The Profit Structure of Banking Improves Dramatically

Return on Equity (ROE) defines the profit structure of the banking industry. ROE is defined by IDC Financial Publishing (IDCFP) as the addition of return on earnings assets (ROEA) and return on financial leverage (ROFL), or operating return plus financial return.

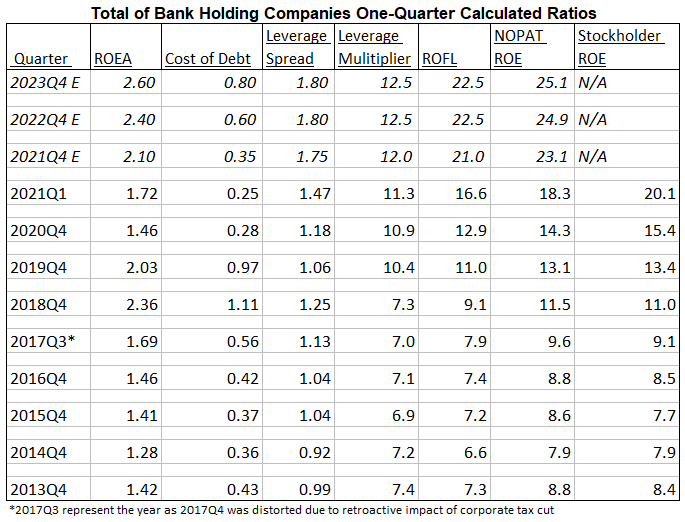

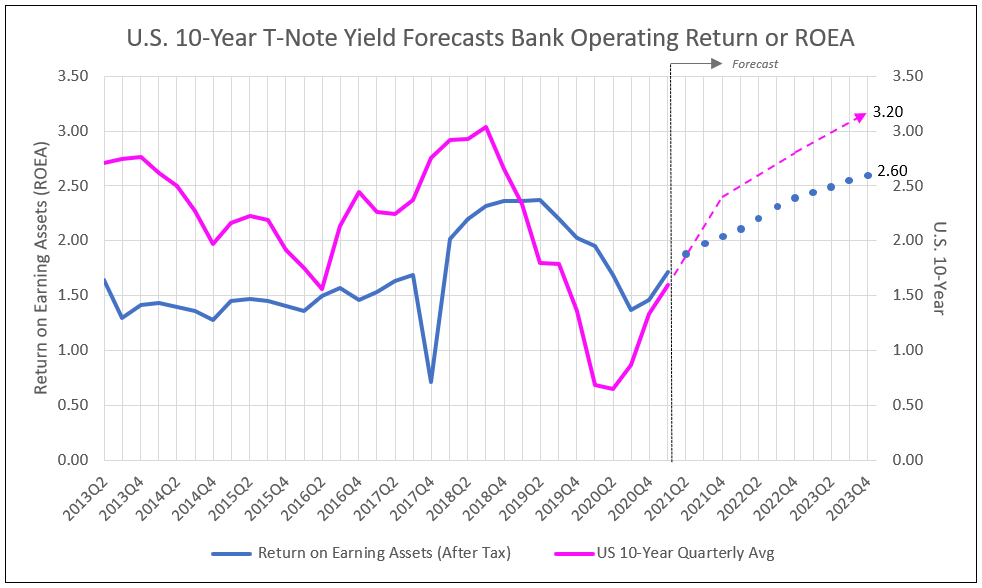

ROEA equals all operating income, less operating expenses (before funding costs) after-tax, excluding the loan loss provision, but adding back the increase in the loan loss reserve, to capture operating performance. Operating returns experienced a rising trend over the past decade. ROEA rose from an average 1.50% from 2013 to 2017 to a peak of 2.37% in June of 2019 and ended 2019 at 2.03%. Covid-19 impact last year reduced ROEA to 1.37% in September of 2020, but it is expected to recover to 2.10% by year-end 2021, then to as high as 2.40% in 2022 and 2.60% in 2023.

Return on Financial Leverage (ROFL) experienced a dramatic acceleration from 6.4% in 2016 to 16.6% in 2021. ROFL in a function of the leverage spread times the leverage multiplier. Leverage spread is the above described ROEA, less the interest cost of adjusted debt, after tax. The amount of earning assets not funded by tangible equity capital and the loan loss reserve is adjusted debt.

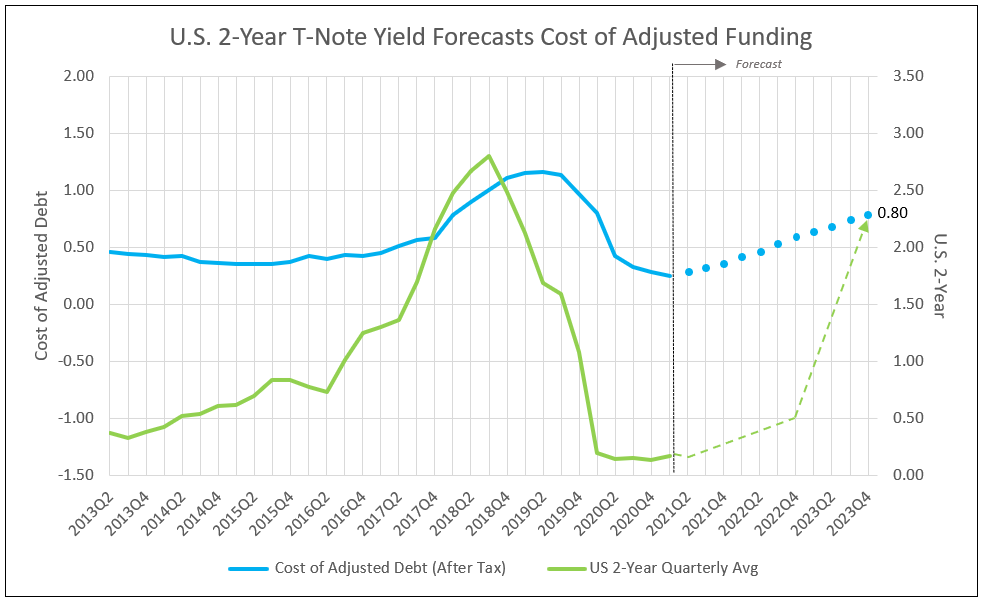

While ROEA grew from 1.36% in 2016 to 1.72% in 2021, cost debt rose from 0.42% in 2016, to a peak of 1.16% in 2019, but fell to 0.25% in 2021 due to Covid-19 and Federal Reserve policies. As ROEA recovers in 2021 through 2023, cost of debt will increase to 0.35%, then reach an estimated 0.60% and 0.80% during the same period. Leverage spread, therefore, increases to 1.75% in 2021, and 1.80% in 2022 and 2023 (see Chart I, II and III).

The key change in the decade was the leverage multiplier increasing from 6.8 to 11.3 in 2021 (see Chart III). The significant rise in leverage, multiplied by leverage spread, dramatically increased ROFL from 6.4% in 2016 to 16.6% in 2021. Adding the ROEA to ROFL provided an increase in profitability (ROE) from 7.75% in 2016 to 18.3% in 2021. In the same period, stockholder ROE rose from 7.4% to 20.1%.

NOPAT ROE (ROEA + ROFL) measures the true cash flow return on tangible equity and the loan loss reserve. Stockholder ROE calculates profitability adjusted for loan loss expense changes to forecast risk. Using NOPAT ROE, the forecast for 2021 through 2023 improves with a ROE of 23.1% and then 24.9% in 2022 and 25.1% in 2023.

As tangible equity per share grows at more than 10%, and ROE increases from 18% to 25%, earnings per share growth accelerates. This earnings per share acceleration with a terminal p/e ratio of 13.5-times, provides the over 90% appreciation potential through 2022 and into 2023.

Earnings Analysis and Projection

Bank holding companies’ earnings reported for the first quarter 2021 were $86.4 billion. In computing NOPAT ROE by IDCFP, only the increases in the loan loss reserve are included in the net income. In shareholder ROE, reductions in the loan loss reserve are included in earnings and amounted to an estimated $7.6 billion in the first quarter of 2021.

Using the IDCFP adjusted net income of $78.8 billion for the first quarter of 2021, we estimate 10% growth a year in tangible book value per share and NOPAT ROE to increase to 23.1% in 2021, 24.9% in 2022 and 25.1% in 2023. Earnings growth from the first quarter 2021 is estimated at 37% by year-end 2021, another 17.1% in 2022, and 10.8% in 2023.

Table I

Banks Benefit from Multiple Forms of Leverage in this Economic Recovery

The combined effect of bank leverage forecasts a 68% price appreciation for the index of large banks (BKX) over the next year, and another 26% through 2022 to 2023, based on the closing stock price on June 24, 2021.

Operating Leverage from an Increase in the Operating Return After Tax (ROEA)

ROEA is the operating return, or earning assets, after taxes, but before funding costs. The ROEA for all bank holding companies was 2.03% as of year-end 2019, declined to a low of 1.37% in the third quarter 2020, and recovered to 1.72% by March 31, 2021. The forecast relies on the U.S. 10-year yield increasing to 2.4% in late 2021 (see Chart I). The continued rise in the 10-year to 3.2% by year-end 2023, raises the forecast of ROEA to 2.4% in 2022 and 2.6% by year-end 2023.

Leverage Spread Increases as the Cost of Funding Adjusted Debt Remains Low

The 2-year T-Note is used to forecast the bank cost of adjusted debt from funding, which was 25 basis points as of March 31, 2021, and expected to remain at 35 basis points in 2021 (see Chart II). Increasing inflation forecasts a rise to 60+ basis points in 2022 and 80 basis points in 2023. The leverage spread (ROEA less cost of adjusted deposits and debt) recovers from 1.47% on March 31, 2021, to 1.75% by December 2021, and 1.8% in 2022 and 2023 (see Chart III).

Significant Rise in Financial Leverage Since 2017 Enhances Return on Financial Leverage

The multi-year rise in the leverage multiplier from 7-times during 2017’s economic recovery to 11.3-times in the current recovery dramatically improved the banking product structure. Return on financial leverage (ROFL) is the result of multiplying the leverage spread times the leverage multiplier. As of March 2021, the leverage multiplier is 11.3; multiplied by the leverage spread of 1.47%, provides a ROFL of 16.6%, up from the low of 12.5% in the third quarter of 2020. A rising leverage spread to 1.8% in 2022 with a leverage multiplier of 12.5 forecasts an ROFL of 22.5% (see Chart III).

Both Operating and Financial Leverage Benefit the Bank Stocks in 2021, 2022 and 2023

Adding the favorable operating return (ROEA) to the high financial return (ROFL) provided a NOPAT ROE of 18.3%, compared to a reported Shareholder ROE of 20.1%, as of March 31, 2021. An expected leverage spread of 1.8% and a forecast leverage multiplier of 12.5-times provides an estimated ROFL of 22.5% and a NOPAT ROE of 24.9% in 2022. An ROEA of 2.6% and ROFL of 22.5% in 2023 provides a NOPAT ROE of 25.1% (see Table I).

Leverage from a Higher NOPAT ROE Less Cost of Equity Capital Drives a Rising Price to Tangible Book Value

Estimating appreciation potential for a bank stock requires a target price.

- Projection of tangible book value per share (TBVPS) one year into the future.

- Forecast of NOPAT ROE one year ahead.

- Forecast of cost of equity capital (COE) based on the 30-year T-Bond yield one year ahead, with COE adjusted for bank-specific risk.

- The spread between ROE and COE determines the projected price-to-book, which is multiplied by forecast TBVPS to calculate the target price.

The favorable ROE of 24.9% to 25.1% is offset by a rising cost of equity capital, due to the increase in the 30-year T-Bond yield. A 3.2% yield on the 10-year raises the 30-year to 4.0% and increases COE to 8.3% in 2022. The spread between NOPAT ROE and COE would be 16.9%. In a fully valued bank stock market, like in February 2018 or December 2019, this spread prices a higher multiple of 2.8 times projected TBVPS. Up from a today’s multiple of 1.75, the forecast TBVPS provides an appreciation potential of 68% by June 2022 and another 26% in 2023 for the average large bank.

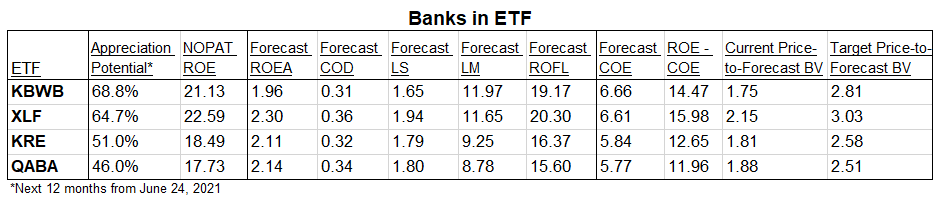

Table II

Tables Glossary:

NOPAT ROE: ROEA + ROFL

ROEA: Return on Earning Assets (before funding costs and after tax)

COD: Cost of Adjusted Debt (after tax)

LS: Leverage Spread

LM: Leverage Multiplier

ROFL: Return on Financial Leverage

COE: Cost of Equity

ROE - COE: Determines target price-to-forecast tangible book value.

IDCFP’s Forecast Process

Due to these multiple forms of leverage in a recovering economy with rising yields, bank stocks outperform value stocks, as represented by the Russell 1000 value stock index. In past bull markets in bank stocks, IDC Financial Publishing (IDCFP) forecasts proved accurate. For example, the BKX* over 20 months, from 6/30/2016 to 2/22/2018, rose to 103.6% of the target price for February 2018. The price appreciation over 20 months was 97.1% and the forecast for the price appreciation was 92.0%. Our forecast for the target price today uses the same process as in past years.

For a more detailed graphic of IDCFP’s Common Stockholder Net Operating Profit (After tax) ROE Equation click here.

*Large Money Center, Regional and Credit Card Banks

Chart I

Chart II

Chart III

General Disclosure

IDC Financial Publishing, Inc. is an independent research company and is not a registered investment advisor and is not acting as a broker-dealer under any federal or state securities laws. Opinions and estimates constitute our judgment as of the date of the material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument, nor does it constitute investment advice or address the suitability of any investment or security. The opinions and projections herein do not take into account individual client circumstances, risk tolerance, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. The recipient of this report must make its own independent decision regarding any bank analysis mentioned herein. All research reports are disseminated and available to all clients simultaneously through electronic publication on the IDCFP portal or by email.

Copyright © 2021 IDC Financial Publishing, Inc.

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director