Treasuries Like a Coiled Spring

The confluence of Fed buying, the spike in reported CPI inflation for October, pipeline supply problems impacting industries like auto and retail, high levels of Fed spending and debt issuance, as well as short covering by traders of the 20-year T-Bond, all together, tighten the “coiled spring” in yields, forcing record low negative yields in the 5 and 10-year TIPS.

An article on March 17, U.S. Bond Market Feels Like a ‘Coiled Spring’ After Fed Meeting, stated the Fed’s “commitment to loose policies that are likely to help further boost economic growth and inflation…a key issue for both investors and Fed officials who would rather not have to ride out another bout of bond market volatility, as a growing body of indicators suggest U.S. growth is poised to take off this year.”

However, the Delta variant of Covid intervened, causing pipeline supply problems and slow GDP growth with inflation accelerating beyond Fed expectations.

Then, another article from August 14, “Bond Market Like a Coiled Spring Before Long-Awaited Fed Confab" stated similar sentiments about treasuries. Real TIPS yields fell to record lows on August 4, 2021, as the U.S. Treasury market digested the same confluences of the Fed buying of Treasuries and mortgages, high reported inflation, supply chain problems and Fed government spending and borrowing plans, combined with rising infections due to the Delta variant.

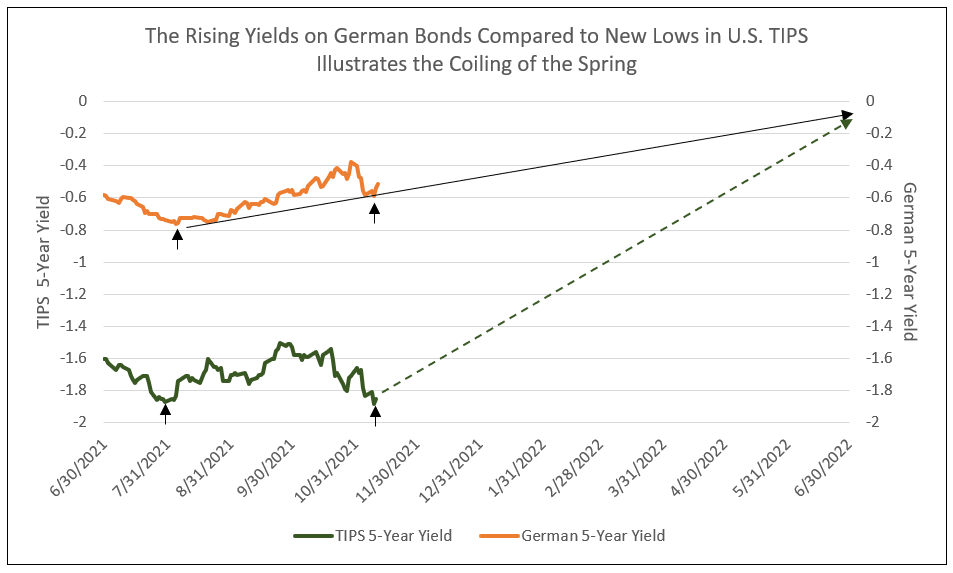

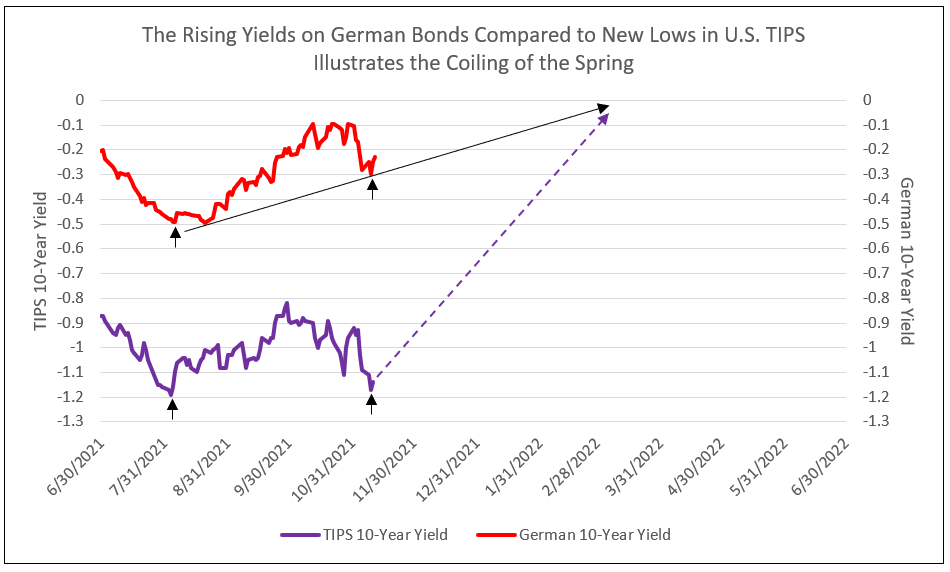

Then, again, on November 9, 2021, TIPS yields on 5 and 10-year Treasuries reached record lows. The yield curve attempted to price a recent record high CPI inflation rate, while supply chain problems persist, the infrastructure spending bill passed, and short covering of Treasuries persisted. The TIPS yield in response hit a record low on November 9, and “coiled the spring” once again (see Charts I and II).

Chart I

Chart II

How TIPS Can Have Negative Yields

The yield on a TIPS bond is equal to the treasury note or bond yield minus the expected inflation rate for that maturity. As a result, when standard treasuries are trading at yields below the expected inflation rate, as has been the case since late 2010, TIPS yields fall into negative territory.

Investors continue to purchase TIPS with negative yields because they are concerned about losing principal in their investments. During periods of high inflation, investors can once again earn a positive return on TIPS because the principal value of TIPS adjusts upward with inflation. The purchase of TIPS at current levels of highly negative yields requires inflation to remain high for a number of years in order for this kind of investment to be worthwhile.

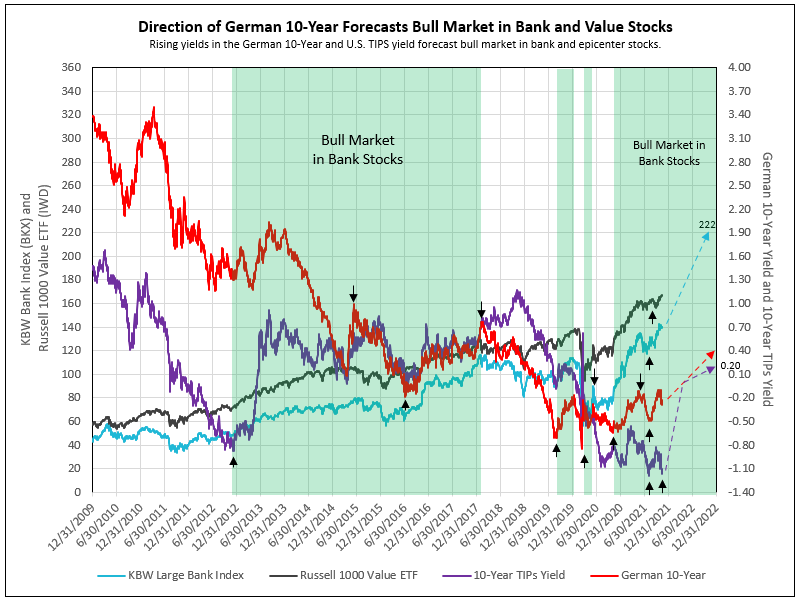

Chart III

The Current Picture in Yields

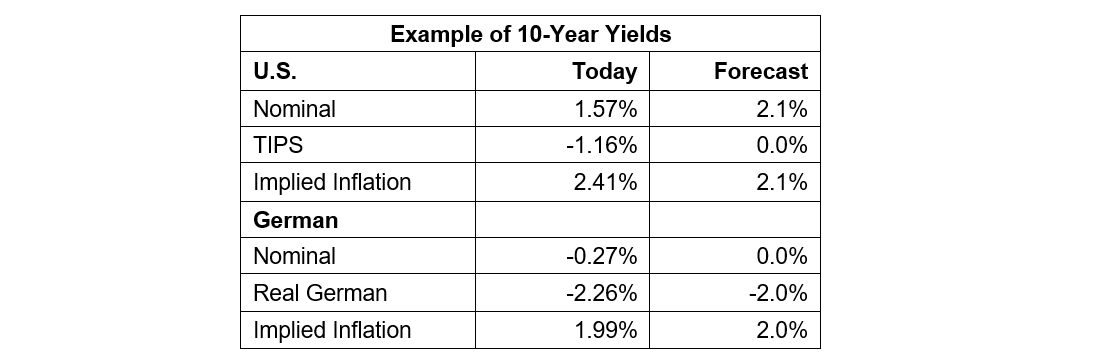

- The German 10-year yield recently recovered to -0.10% three times and is set to breakout to zero or positive yields in 2022.

- From 2014 to early 2018, the 10-year German yield and the U.S. TIPS yield were approximately equal. These two yields are expected to again converge around zero in the first half of 2022 (see Charts I and II). The reason these yields were nearly equal from 2014 to 2018, and forecast to be equal in the future, is because Germany is the largest export customer of the U.S. To maintain currency equilibrium, the nominal yield spread should reflect U.S. inflation expectations. The narrow nominal yield spread since May has been reflected in a strong

dollar versus the Euro. Therefore, the nominal yield spread is expected to widen, as implied inflation narrows, until the U.S. TIPS equals the German 10-year – all reversing the strong dollar.

Table I

- From February 2018 to August 2019, the German 10-year yield fell due to Bundesbank policy to reduce yields and stimulate the German economy in the face of U.S. tariffs on Europe and China. The yield decline reached a second low on March 9, 2020, due to the Covid crisis.

- For the first time. beginning in May 2020, the U.S. 10-year TIPS yield declined below the German 10-year yield, reaching a low of -1.03% on August 29, 2020 (the first cycle low in the “coiled spring”). The second low in the TIPS yield occurred on December 31, 2020 at -1.08%. The third occurred on August 3, 2021 at -1.19%. The last “coil” low occurred on November 9, 2021 at -1.17%.

As inflation peaks, buyers of TIPS fade, implied inflation (the difference between nominal and TIPS yields) narrows, and the U.S. TIPS yield recovers, rising toward the German 10-year yield (see Chart III). A similar event occurred in the first half of 2013 in response to tapering announcements by the Federal Reserve, resulting in the 10-year TIPS yield rising by itself in just two months, from -0.74% on April 5, 2013, to zero by June 7, 2013.

The yields were a coiled spring in 2013 and are again today. An end to supply chain issues, the availability of the Pfizer pill reducing Covid-19 fears, a peak in reported or perceived inflation, and tapering, together could trigger the release of the coiled spring, with TIPS yields rising toward zero.

Goldman Sachs economists projected that core PCE inflation, the Federal Reserve’s preferred gauge, will rise from 3.6% to 4.4% by the end of 2021. Their forecasts also indicate a cooling to 2.3% at the end of 2022 and 2.1% by the end of 2023, supporting our forecast.

A gradual rise in TIPS yields is the best outcome for bank stocks and the equity markets, as growth stocks adjust to higher yields due to a rising discount rate in the P/E ratio. A sudden and sharp rise in TIPS could reduce growth stock P/E ratios, while favoring value stocks, especially bank stocks (see Chart III).

Regardless of the case, bank stocks are the winner.

To inquire about IDC’s valuation products and services, please contact jer@idcfp.com or call 262-844-8357. To view all our products and services please visit our website www.idcfp.com.

For more information, or for a copy of this article, please contact us at info@idcfp.com.

John E. Rickmeier, CFA

President

Robin Rickmeier

Marketing Director