Credit Unions are a Growing Force with Increasing Risk

Credit unions have grown to become a major factor in the U.S. economy, with assets that have grown at nearly twice the pace of banks’ over the past decade.1 Credit unions are owned by their members and are designed to offer lower borrowing costs and higher deposit rates. In addition, the median large credit union (greater than $50 million in assets) earned a return on equity (shares and reserves) of 3.6% and experienced 3% loan growth over the past year.

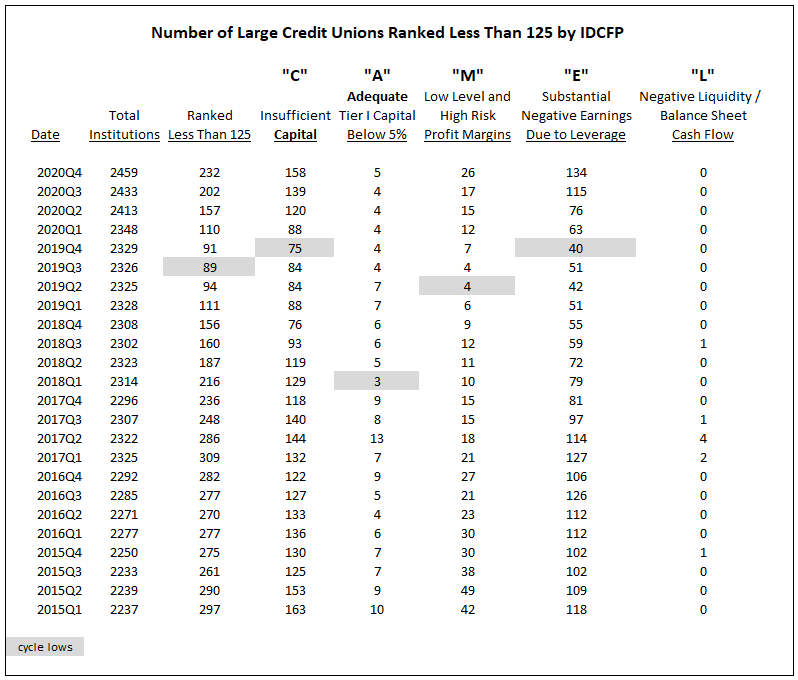

IDC Financial Publishing (IDCFP) focuses on 2,459 credit unions with $50 million or more in assets to determine the risks to the financial system. These larger institutions are using their strength to compete aggressively for business. The group of 2,746 credit unions with assets less than $50 million remain important to the industry, but are not a major risk factor in a potential economic downturn or the overall health of our financial system.

The Risk in Large Credit Unions

IDCFP calculated the CAMEL rating of 5,205 credit unions in the fourth quarter of 2020. The 2,459 large credit unions account for 97% of total credit union assets and remain a potential risk factor in a future major economic downturn.

To determine this risk, we separate the credit unions ranked under 125, which is below-investment-grade and the industry standard. As of the end of the fourth quarter 2020, 232 large credit unions were ranked below 125 by IDCFP, up from 202 the previous quarter. This rise in institutions is the first risk alert, which is confirmed by all components of CAMEL hitting lows and rising. All the components are increasing, except for institutions with negative liquidity which remains at zero.

The “C” in CAMEL, which represents insufficient capital reached a low of 75 in the fourth quarter of 2019 and rose to 158 in 2020Q4. The “A” in CAMEL, or adequate Tier 1 capital to meet loan delinquency, reached a low of 3 in the first quarter of 2018 and increased to 5 in 2020Q4. The “M” in CAMEL, which measures operating profit margins with high risk characteristics, reached a low of 4 institutions in the second quarter of 2019 and rose to 26 as of 2020Q4. The number of institutions below investment grade under “E” with negative earnings also reached a low of 40 in the fourth quarter of 2019 and rose to 134 in the fourth quarter of 2020.

We have seen an increase in the total number of large credit unions ranked below 125, in addition, four out of five components of CAMEL reached a low and increased in number. Because of these combined trends, IDCFP forecasts potential risk to come in the credit union industry, making it increasingly important to monitor (see Table I). Hopefully, the post Covid-19 economic recovery, with a strong growth in employment, will heal the ills currently seen in large credit unions.

Table I

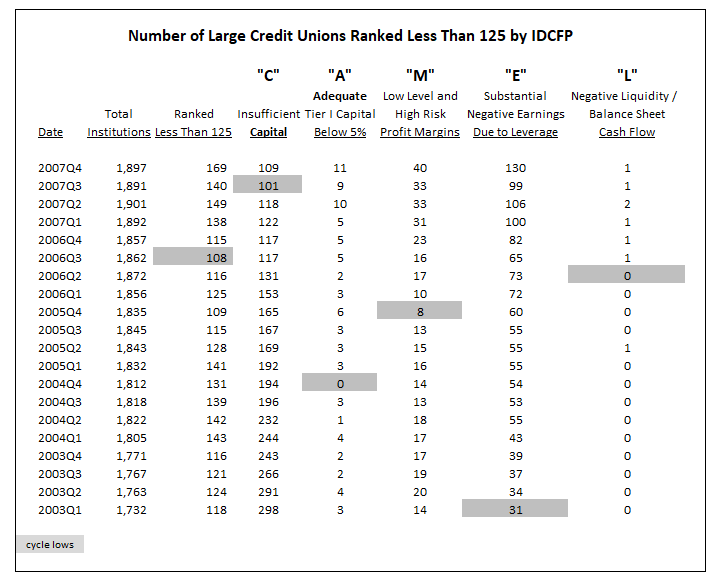

The Risk Illustrated by IDCFP in 2005 to 2007 Forecast the 2008/2009 Credit Union Crisis

IDC successfully indicated a risk alert for the credit union industry as early as the fourth quarter of 2006, over a year prior to the financial and economic collapse of 2008 and 2009. Out of the 1,862 large credit unions in the third quarter of 2006, 108 were ranked below 125, or less than investment grade. The increase to 115 in the fourth quarter signaled the major risk alert for credit unions.

The “C” in CAMEL bottomed at 117 in the third quarter of 2006, but then recycled when it hit a low of 101 in the third quarter of 2007. The “A” low of zero was in the first quarter of 2005, the “M” low of 8 was in the fourth quarter of 2005, the “E” low of 31 was much earlier, in the first quarter of 2003, and the “L” component of CAMEL was zero in the second quarter of 2006.

In summary, IDCFP’s risk alert for the financial downturn of large credit unions, as well as, the entire credit union industry, was evident in the fourth quarter of 2006, successfully forecasting the financial problem to occur in 2008 and 2009 (see Table II).

Table II

1: How Credit Unions Outgrew Their Down-Home Reputation, Wall Street Journal, 12.3.2019

To view our products and services please visit our website at www.idcfp.com . For more information about our CAMEL ratings, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director