The Great Bond Market Breakout

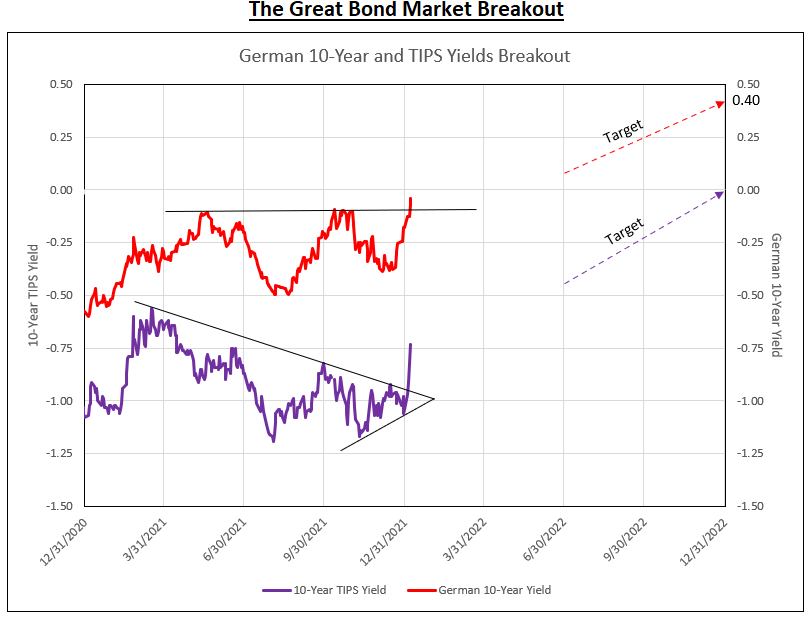

IDC Financial Publishing (IDCFP) forecast the beginning of the bull market in bank stocks in October 2020 with the anticipated rise in 10-year yields. Our forecasting requires an increase in the 10-year nominal yield, supported by rising TIPS yields, and, especially, a higher German 10-year yield.

The first leg of the bank bull market lasted from October 2020 to May 2021. Then, from May to July 2021, an intermission occurred, as the German 10-year peaked at -0.10% and declined to -0.50%. The second leg of the bank bull market began in July 2021, but Delta and, later, Omicron, stalled this potential bull market.

The result was a coiled spring in the TIPS yield, which continued to hit lows as the German 10-year recovered to peaks around -0.10% in October. In early 2022, TIPS yields broke out of the descending triangle as the German 10-year rose to -0.04%, on its way to zero.

The German yield fell into negative levels in 2019 in response to Trump tariffs, and then remained negative due to Covid. Strong economic growth in Europe, after the peak in Covid, forecasts positive yields in 2022 (see Chart I).

Chart I

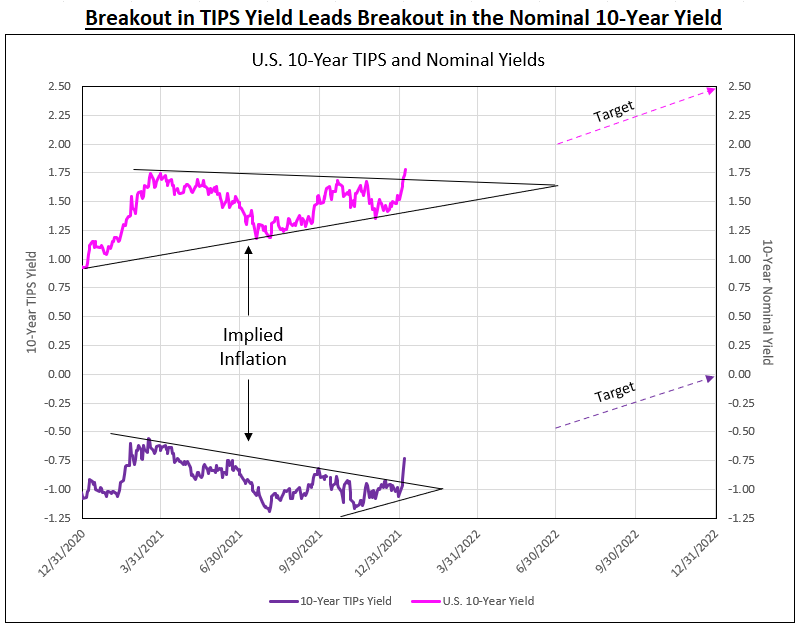

The nominal U.S. 10-year yield broke out of its descending wedge to 1.75%, and is on the way to 2.00% by June and 2.50% by year-end 2022. The rise in nominal yields was triggered by the sharp breakout in the 10-year TIPS yield from its descending wedge to -0.73%, with forecasts of -0.40% by June and zero by year-end 2022 (see Chart II).

Implied inflation, the difference between the nominal 10-year yield of 1.78% and a negative TIPS of -0.73%, remains 2.51%. Implied inflation is forecast to remain in this range in 2022, as portions of inflation are transitory.

Chart II

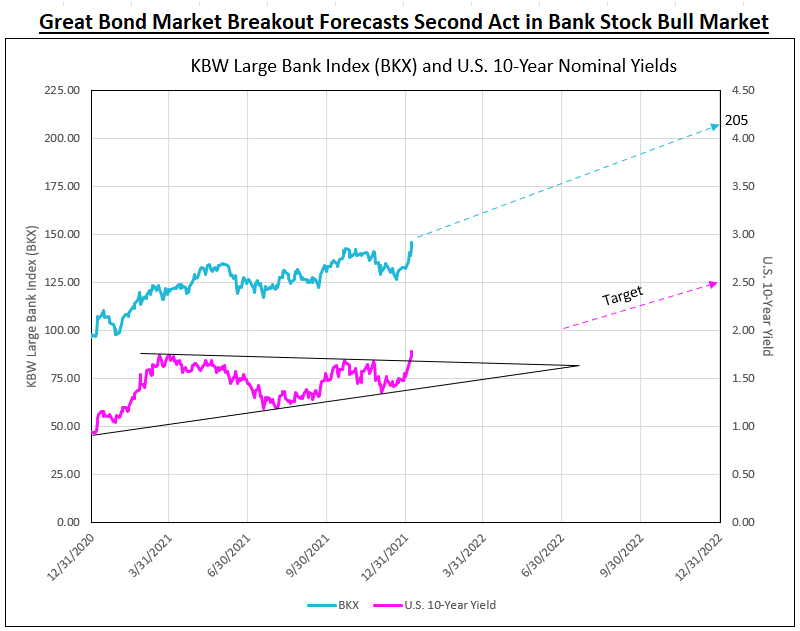

The Great Bull Market in Bank Stocks

As noted above, the bull market in bank stocks began in October 2020 and the first leg lasted to May 2021, as the German 10-year peaked and the U.S. 10-year failed to make new highs. The intermission lasted from May to mid-July as the U.S. 10-year fell to cycle lows (see wedge in Chart III).

The second leg of the bank bull market began in July 2021, but stalled as the U.S. 10-year remained in the wedge, reflecting the resurgence of Covid in Delta and Omicron. Not until early 2022, led by the breakout of the TIPS and German yields, did the U.S. 10-year yield breakout.

Chart III

The KBW Large Bank Index (BKX) rose to new highs in November 2021, only to correct to the December low due to the Omicron variant. The U.S. 10-year forecast of 2.0% by June and 2.5% by year-end indicates a continued second leg in the bull market in bank stocks, with more than a 40% appreciation potential in 2022 (see Chart III).

For a limited time, IDCFP is offering a free valuation of your favorite bank stock. Email info@idcfp.com with the ticker symbol of your chosen bank stock to take advantage of this service.

To view all our products and services please visit our website www.idcfp.com. For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director