Sudden Rise in the 10-Year Yield Expected

The recent sharp rise in the nominal 10-year T-Note yield is a normal expectation for a recovery period and should continue in the next four months.

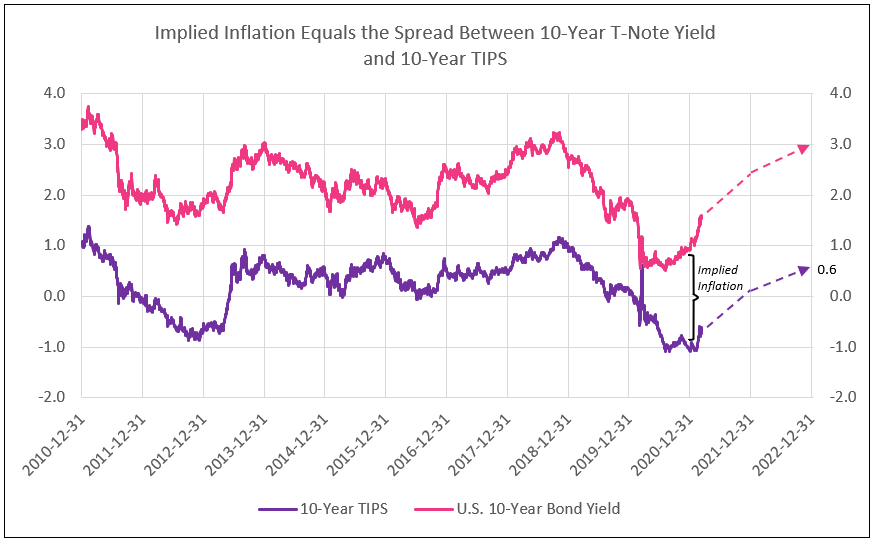

The Treasury market is implying substantially more inflation is to come over the next decade, than in the COVID period of 2020. Higher inflationary expectations, coupled with a recovery in the real yield (TIPs), indicates a higher 10-year yield than the analysts expect. The repricing of the TIPs yield is and will continue to be the cause for the sharp rise in the nominal 10-year yield.

The 10-year breakeven rate, or the difference between the yield on the 10-year Treasury note and the 10-year Treasury inflation-protected security, is the bond market investors’ judgement of where inflation is headed. It now stands at 2.25% and can be compared to other surveys and expectations.

A Federal Reserve Bank of Philadelphia survey of economists indicates inflation to average 2.2% over the next decade, up from 2.12% last quarter. A Federal Reserve Bank of New York survey from January indicates expectations of 1.95% and 2.1%. Finally, the University of Michigan’s February survey of consumers indicated an average 2.7% inflation rate over the next 5 to 10 years.

The biggest surprise, however, is not IDC Financial Publishing’s (IDCFP) expectation of 2.4% implied inflation over the next decade, but the sudden and sharp rise in the real 10-year TIPs yield from a -1.0% to -0.6% in just a few weeks (see Chart I). However, this yield increase is normal for the current period of economic recovery.

Chart I

The only time the 10-year TIPs yield was negative other than today in history was in 2012 and 2013 (see Chart I).

The 10-year TIPs yield declined to its most negative level in 2013 in fear of recession but recovered 150 basis points in just 3 months in the middle of 2013. The TIPs yield was consistently greater than zero since 2013, until the beginning of Covid-19 in February 2020. Then the TIPs yields declined in 2020 due to the Federal Reserve policy to maintain a near-zero short-term yield on Treasuries. The Fed action in buying securities to control short-term rates and fear of recession reduced the 10-year TIPs yield to a negative 1% (see Chart I). As Treasury long-term yields responded to economic recovery expectations due to vaccines and potential herd immunity, TIPs yields rose to -0.6% in just a few weeks in February and March and could potentially reach zero by year-end 2021 or before.

As implied inflation stabilizes around 2.4%, the rise in 10-year nominal yields is reflected in an economic recovery with a higher TIPs yield. Recovery in the TIPs yield to zero, is only normal, as occurred in 2013 and again expected in 2021. A zero TIPs yield, coupled with 2.4% implied inflation (supported by the surveys listed above), lifts the nominal 10-year yield to as high as 2.4% by year-end 2021, above most analysts’ expectations.

Robust growth in 2022 could raise the TIPs yield to a positive 0.6%, similar to the economic recovery experienced in 2016 (see Chart I). Note, the TIPs yield rose suddenly in late 2016 some 80 basis points and maintained that level in 2017. When the 0.6% TIPs yield is combined with 2.4% implied inflation, it forecasts a 3% nominal 10-year yield by the end of 2022. The major beneficiary of the sharp rise in the nominal 10-year T-Note yields are commercial and savings banks. Rising longer-term yields with low short-term rates widen the net interest margin. Current GDP growth of 8% indicates a surge in future loan growth.

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director