Foreign Buyers Dominate Net Buying of U.S. Treasury Securities, Creating Weakness in the U.S. 10-Year Yield

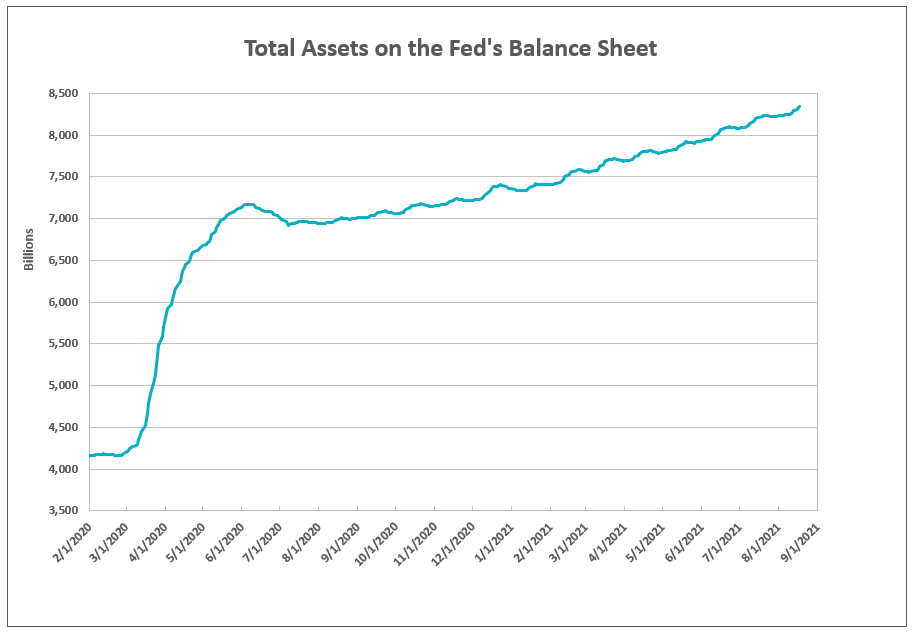

Quantitative Easing (QE)

Chart I

A potential peak in Fed’s buying of mortgages and Treasury securities is expected in November 2021, as the Federal Reserve begins tapering.

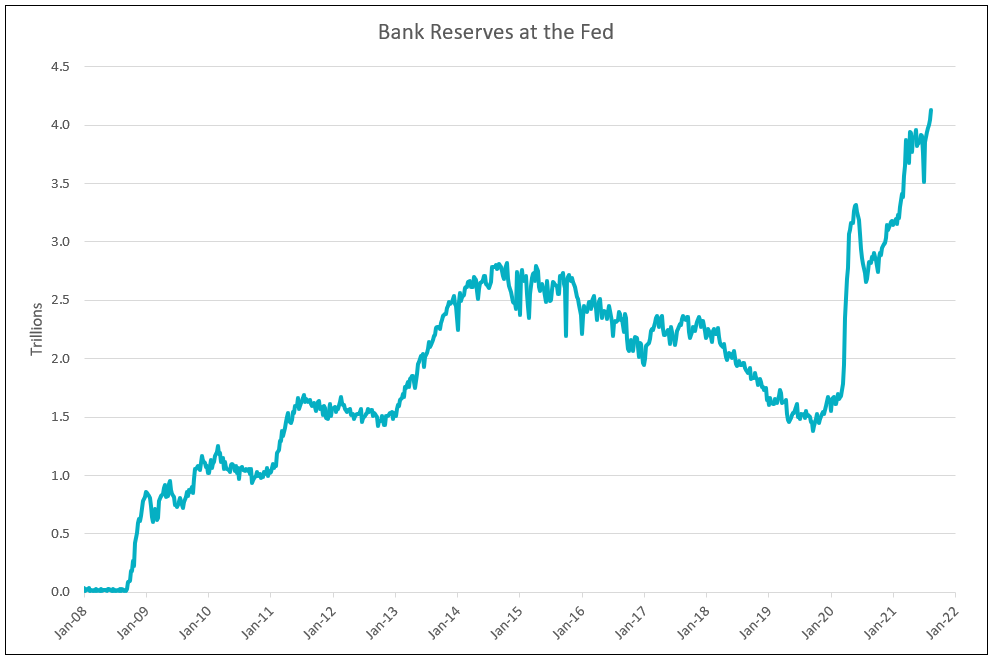

Quantitative Easing Increases Bank Reserves at the Fed

Chart II

“The Fed could stop buying securities altogether and reduce its balance sheet, which would also drain liquidity from the market. But the Fed cannot do that because it said it would be slow and deliberate in announcing changes in its monetary policy, and that it might eventually talk about talking about tapering, so it can’t just suddenly do an about-face.” 1

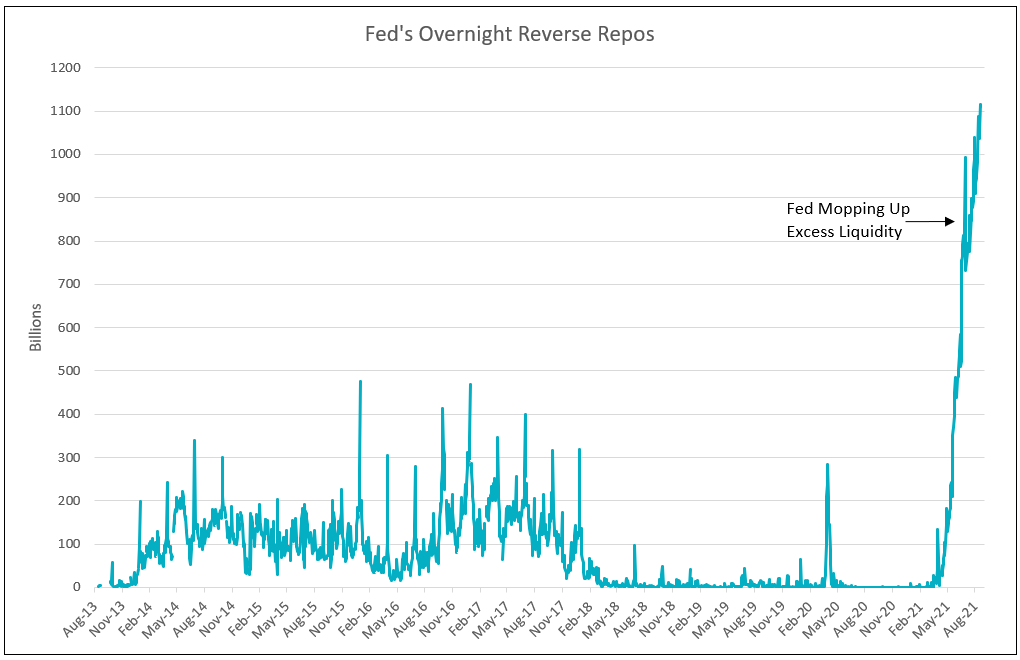

But this liquidity-haywire situation appears to be an emergency that needs to be addressed now, and so the Fed has addressed it through the backdoor via the overnight reverse repos.1

Over $1.1 Trillion in Treasury Securities via Reverse Repos,to Drain Liquidity from the Treasury Market – The Opposite of QE

Chart III

The Tsunami of Liquidity1

“Everyone has their own theory as to why there is so much demand for Treasury securities. But one thing we know: the banking system is creaking under a huge amount of liquidity.”1

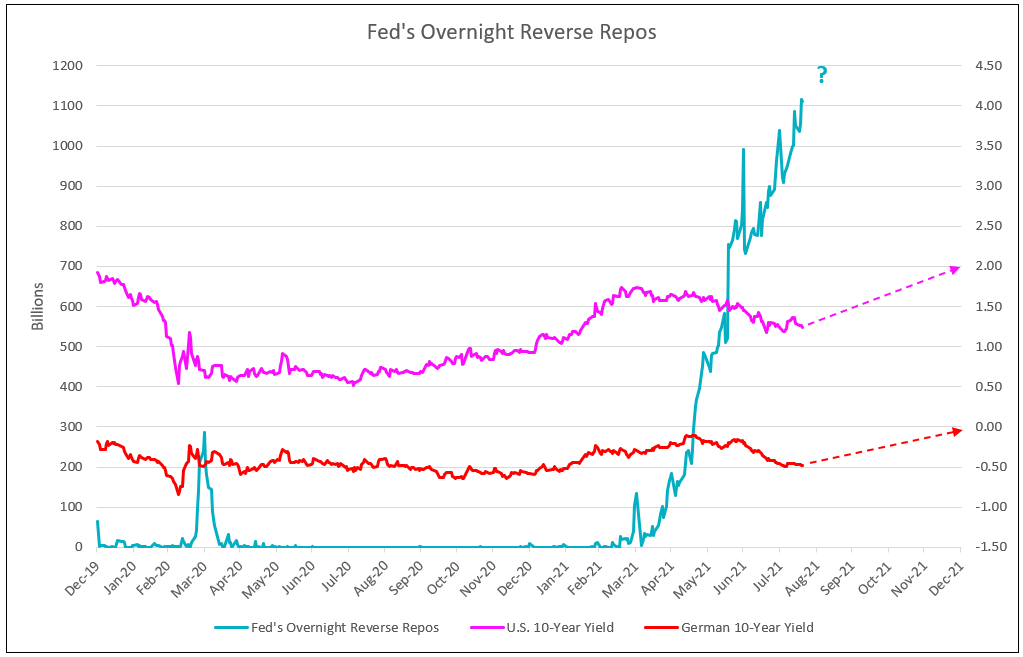

In the second quarter 2021, foreign central banks and government entities, foreign institutional investors and corporate entities, banks and individuals increased their holdings of U.S. Treasuries by $174 billion. Note, China and Japan, the largest holders of U.S. Treasuries, decreased their positions. In an August 10-year T-Note auction, indirect (foreign) purchases accounted for 75% of the demand. Therefore, foreign entities could well account for the over $200 billion increase in holdings of U.S. Treasury securities in the third quarter of 2021, as excess liquidity in Europe flows into the U.S.

While the Fed increased its holdings of Treasury Securities by $241 billion in Q2, reverse repos eliminated that liquidity impact. Large foreign European purchases and covering of U.S. hedge fund short positions created the decline in the 10-year yields to the low on July 19th and the weakness in August, despite the Fed’s mopping up excess liquidity. Rising yields in the German 10-year from -0.47% and coming peak in liquidity increase the U.S. 10-year yields toward 2% in the second half of 2021.

European Buyers of U.S. Treasuries and Covering of U.S. Hedge Fund Short Positions Drove Yields to Recent Lows

Chart IV

1 - Wolf Street: Fed Drains $485 Billion in Liquidity from Market via Reverse Repos,...

For further information or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com. To view our products and services please or visit our website at www.idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director