A Potential Supercycle Developed from a Commodities Boom

A surge in commodity prices has the Federal Reserve and Wall Street banks gearing up for the start of a possible new supercycle. Defined by an extended period during which demand drives prices well above their long-run trend, the impetus for this supercycle is the massive federal government spending coupled with Federal Reserve Monetary stimulus, creating economic recovery following pandemic lock-downs. As evidence, surging copper, agricultural prices and oil back at or above pre-Covid-19 levels. One theory is that this could be just the start of a years-long rally in appetite for raw materials across the board.1

What is a supercycle?1

An abnormally strong and sustained demand growth that producers struggle to match, sparking a rally in prices that can last years. For some analysts, the current rally is reminiscent of the supercycle seen during China’s rise to economic heavyweight status beginning in the early 2000s.1

What did the last supercycle look like?1

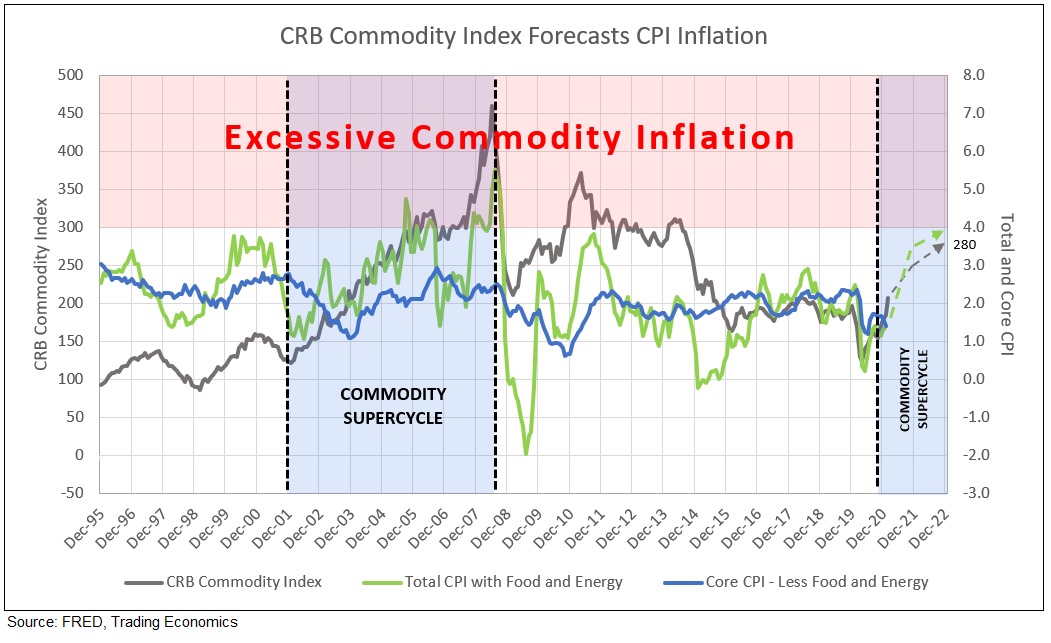

From early 2002, China entered a phase of roaring economic growth, fueled by a rollout of modern infrastructure and cities on an unprecedented scale. Suppliers struggled to fulfill surging demand for natural resources. In commodities, there is often a time lag to get the product where it’s wanted since adding capacity, such as opening a new mine, doesn’t happen overnight. For more than a decade, materials including iron ore were in tight supply. For example, copper, priced below $2,000 a ton for much of the 1990s, broke $10,000 and oil jumped from $20 a barrel to $140.1 (See the CRB Commodity Index in Chart I).

Who says this is another supercycle?1

Analysts at JPMorgan Chase & Co. and Goldman Sachs Group Inc., among others forecast that outcome. According to JP Morgan, the commodities rally will be a story of a “roaring 20s” post-pandemic economic recovery that includes loose monetary and fiscal policies. In addition, commodities may also jump as an unintended consequence of the fight against climate change, which threatens to constrain oil while boosting demand for metals needed to build renewable energy infrastructure and manufacture batteries and electric vehicles. Those include cobalt and lithium. Furthermore, commodities are typically viewed as a hedge against inflation, which has become a major concern among investors.1

Today, the sharp rise expected in the CRB Commodity Index is similar to the 2002 to 2004 period. From December 2001 to late 2004, the increase in the CRB Commodity Index from 125 to over 300 was matched by the acceleration in CPI from 1% to over 4%. In 2021 and 2022, the CRB could approach 300 and the year-to-year change in CPI could again approach 4% (see Chart 1).

Chart I

What’s been happening with oil?1

Oil prices collapsed in 2020 but have recovered as demand rebounded more strongly than expected. Early in 2021, the Organization of the Petroleum Exporting Countries and its allies were holding back crude equivalent to about 10% of current global supply. Market fundamentals have shifted, especially in the U.S. with the emergence of shale oil. However, the Biden Administration has reduced oil supply by stopping production on Federal lands and shutting down oil pipeline construction. There is a prospect that a prolonged period of high prices would trigger new supply by OPEC. Some experts predict the eventual return of prices to $75, and even above $100, a barrel.1

Which other commodities are rising?1

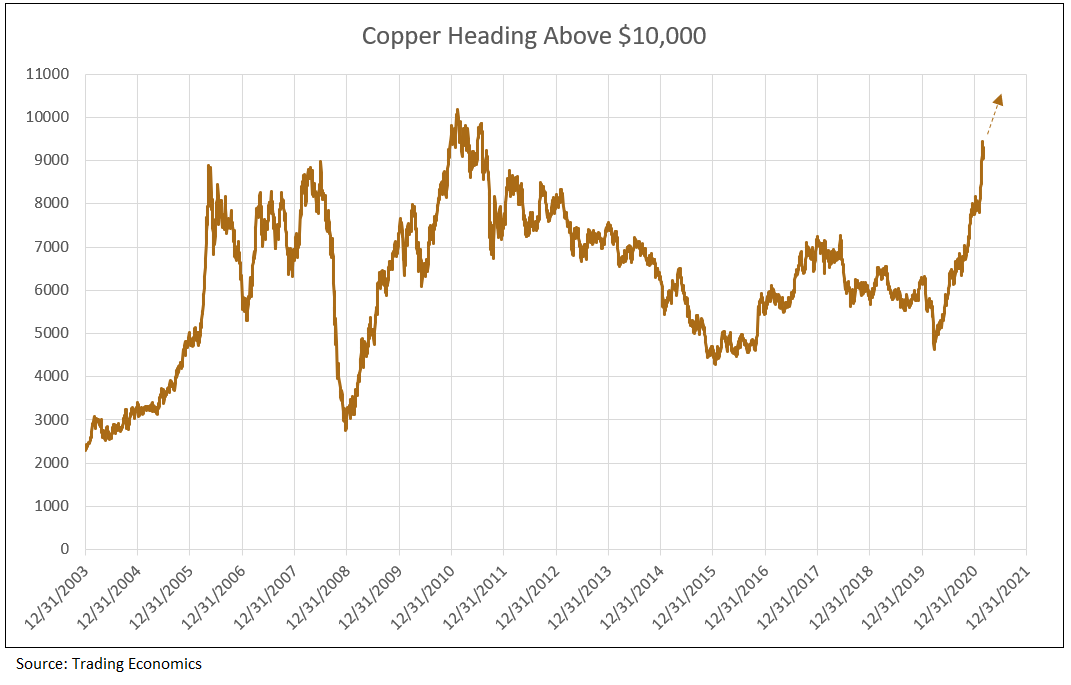

Copper was on a tear in early 2021 thanks to rapidly tightening physical markets as governments plow cash into electric-vehicle infrastructure and renewables. Goldman Sachs, BlackRock Inc., Citigroup Inc. and Bank of America Corp. saw the metal moving toward all-time highs. While agricultural commodities have their own dynamics, soybeans and corn have rallied to multiyear highs, driven by relentless buying from China as it rebuilds its hog herd following a devastating pig disease. Agricultural prices are more dependent on global economic and population growth, rather than the decarbonization trend underpinning excitement in metals.1

Chart II

Will implied inflation rise above 2.5%?

On March 4th U.S. Treasuries tumbled, driving long-maturity yields to their highest levels and pushing up inflation expectations. Benchmark 10-year Treasury yields surged to 1.557%. Meanwhile, a market proxy for the anticipated annual inflation rate for the next half-decade exceeded 2.5% for the first time since 2008 -- aided by climbing oil prices.

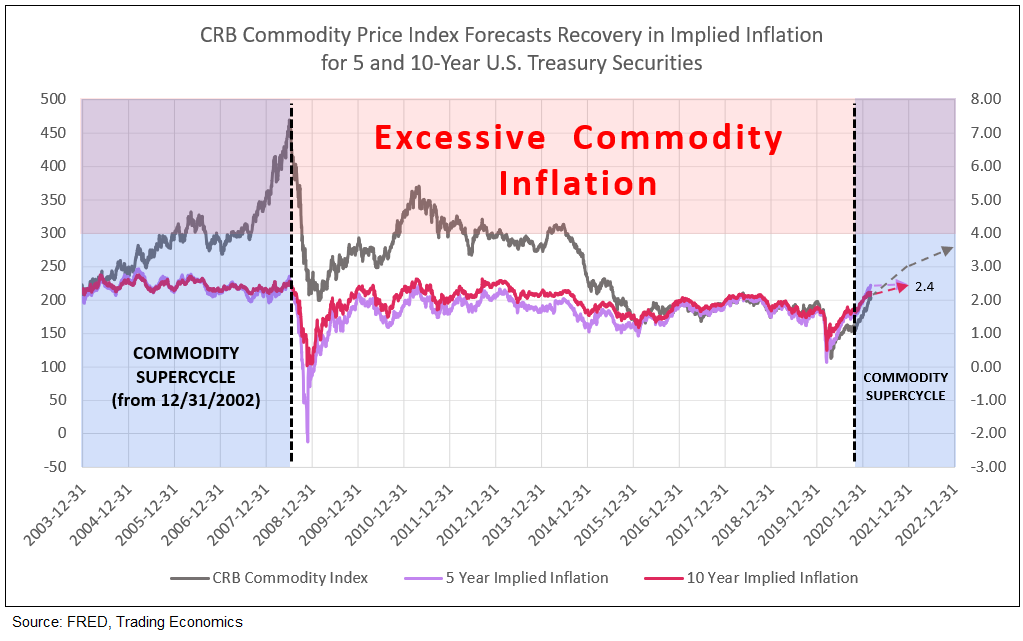

Implied inflation can temporarily rise above this threshold. During the super cycle in commodities, as occurred in 2004, the 5-year implied inflation rose above the 10-year implied inflation, similar to today. In 2004, implied inflation on both the 5 and 10-year T-Notes rose above 2.5%, to as high as 3% (see Chart III). Once implied inflation reaches this level of expectation, further increases in nominal yields will be recognized in TIPS, or real yields, recovering from negative levels to zero and up to a positive 1%.

Chart III

Outlook for 10-Year Yields

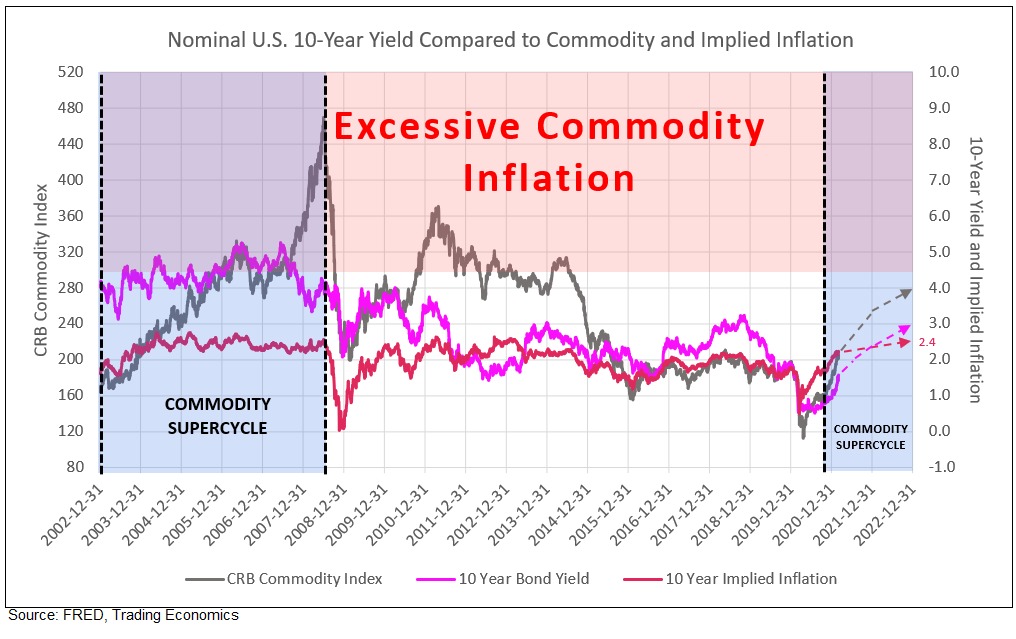

We forecast the CRB Commodity Index to rise to a level of 280 by 2022, implied inflation will level off at 2.4% and the 10-year nominal yield will increase to 3%. The V-shaped economic recovery favors economically sensitive industries. A commodity supercycle is constructive in creating cyclical inflation, given the CRB commodity remains below 300. A return to 2.4% implied inflation and 0.6% real yields, therefore a nominal 10-year forecast of 3% for 2022, reflects strong bank loan demand and a recovery in brokered CDs to prior highs (See Chart IV). An increase in the CRB Commodity Index above 300, however, would cause the Federal Reserve to raise the Fed funds rate to control excessive commodity inflation.

Chart IV

1 Bloomberg, When Does a Commodities Boom Turn Into a Supercycle?

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director