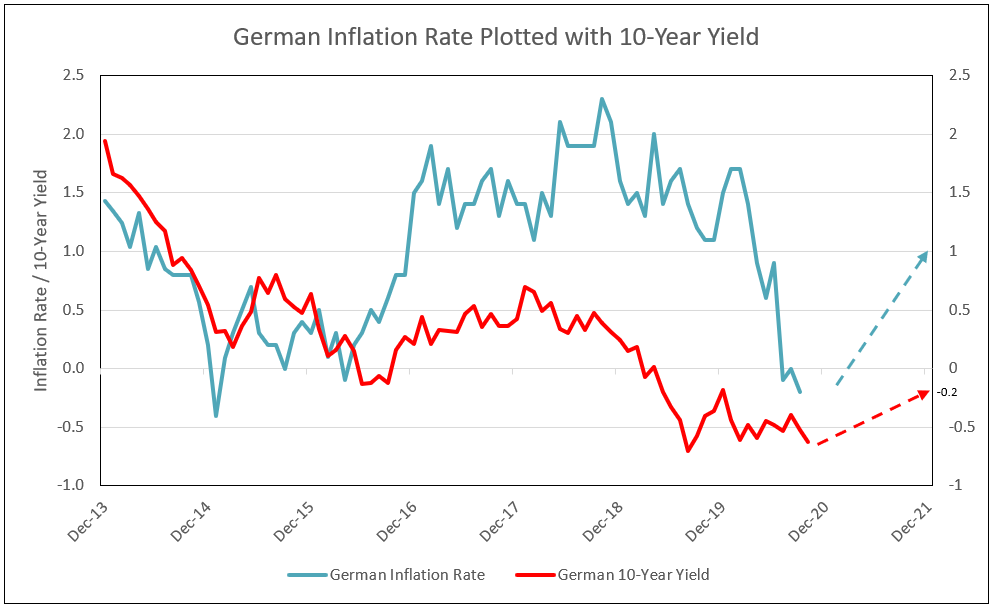

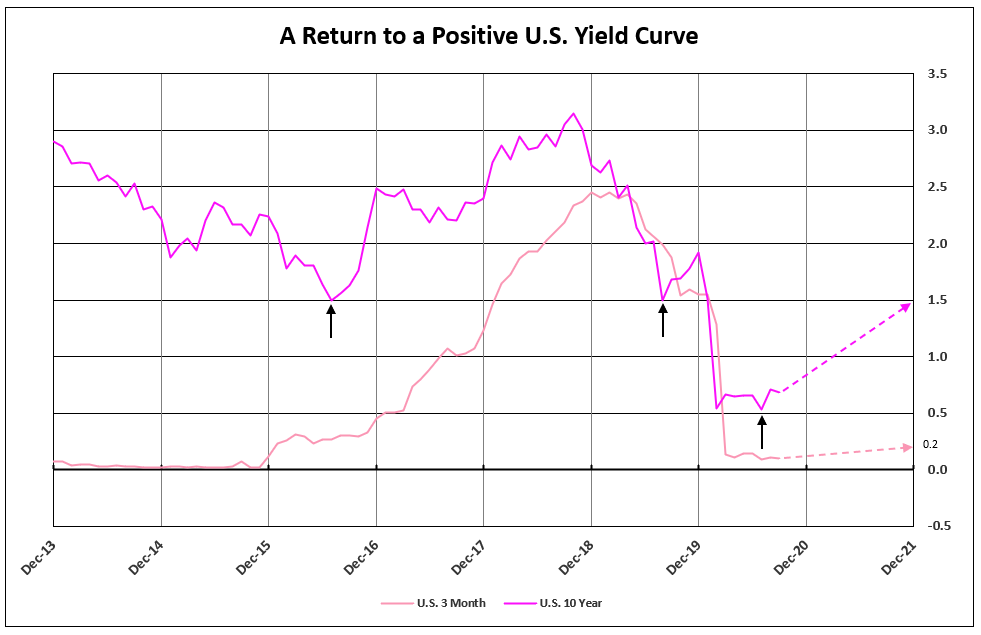

Chart III

Recovery in German inflation to 0.5% and above remains dependent on (1) control over Germany’s Covid-19 outbreak (2) strong auto demand in China and the world, and (3) continued improvement in German economic output as indicated by German PMI.

The decline in Germany’s inflation in 2020 due the advent of Covid-19 yet was met with stable negative German 10-year yields around -0.50%. Inflation rates in 2021 could rise above 0.5%, and, potentially, increase to 2.0% by 2022. This sets the stage for German 10-year yields to increase to at least -0.2% in 2021, from current levels of -0.62% or less.

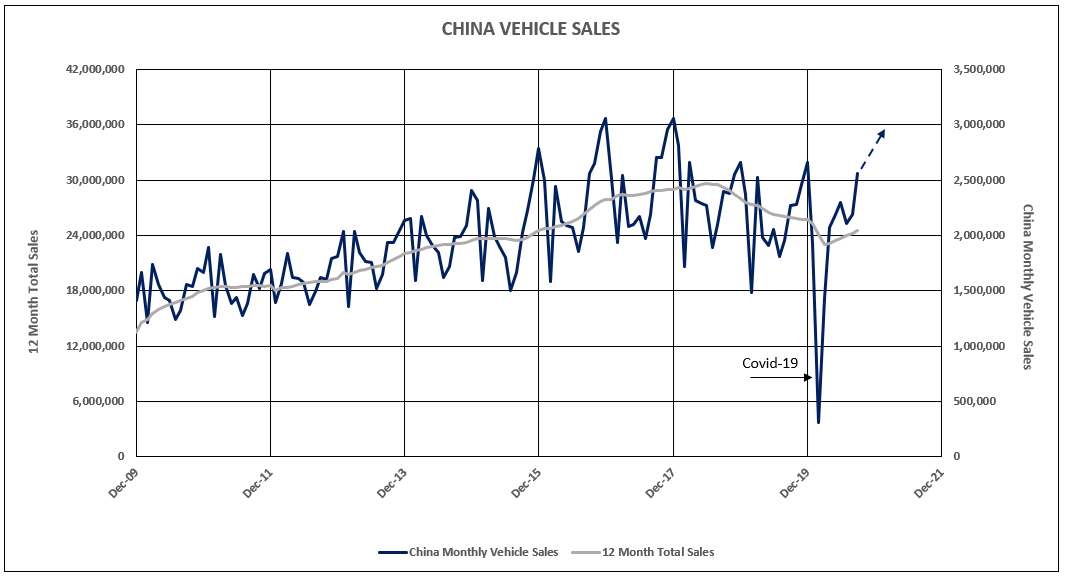

Chart IV

Exports to China from Germany account for 49% of Germany’s GDP. The strength in the German economy has responded to the V-shaped recovery in China vehicle sales to record highs (see Chart IV).

Chart V

German PMI recovered from its Covid-19 recession to 56.4 in September, with the expectation of reaching record highs in 2021 (see Chart V).

The recovery strength in both German and U.S. PMI’s pave the way for rising 10-year bond yields (see Chart VI).

Chart VI

The coronavirus threat to the German economy caused Germany to reduce yields in March of 2020. The German 2-year fell to -101 and the German 10-year to -84 basis points. This low in yield is currently being tested with the German 2-year at -78 and German 10-year at -62 basis points. The subsequent V-shaped recovery in Germany in 2020 and 2021, in both output and prices, sets the stage for recovery of the German 10-year yield to at least -0.20%, while short-term rates remain substantially negative.

Chart VII

U.S, short-term yields are expected to remain in a range of zero to 20 basis points into 2022, as determined by Fed policy. Following a rise in German 10-year yields, the U.S. 10-year is expected to rise to 1.5%, for a positive yield curve of 130 basis points.

To view our products and services please visit our website at www.idcfp.com . For more information, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director