SPYD Best Diversified Dividend Stock ETFs vs. Inflation

In May, IDC published this article and predictions based on trailing 12-month dividends. These included realized capital gains, so this double-counted the forecast. Following is our corrected forecast.

Inflation can erode purchasing power over time, especially in a fixed income investment. Carefully selected dividend stock ETFs, with high yield and dividend growth, can provide a hedge against inflation by generating a rising income stream, and still appreciate.

Dividend Income

Many epicenter companies in reopening industries, such as banks and other financials, industrials, materials, and oil and gas, are about to increase dividends. High-dividend-yielding stocks with dividend growth can provide a good stream of income and are likely to protect an investor against inflation, if the earnings growth supports rising dividends.

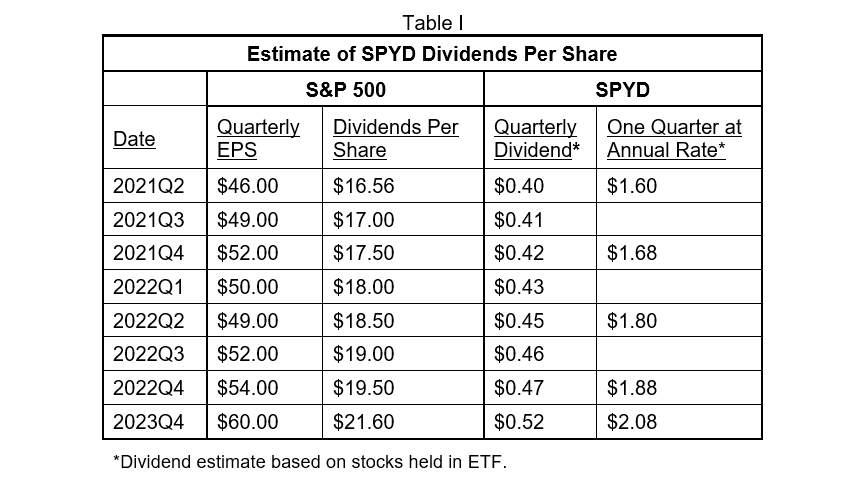

SPYD offers a no-nonsense ETF approach to capture high yields and dividend growth in the U.S. large-cap space. The fund ranks all dividend payers in the S&P 500 by indicated yield and selects the top 80 stocks. SPYD does not include any of the dividend sustainability or quality screens that some peers use. SYPD equally weights its portfolio. The dividend paid by the SPYD with pass through dividends from holdings in the 2nd quarter 2021 was $0.3989 for an annualized 2nd quarter 2021 dividend of $1.60 (see Table I).

Dividends Growth

Companies are expected to increase dividends in a reopening economic environment. Dividend increases can provide excellent protection against inflation. For example, you buy 1000 shares of SPYD at $40 a share, which pays 40 cents a share dividend in the second quarter of 2021, so you stand to collect $400 in quarterly dividend income. Next year, consumer prices increase 3 percent – an item that costs $400 now sells for $412 in 2022. But the SPYD ETF boosts the dividend to 45 cents a share or by 12.5% to $450, which puts you $38 ahead.

Estimation of the SPYD Dividends Based on S&P 500 of Earnings and Dividends from Stocks Held in ETF

IDC Financial Publishing, Inc. (IDCFP) estimated future quarterly dividend payments for the SPYD, based on the forecast of EPS and dividends per share at a 36% payout ratio.

Yield vs. Growth

Dividend yield shows the investor how much you stand to collect in income on your investment now ($0.3989 in the 2nd quarter 2021 and $1.60 at an annual rate) and dividend growth shows how much the income increases over time. Over one year, IDCFP forecasts the SPYD dividend is expected to increase from its current value of $0.3989 to $0.45, a 12.5% growth rate, far more than the inflation rate for the 12-month period ending June 2022. The dividend growth rate from June 2022 to December 2023 is forecast at 15.5%, or 10.4% at an annual rate. The annual 10.4% increase in dividends occurs after the initial economic reopening and recovery over 6 quarters, continuing to exceed expected inflation.

Future Minimum Target Price and Stock Price Appreciation Potential

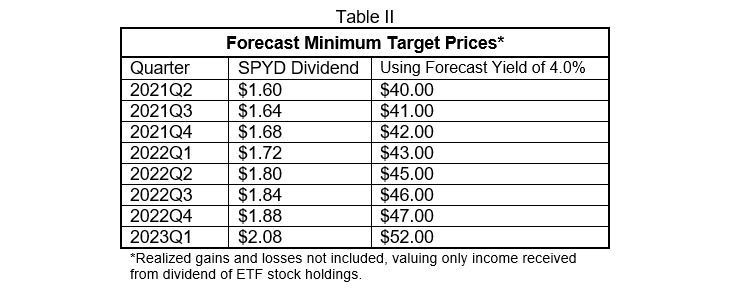

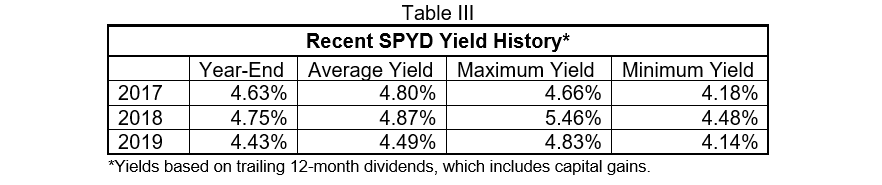

Today’s yield on a $1.60 annualized dividend is 4.0%. SPYD historically sold at an annualized yield of 4.0%. A terminal yield of 4.0% on the annualized quarterly dividend of $2.08 for 2023Q4, provides a minimum target price of $52. The appreciation potential from today’s price of $40 to $52 is 30%, plus the 4.0% yield at cost (see Table II).

SPYD Weighted to Benefit from a Reopening Economy

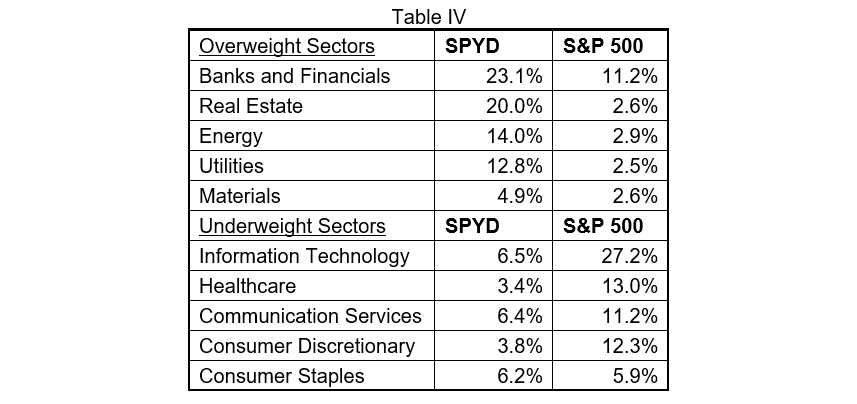

The SPYD ETF highest-yielding 77 stocks selected from the S&P 500 are equally stock weighted but benefit from being overweight in sectors such as banks and financials, real estate, materials, and oils and gas. The SYPD also benefits from being underweight in technology, healthcare, communication services and consumer discretionary stocks, whose valuations could be capped in an environment of rising long-term U.S. Treasury yields (see Table IV).

Banks and financials benefit from the reopening reflation trade, with rising loan demand and loan yields, created by higher long-term yields that price inflation and rising TIPs yields. Real estate is an inflation hedge sector. Energy and materials industries benefit from rising prices and demand during a reflation economic recovery. Underweight sectors, such as information technology, healthcare, communication services and consumer related companies, are the higher price-to-earnings sectors, experiencing stock selling, as rotation moves money into epicenter reflation stocks.

Risk in the SPYD

The SPYD is structured to outperform in dividend growth and price appreciation in a strong economic recovery which favors epicenter stocks. The risk is a failure to experience an economic recovery from the COVID recession, which appears a relatively low risk at this time. Stock market prices fluctuate in the future with potential stock market corrections in a bull market. The SPYD offers a 4%-plus yield for patient investors during periods of corrections. The management fee is 0.7%, the lowest among dividend and other S&P ETFs.

General Disclosure

IDC Financial Publishing, Inc. is an independent research company and is not a registered investment advisor and is not acting as a broker-dealer under any federal or state securities laws.

Opinions and estimates constitute our judgment as of the date of the material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument, nor does it constitute investment advice or address the suitability of any investment or security. The opinions and projections herein do not take into account individual client circumstances, risk tolerance, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. The recipient of this report must make its own independent decision regarding any bank analysis mentioned herein.

All research reports are disseminated and available to all clients simultaneously through electronic publication on the IDCFP portal or by email.

Copyright

© 2021 IDC Financial Publishing, Inc.

To view all our products and services please visit our website www.idcfp.com. For more information, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director