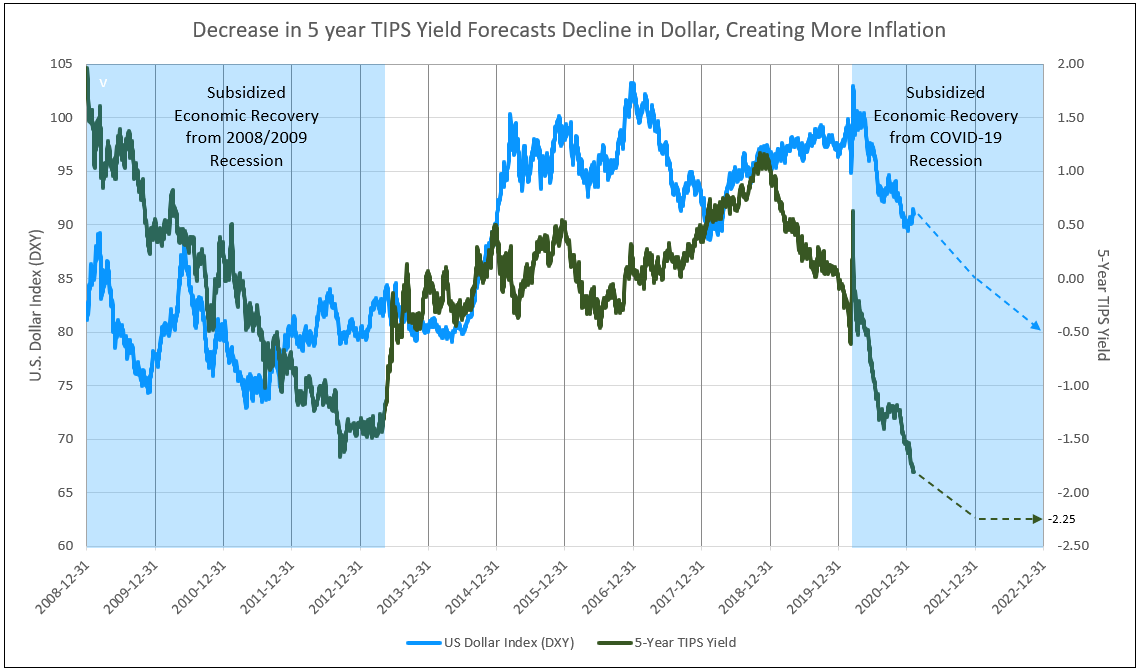

Decline in 5-Year TIPS Yield Forecasts Fall in Dollar, Creating More Inflation

The decline in the yield on Treasury Inflation Protected Securities (TIPS) best explains how the Federal Reserve stimulates the economy following a recession. During the 2009 to 2012 period of recovery following the financial crisis of 2008/09, the TIPS yield peaked at 2.0% in 2008 and subsequently declined to -1.5% by 2012. During this period, the Federal Reserve aggressively bought U.S. Treasury securities and mortgages to reduce and hold down interest rates to stimulate the economy. The U.S. Dollar, however, fell initially to 75, and subsequently traded around the 80 level and, therefore, failed to create substantial import goods inflation.

The Federal Reserve used the same method of buying U.S. treasuries and mortgages to reduce and hold down interest rates in the COVID-19 recession of 2020. At the beginning of this recession period in early 2020, however, the U.S. Dollar was near all-time highs of over 100. The yield on the 5-year TIPS fell from above zero in March 2020 to -1.8% today. The U.S. Dollar during this period fell from 100 to 90, which, in turn, created import goods inflation. In 2021, with a continuation of the decline in the 5-year TIPS yield to -2.25%, the dollar is expected to decline to 85 and, potentially, 80 in 2022 (see Chart I).

Chart I

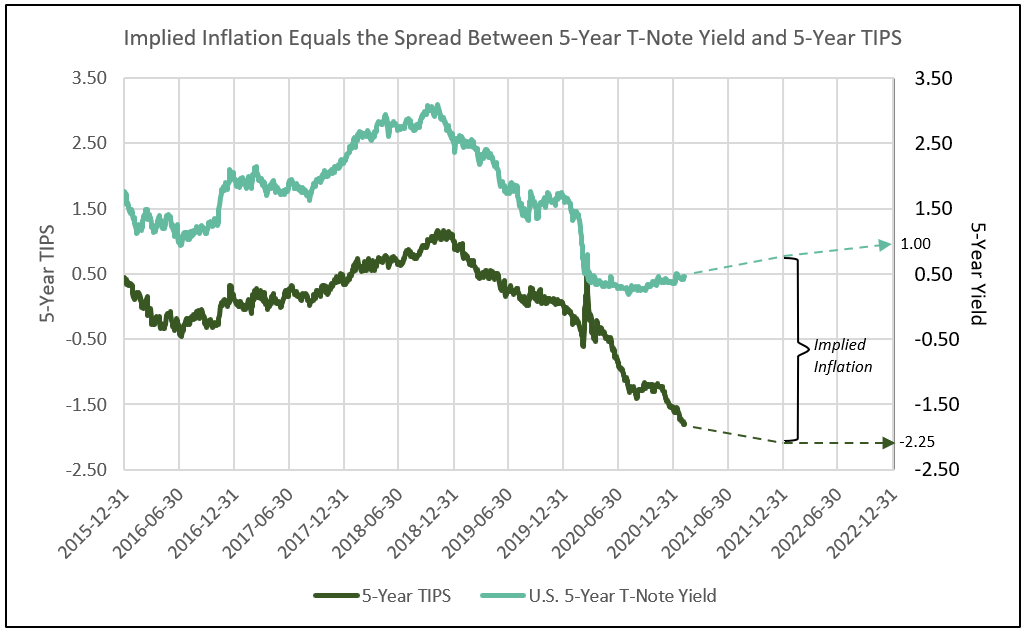

The TIPS yield becomes more negative in these periods, as the nominal 5-year U.S. Treasury yield is reduced or held down by the Fed’s buying. Inflation expectations, then, can only be priced by a declining TIPS yield. In Chart II, the implied inflation in the 5-year U.S. Treasury is illustrated as the difference between the nominal and tips yields.

Chart II

The yield on 5-year TIPS is not expected to recover from the -2.25% level until 2023, as implied by current Federal Reserve policy. Therefore, a continuous decline in the U.S. Dollar to 80 in 2022 is the most likely outcome (see Chart I).

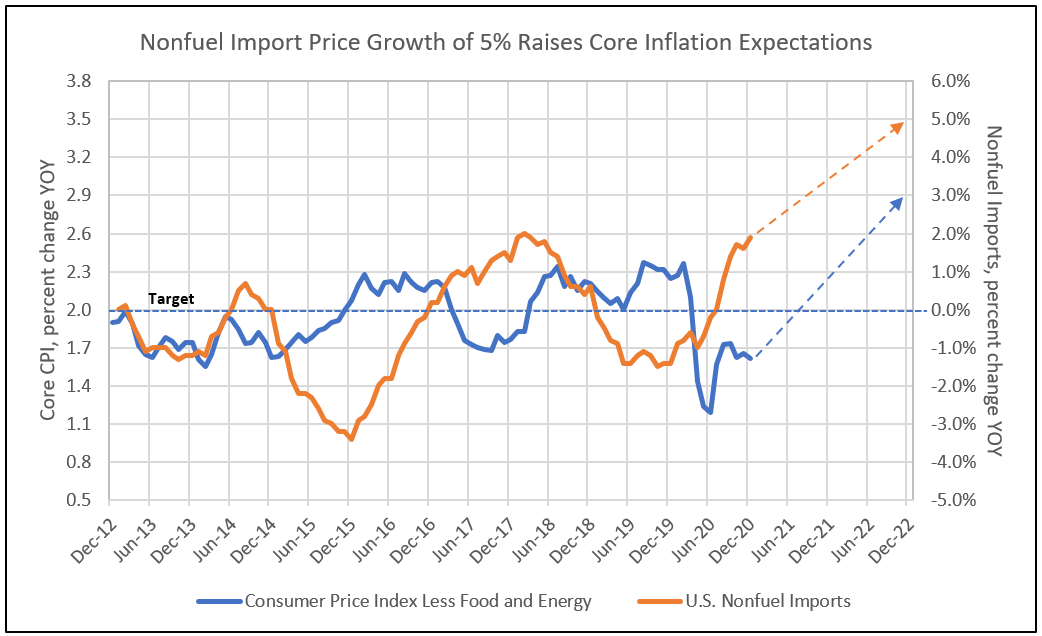

The fall in the dollar to 85 and then 80 raises the price of imported goods and creates even more inflation. Chart III illustrates the relationship between rising import prices and the core CPI inflation rate, with nominal import prices forecast to accelerate to 5.0% by 2022 and core CPI to reach 3.0%.

Chart III

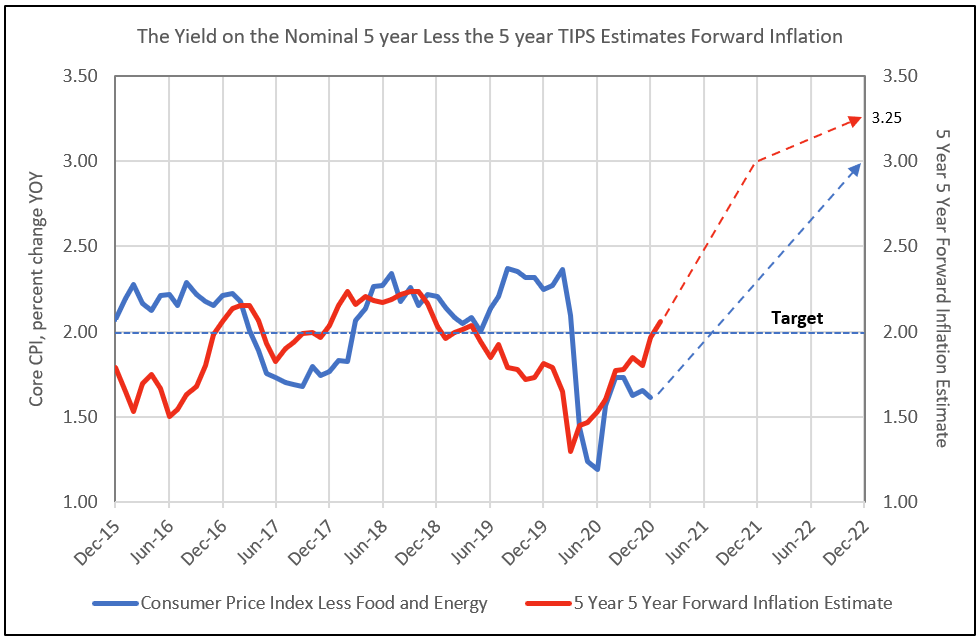

The rise in nonfuel import prices increases the expectation for future inflation. This is reflected by the widening spread between the nominal 5-year yield and the 5-year TIPS yield, reaching 3.0% in 2021 and 3.25% 2022. Implied inflation of 3.25% predicts 3% growth in core CPI in 2022 (see Chart IV).

Chart IV

The Similarity Between the U.S. and Germany

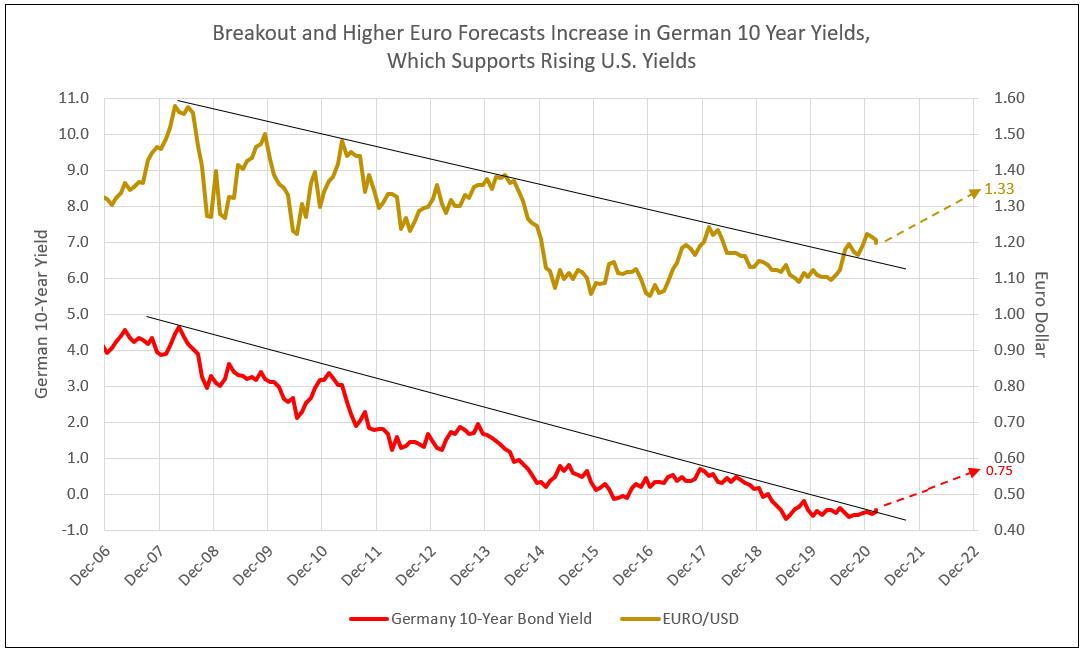

The weakness forecast for the U.S. Dollar is reflected in the projected strength in the Euro currency. The higher Euro in 2021 forecasts the German 10-year yield increases to +0.2% from -0.4% today. Further Euro strength in 2022 projects a German 10-year to increase to 0.75%. The higher yields are a realization of accelerating inflation and economic recovery post COVID.

Chart V

To view all our products and services please visit our website www.idcfp.com.

For more information about our Deposit Database, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director