Brokered CDs at Risk Decrease to $475 Million in Fourth Quarter 2020

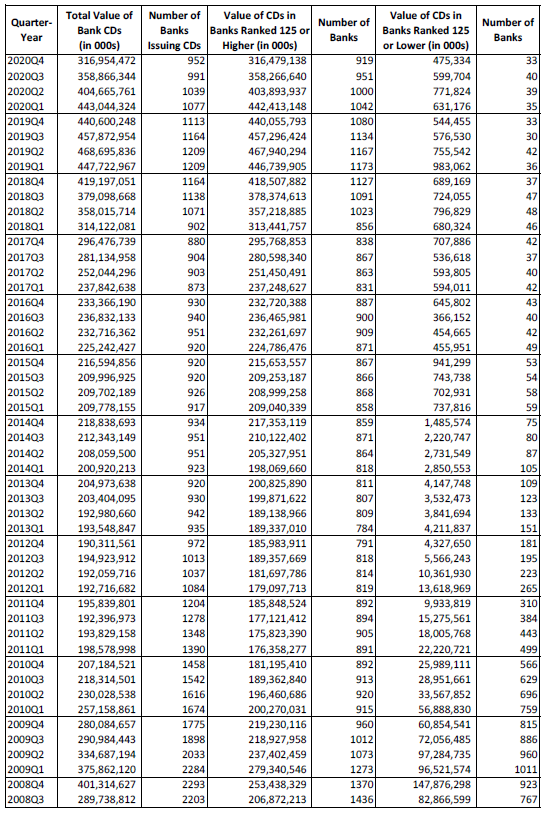

In the fourth quarter of 2020, total brokered deposits with CUSIPs less than $250,000 decreased to $359 billion from $405 billion the previous quarter. The number of banks with these brokered CDs that are ranked below investment grade by IDC Financial Publishing (IDCFP), fell to 33 from 40 in the third quarter, and the value of those banks’ issued CDs decreased to $475 million from $599 million.

While the total number of financial institutions issuing brokered CDs in December 2020 was less than half the number from 2008 and 2009, the institutions ranked 125 or higher (investment grade) were 919, approximately 300 less than the average number of highly ranked institutions from 2009. Financial institutions ranked less than 125 (below investment grade) peaked at 1,011 in 2009Q1 and fell to a low of 30 in 2019Q3. This number temporarily increased in 2020, but declined to 33 as of 2020Q4. As economic recovery continues in 2021, we expect the number of these institutions to continue to decrease.

The values for brokered CDs and the number of financial institutions issuing these CDs are calculated by IDCFP using the total of brokered deposits less reciprocals and uninsured brokered CDs. This residual is then required to be less than the change in time deposits to qualify as brokered CDs less than $250,000.

IDCFP has been publishing institution ranks for over 35 years. Users of our ranks have determined institutions ranked 125 or higher to be investment grade, while those ranked below 125 are below investment grade. IDCFP ranks range from 300 (highest) to 1 (lowest). Our ranks are also sub-categorized into Superior (rank of 200 to 300), Excellent (rank of 165 to 199), Average (rank of 125 to 164), Below Average (rank of 75 to 124), Lowest Ratios (2 to 74) and Rank of 1.

Due to the inverted yield curve in 2018-19 and declining yields on U.S. Treasuries in 2020, an effect of the coronavirus pandemic, the total number of banks issuing brokered CDs was reduced. In 2020 we saw an increase in the value of brokered CDs represented in institutions ranked below investment grade, which may lead to increased risk to CD portfolios. However, the value is dramatically less than was experienced in 2008 and 2009.

As in the past, IDCFP ranks are critical for investors going forward to monitor the strength of financial institutions during periods of risk or growth. Based on both the V-shaped economic recovery that is occurring and, particularly, the rise in Treasury yields in 2021, the forecast is for strong loan demand and higher bank issuance of brokered CDs over the next few years.

Table I

Value of CDs in Banks Issuing Brokered CDs*

Banks Ranked 125 and Higher and Less Than 125

*S&L totals added to Bank totals prior to 2012

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director