The Coming Bull Market in Regional Bank Stocks

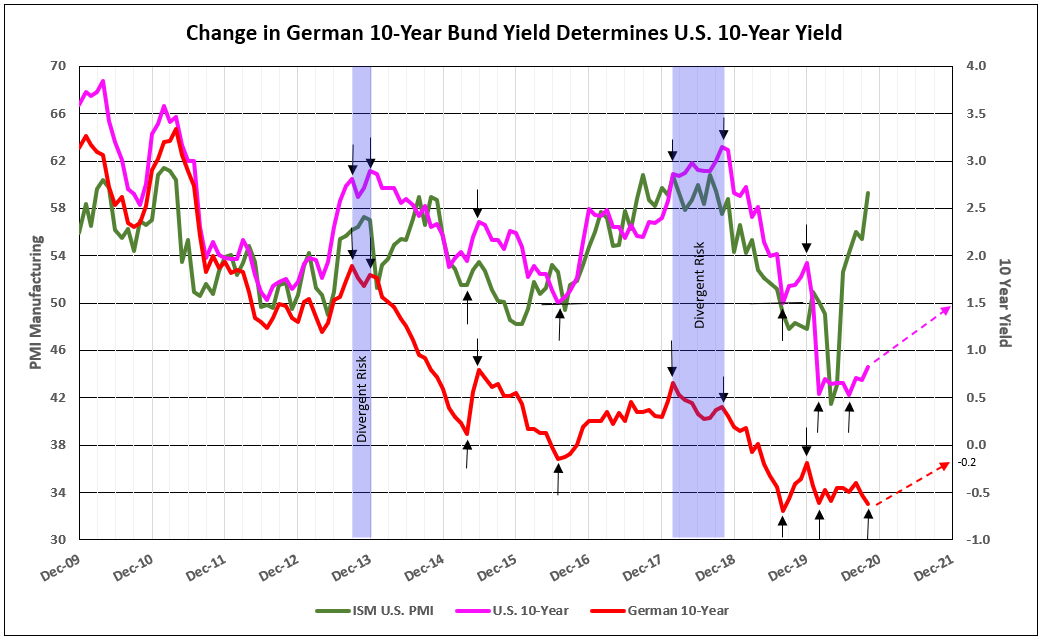

Higher U.S. 10-year yields forecast a bull market in regional bank stocks. Also, a rising German 10-Year yield, historically, has been and remains one of the best indications of absolute performance of U.S. Regional Bank Stock prices.

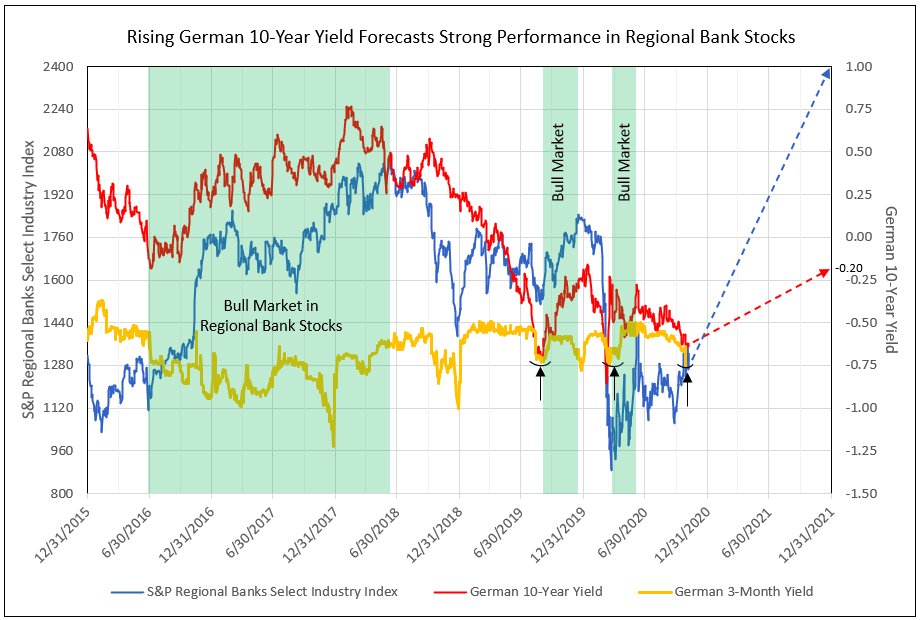

Chart I

Recently, the German 10-year yield declined to levels below -0.62%. Historically, low spikes in this yield led to a reversal, such as on 6/30/2016, 8/30/2019 and late March 2020 and potentially in the near term. Each low led to major rallies in U.S. Regional Bank Stocks. A recovery toward -0.20% creates the opportunity for a major rise in these bank stocks into 2021.

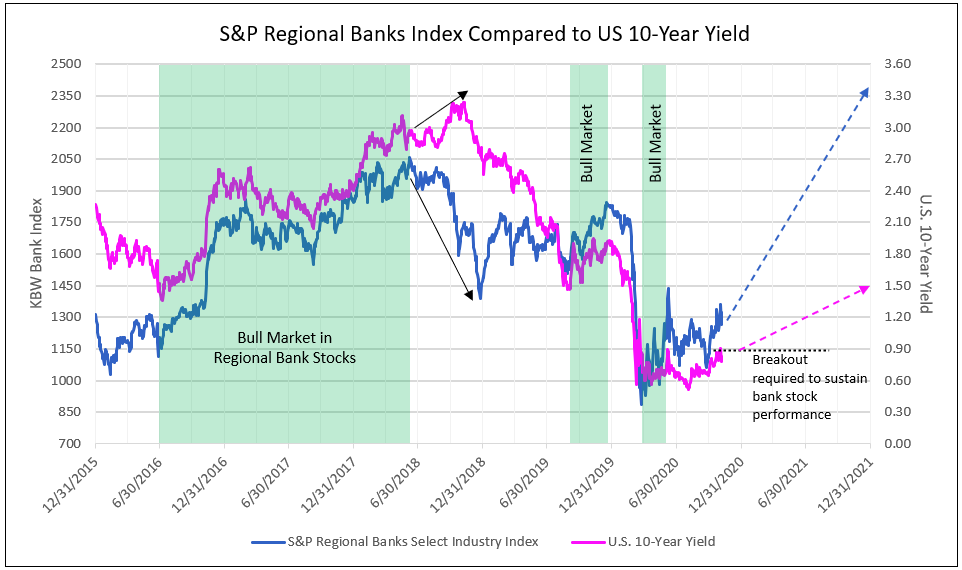

Chart II

The change in the U.S. 10-Year yield reflects the change in the German yield, as well as U.S. economic strength. The U.S. 10-Year is typically a good predictor of bank stocks, however the divergence in 2018, with the U.S. 10-year yield continuing to rise, while the German 10-year declined, was a false signal, and created a large drop from 2050 to 1400 in the S&P Regional Bank & Select Industry Index (see Charts II & VI).

The U.S. 10-year T-Note Yield continues to respond to a strong U.S. economic recovery, rising to 0.87%. However, the current election uncertainty reduced the U.S. 10-year yield to 0.77%. A breakout above 0.90% is required for a major bull market in regional bank stocks.

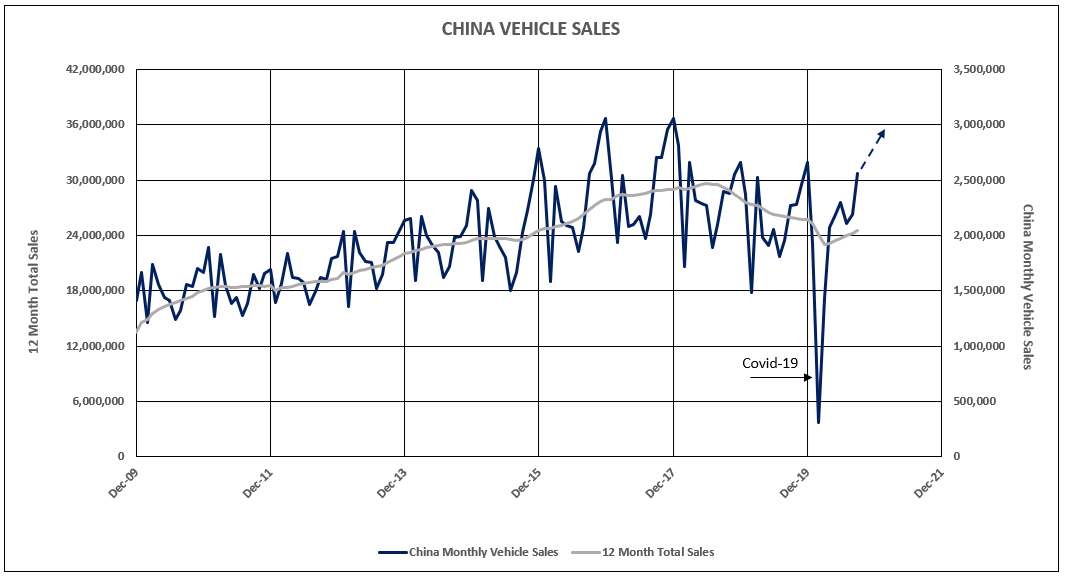

Chart III

The Recovery in German Yields is Yet to Occur

Recovery in German inflation to 0.5% and above remains dependent on (1) control over Germany’s recent Covid-19 outbreak (2) strong auto demand in China and the world, and (3) continued improvement in German economic output as indicated by German PMI.

The decline in Germany’s inflation in 2020 due the advent of Covid-19 yet was met with stable negative German 10-year yields around -0.60%. Inflation rates in 2021 could rise above 0.5%, and, potentially, increase to positive 2.0% by 2022. This sets the stage for German 10-year yields to increase to at least -0.20% in 2021, from current levels of -0.62%. More importantly, the recovery in German yields helps lift the U.S. 10-year yields toward 1.50%.

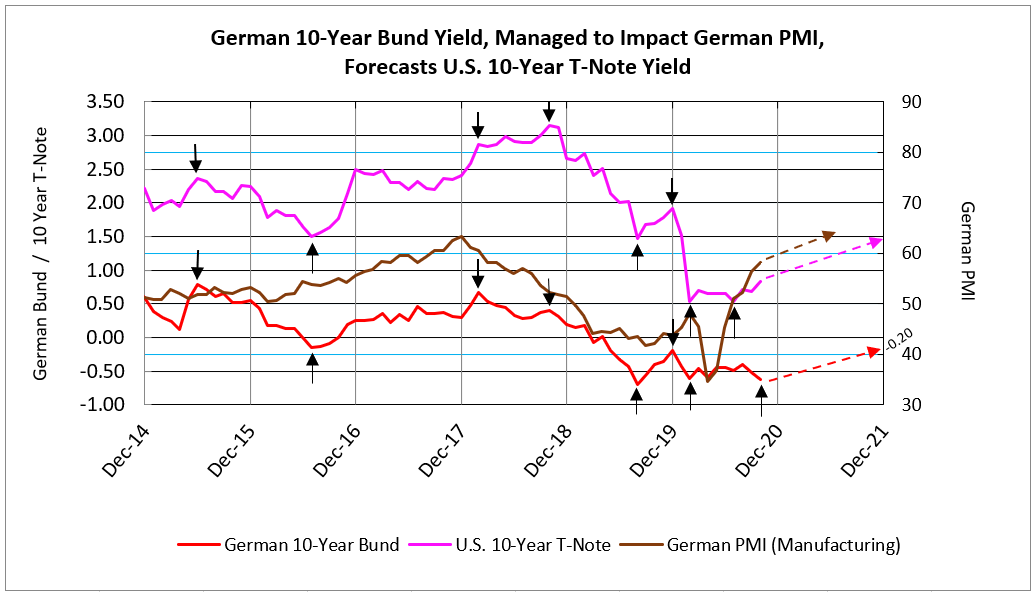

Chart IV

Exports to China from Germany account for 49% of Germany’s GDP. The strength in the German economy has responded to the V-shaped recovery in China vehicle sales to record highs (see Chart IV).

Chart V

German PMI recovered from its Covid-19 recession to 56.4 in September, with the expectation of reaching record highs in 2021. Note the German PMI is the widest spread to the German 10-year that we have seen in recent history (see Chart V).

Chart VI

The recovery strength in both German and U.S. PMI’s pave the way for rising 10-year bond yields (see Chart VI). On November 2nd, the Institute for Supply Management® (ISM®) reported the U.S. October Manufacturing PMI® registered 59.3 percent, “up 3.9 percentage points from the September reading of 55.4 percent and the highest since September 2018”.1 This increase indicates strength in manufacturing and expansion in the overall U.S. economy for the sixth month in a row, following a contraction in April 2020. It is worth noting the spread between the U.S. ISM PMI and the 10-Year yield is the widest in history, which forecasts a significant increase in the U.S. 10-Year yield.

The coronavirus threat to the German economy caused Germany to reduce yields in March of 2020. The German 2-year fell to -101 and the German 10-year to -84 basis points. This low in yield is currently being tested with the German 2-year at -80 and German 10-year at -62 basis points. The subsequent V-shaped recovery in Germany in 2020 and 2021, in both output and prices, sets the stage for recovery of the German 10-year yield to at least -0.20%, while short-term rates remain substantially negative.

The German recovery post the recent Covid-19 spike, and the strong U.S. economic growth, sets the stage for a recovery in the U.S. 10-year T-Note yield.

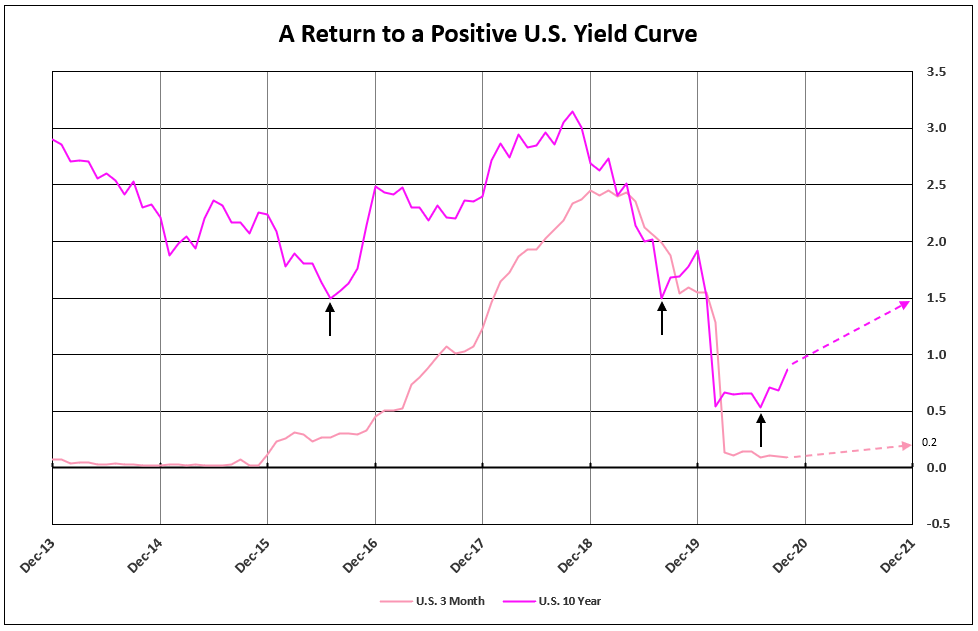

Chart VII

U.S, short-term yields are expected to remain in a range of zero to 20 basis points into 2022, as determined by Fed policy. The strong U.S. economic recovery plus an increase in German 10-year yields, forecasts the U.S. 10-year to rise to 1.5%, for a positive yield curve of 130 basis points.

1-Manufacturing PMI® at 59.3%; October 2020 Manufacturing ISM® Report On Business®

To view our products and services please visit our website at www.idcfp.com . For more information, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director