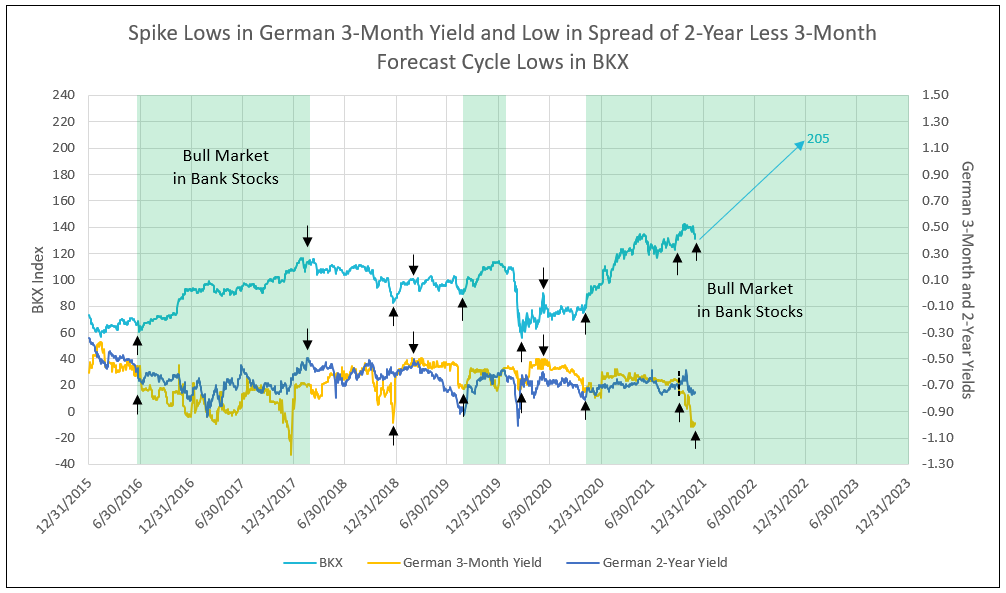

Decline in German 3-Month Yield Triggers Bull Markets in Bank Stocks

- A low in the German 3-month yield determines the low in BKX Index of large bank stocks. A cycle low in the German 3-month yield at less than -1.00% occurred on October 31, 2021, and since November 15, 2021 to date. Previously, cycle lows only occurred in November of 2016, 2017, and 2018. An intra-day recovery of the German 3-month above -0.95% forecasts a buy for in the BKX and S&P 500.

- The German 10-year yield held a low of -0.35%, and with lower yields in the German 3-month and 2-year, steepened the German yield curve.

- · The BKX index broke out to the upside, following its low of 130.48 on September 30, 2021, a retest low for the current correction.

- TLT, the ETF for the U.S. 20-year T-Bond, reached a double top of 152 on November 30 and November 9, 2021, as massive short covering raised the TLT price. On November 30, the U.S. 10-year T-Note yield declined to 1.44%, similar to its low of 1.43% on November 9, 2021, indicating yield decline exhaustion.

- On November 29, 2021, the intra-day high yield for the German 3-month yield was -0.927% -- less than the -0.95% required to call a stock market low. On November 30, both banks and the stock market reached a low and recovered from this signal. A year-end seasonal recovery is expected to follow. Appreciation potential for bank stocks over the next year remains 50% with select portfolio potential returns as high as 80% to over 100%.

To inquire about IDC’s valuation products and services, please contact jer@idcfp.com or info@idcfp.com or call 800-525-5457.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director