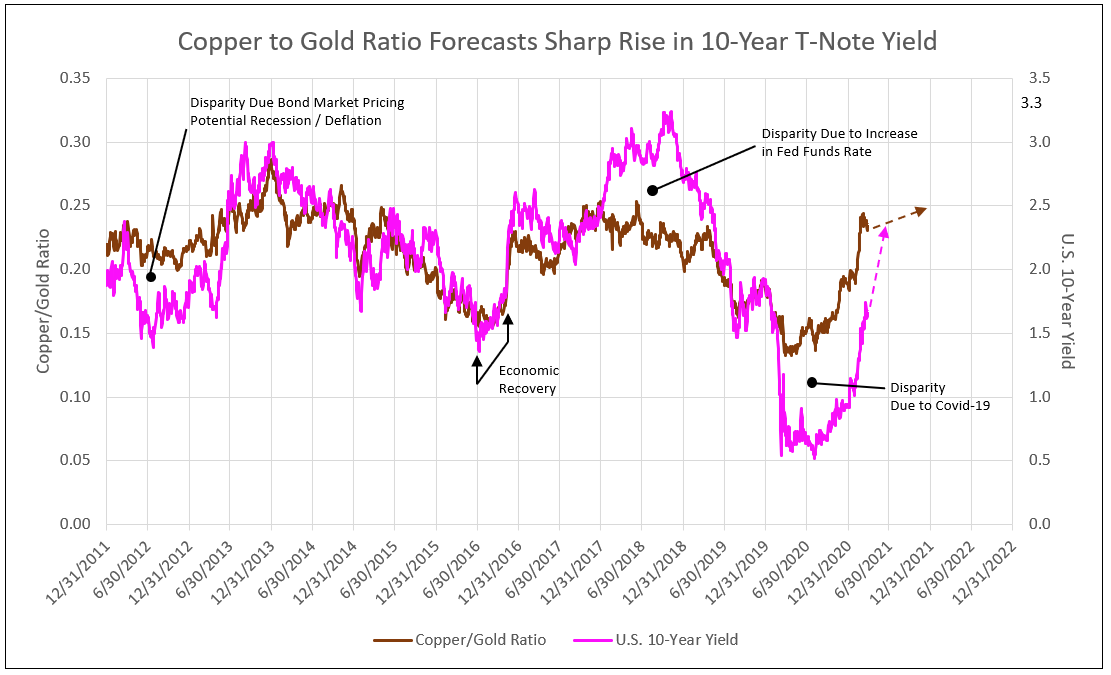

Copper to Gold Ratio Forecast a 2.4% Yield on the U.S. 10-Year T-Note by the Summer or Fall of 2021

The copper-to-gold ratio is highly correlated to the U.S. 10-year yield since 2015. A disparity occurred in 2012 and 2013 as the bond market priced potential recession / deflation. The subsequent change in sentiment to recovery / inflation returned the 10-year yield to correlation to the copper to gold ratio.

A second disparity occurred in 2018 and the first half of 2019 due to the Federal Reserve increasing the Federal Funds rate, lifting the 10-year yield above the 2.5% level forecast by the copper to gold ratio. Correlation resumed in the second half of 2019.

Disparity reappeared from February to July 2020, due to Covid-19, the lockdowns and resulting economic recession. Since July 2020, the spread between the copper-to-gold ratio and the 10-year yield narrowed, as the copper-to-gold ratio rose from a low of 0.14 to above 0.20, forecasting a recent steady rise in the 10-year yield from 0.5% to 1.7%. The current ratio of 0.24 forecasts the potential for the 10-year T-Note yield to rise to 2.4% by the summer or fall of 2021.

The significant and sharp recovery in the 10-year yield is also due to the expectation of successful vaccinations and potential herd immunity to Covid-19. This expectation indicates a marked recovery in the U.S. economy with a commensurate rise in inflationary expectations (see Chart I).

Chart I

Many analysts use this ratio to forecast yields, but what other evidence supports this projection? See the following five observations.

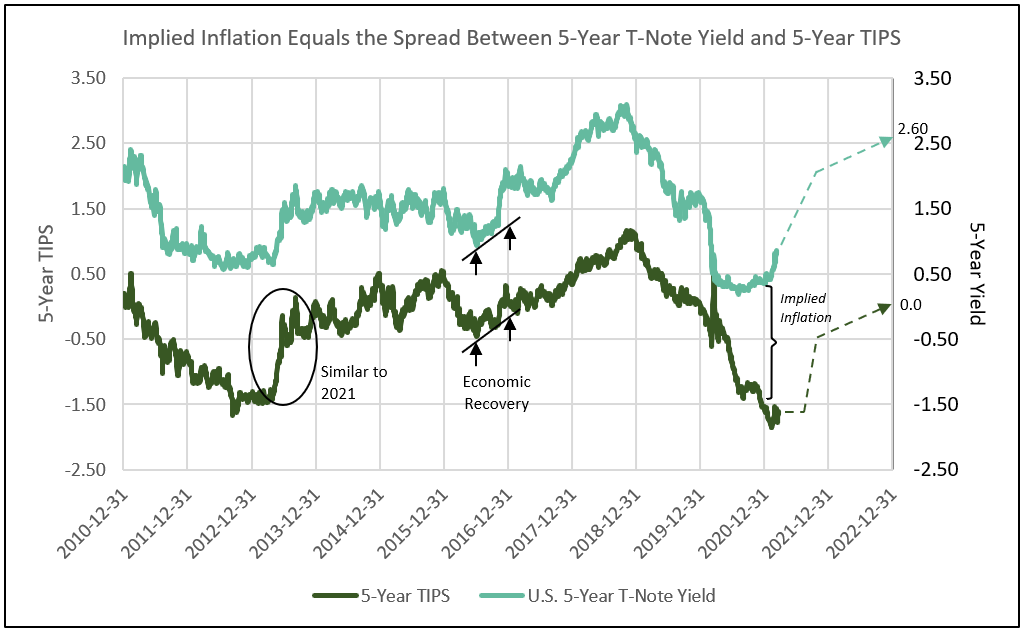

1) The inflation-protected 5-year TIPs yield in 2021 is expected to mirror its sharp recovery to zero in 2013.

The 5-year real or TIPs yield became most negative in 2013, and again in 2021 when it reached -1.5% due to fear of recession and deflation. An end to such fears allows a rebound toward zero in the 5-year TIPs yield as occurred in mid-2013. With the real yield currently suppressed at -1.7%, a rise in nominal yield creates a widening spread between real and nominal, or higher implied inflation. Implied inflation in 2021 could rise to a level of 3%, before the TIPs yield finally rebounds to -0.5% by the summer or fall of 2021 (see Chart II).

Chart II

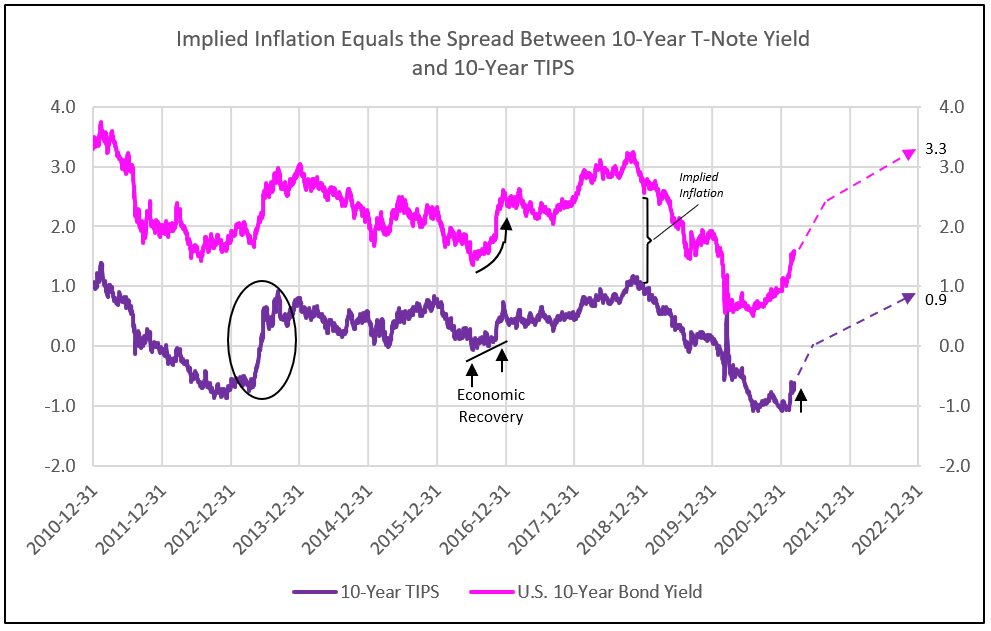

2) The 10-year TIPs yield climbs to zero in 2021, raising the nominal yield to 2.4%, and implying 2.4% 10-year inflation.

Similar to 2013, a change in outlook from recession / deflation to recovery / inflation lifts the 10-year real yield (TIPs) to zero from the lows of -1.0%. Recent implied inflation rose to 2.3% and is expected to widen further to 2.4% by the summer to fall of 2021, providing a nominal 10-year yield of 2.4%. Further gains in the TIPs to 0.9% in 2022 and 2.4% implied inflation forecasts a 3.3% nominal 10-year yield by year-end 2022 (see Chart III).

3) Economic recovery also lifts yields higher, as was the case in 2016.

The impact of economic recovery, with a 100-basis point rise in the TIPs yield, raised 5- and 10-year nominal yields in 2016 (see Chart II and III). The combination of both the sentiment shift of 2013 and economic recovery in 2016, together forecasts significant yield increases for 2021.

Chart III

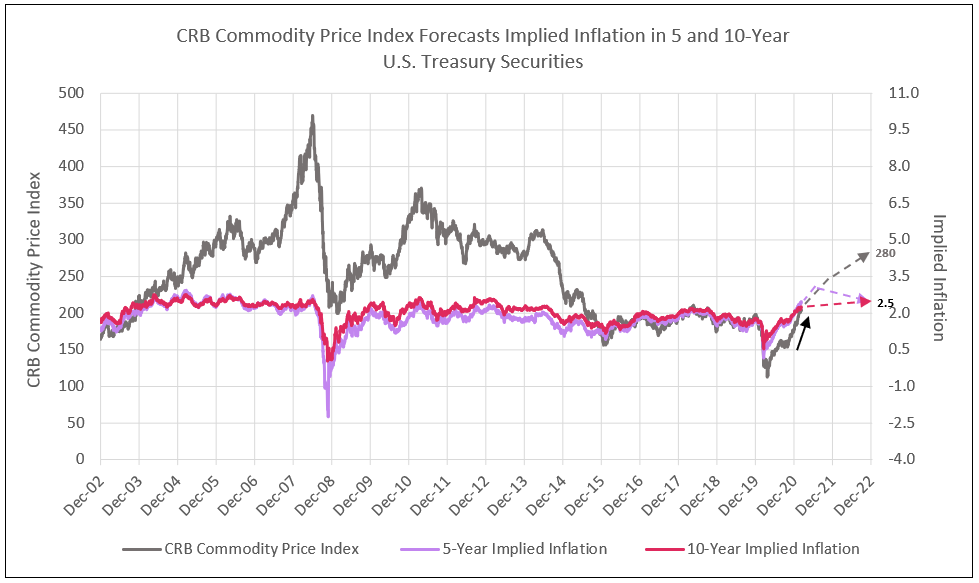

4) The rise today in 5-year implied inflation above the 10-year levels is consistent with the economic recovery and commodity boom of 2004.

A commodity super-cycle in 2003 to 2006 initially created an inversion in the 5-year implied inflation above 10-year levels in 2004. Both 5- and 10-year implied inflation rose above 2.5%, temporarily.

A similar pattern is developing in 2021 with the 5-year implied inflation rising above 2.5% and potentially approaching 3%. The primary reason for the inversion is the Fed’s determination to keep short-term treasury yields slightly above zero, restricting the 5-year TIPs yield as the nominal yield increases, leading to higher implied inflationary expectations (see Charts II and IV).

Another reason for the inversion is the market expectation for higher inflation to be temporary, priced in 5-year TIPs, but not 10-year TIPs (see Charts II and III).

Chart IV

5) Ed Yardeni, veteran strategist, is comfortable with yields above 2%, given the expected economic and earnings recovery.

“[Rising yields] is an indication that the economy is doing well and that will be very good for earnings,” said Yardeni, the president and founder of Yardeni Research Inc. “The years prior to the pandemic, bond yields were 3% to 4%. So I don’t really have a problem with 2% to 3%, which is probably where they’re likely to settle in the second half of the year.”1

Underpinning Yardeni’s confidence is an economy roaring back from the Covid-19 pandemic, buttressed by vaccines and President Joe Biden’s $1.9 trillion stimulus package. It’s those things that have pulled yields up from below 1% and set the stage for S&P 500 companies to rattle off the streak of earnings growth analysts currently estimate -- at least six quarters of double-digit expansions, including a 49% surge in the June-April period.1

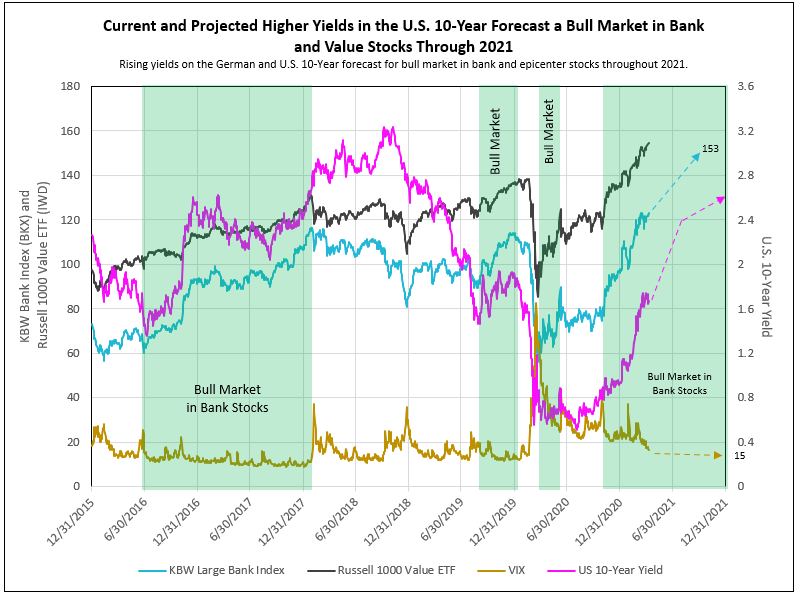

The Major Beneficiaries of a Rising 10-Year Yield and Low Short-Term Treasury Yields are the Banks

Economic recovery, following the battle against Covid and resulting recession, provide two key ingredients that benefit banks:

- A strong economic recovery in GDP of 6% to 8% in 2021 provides 6% to 8% loan growth.

- A rise in the 10-year to 2.4% by summer to fall of 2021 with a low Fed Funds rate widens the spread between bank’s loan yields and deposit costs.

In addition to banks, the major beneficiaries of the economic recovery, with the Federal Reserve stimulus controlling short-term rates and the fiscal policy stimulus from Federal Government spending, are epicenter and value companies (see Chart V).

Chart V

1-Bloomberg.com, Ed Yardeni Can Live With Higher Yields for the Sake of Earnings

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director