Bank Financial History Illustrates a Secular Increase in Profitability

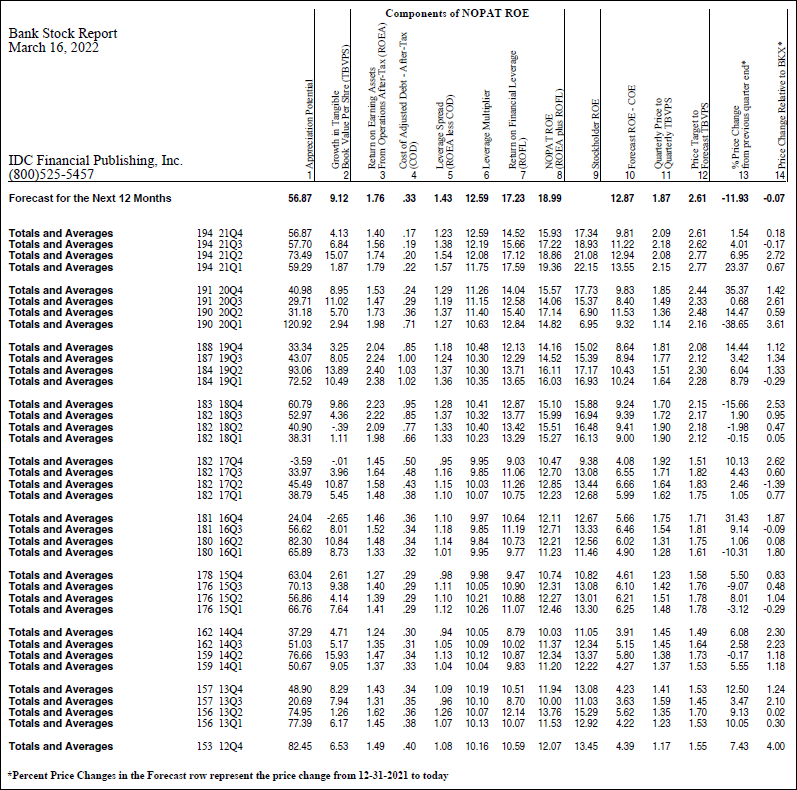

Updated for 2021Q4

In the last five years, banking financials have improved dramatically based on IDC Financial Publishing‘s (IDC’s) NOPAT ROE rising from 12.1% in the fourth quarter of 2016 to a peak of 15.9% in the fourth quarter of 2021. During the same period, reported stockholders ROE increased from 12.7% to 17.3%. NOPAT ROE is expected to maintain the trend, with a forecast of 19% by the December quarter of 2022.

What fundamentals are driving this secular improvement in profitability?

IDC’s non-traditional approach to financial ratios, modeling, forecasting, and valuation offers a unique perspective to bank stock selection. The following description demonstrates how we are different and offers an explanation as to why and how the secular improvement is occurring in banking, driving higher price-to-tangible book valuations. By using the following unique ratios developed by IDC to forecast a bank’s appreciation potential, we demonstrate how our approach is superior to the standards of most bank analysis.

The Traditional ROE Equation and the Problem with the Bank Stock Analysis

The traditional ROE equation simply divides net income by the average of common stockholder’s tangible equity capital. The stockholder ROE, as a bottom-line measure of profitability, fails to reflect the true nature of asset value. Additionally, the traditional components of the ROE percentage – net interest margin, net income return on assets (ROA), and resulting stockholder ROE – confuse the source of net income by subtracting cost of funding too early in the analysis. Bank common stock evaluation is unable to separately compare operating and financial returns. Finally, accounting for the loan loss provision and not adjusting net income for the increase on the loan loss reserve, fails to reflect the true cash flow to earnings used to value a bank stock.

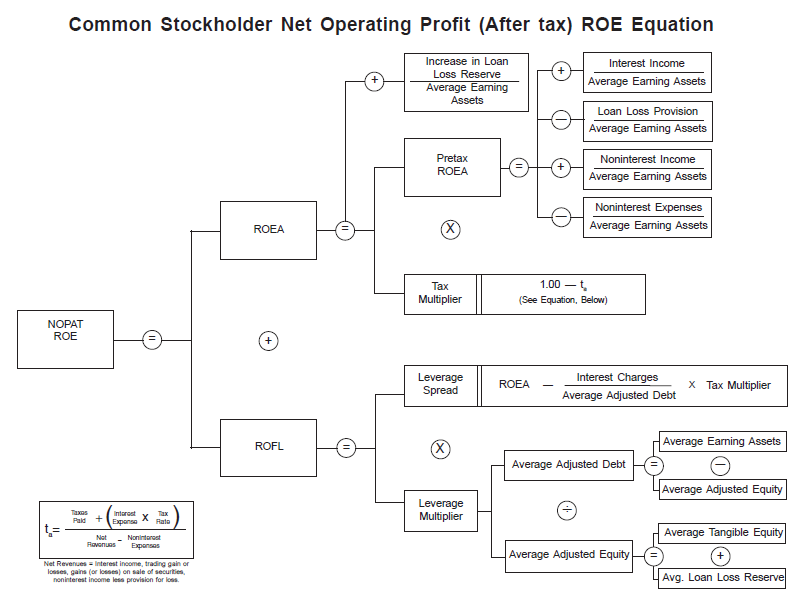

The NOPAT ROE Equation (see Diagram I)

In contrast IDC uses the NOPAT ROE equation to express ROE as a sum of two components, operating return (ROEA) and financial return (ROFL). ROEA equals the return that the bank earns on loans, securities, cash equivalents and other earning assets, after operating expenses, loan loss provision, and taxes (but before interest expenses), and then adding back the increase in the loan loss reserve. ROEA focuses on the operating strategy, which identifies returns from investments, loans, and non-interest income sources net of noninterest expenses and taxes, plus the increases in the loan loss reserve, all as a percent of earning assets. Return on financial leverage (ROFL) measures financial returns or the after-tax cost of deposits and debt required to finance earning assets not funded by tangible equity and the loan loss reserve. See our example below (Table I) that details the components of NOPAT ROE for all banks analyzed by IDC.

Valuations Components – An Example of Bank Valuation

The key components required by IDC to value a bank are the forecast of tangible book value per share (TBVPS), NOPAT ROE, and cost of equity capital (COE).

Forecast growth in TBVPS is based on the recent growth rates for TBVPS, which is enhanced by increased share buy-backs. The annualized growth in average TBVPS for the sum of 194 banks followed by IDC in the fourth quarter of 2021 was 4.1% and expected to increase by 9.1% over the next 12 months.

The components of NOPAT ROE are the operating returns (ROEA) plus the financial returns (ROFL). ROEA measures the operating profits after tax, excluding funding costs, but includes the increase in the loan loss reserve to capture the true cash flow from operations. In the last five years, ROEA has improved from 1.45% from year-end 2016 to 2.04% in 2019Q4. Banks are expected to return to or exceed the favorable 2.04% earned in the last quarter of 2019, by year-end 2023. IDC forecasts ROEA to recover to 1.76% by the fourth quarter of 2022.

To compute the financial return (ROFL), IDC forecasts 1) cost of adjusted debt after tax (COD), which is the after-tax funding cost divided by the earning assets less tangible equity and the loan loss reserve. COD fell from 0.85% in 2019Q4 to 0.17% in 2021Q4 due to Covid and Federal Reserve policy to keep short term rates near zero. IDC forecasts banks will add 16 basis points to COD by December 2022, increasing after-tax cost of debt to 0.33%, due to the expected increase in the Fed funds rate.

Subtracting COD from ROEA provides 2) leverage spread, which increased from 1.10% at year-end 2016 to 1.23% in 2021Q4, exceeding the 1.18% realized in 2019Q4. The forecast for leverage spread improves again in 2022 to 1.43%, as strong operating returns exceed the increase in COD.

The most dramatic secular change in banking is 3) the leverage multiplier, which rose from 10-times in 2016Q4 to 12.6-times in 2021Q4. The leverage multiplier is the product of the earning assets excluding tangible equity and the loan loss reserve divided by the equity and loan loss reserve.

Return on financial leverage (ROFL) then equals the leverage spread times the leverage multiplier. In December 2022, a forecast leverage spread of 1.43% times a record high leverage multiplier of 12.6 provides a favorable forecast ROFL of 17.23%. Adding the forecast ROEA of 1.76% to the forecast ROFL of 17.23% provides a forecast NOPAT ROE 18.99% (see Table I).

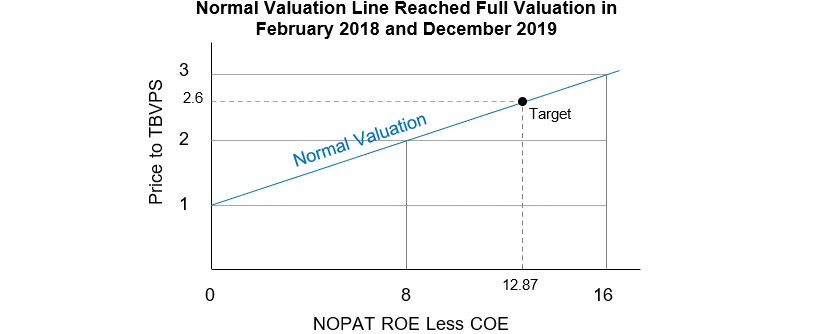

The NOPAT ROE less the cost of equity capital (COE) provides the price-to-book estimate and appreciation potential (see Table I, columns 11 & 12).

Table I

Bank Financial Ratios from 2012Q4

What other industry realizes a secular increase in ROE from 10.5% to 19.0% in 5 years like banking?

An increase of 9.1% in TBVPS coupled with a dramatic improvement in ROE to 19% creates accelerating EPS growth added at a terminal p/e of 13.8-times, from current p/e of 9.7-times, provides a 51% appreciation potential for the average bank stock. The estimated target price to forecast TBVPS of 2.61 in December 2022 is a function of the forecast NOPAT ROE less the cost of equity capital (COE, estimated at 6.1% for December 2022) with the COE based on the forecast of 3% in long term U.S. Bond yields in 2022, plus one-half the bond yield adjusted for the specific risk of a bank. The current price to reported fourth quarter 2021 TBVPS is 1.87-times.

Chart I

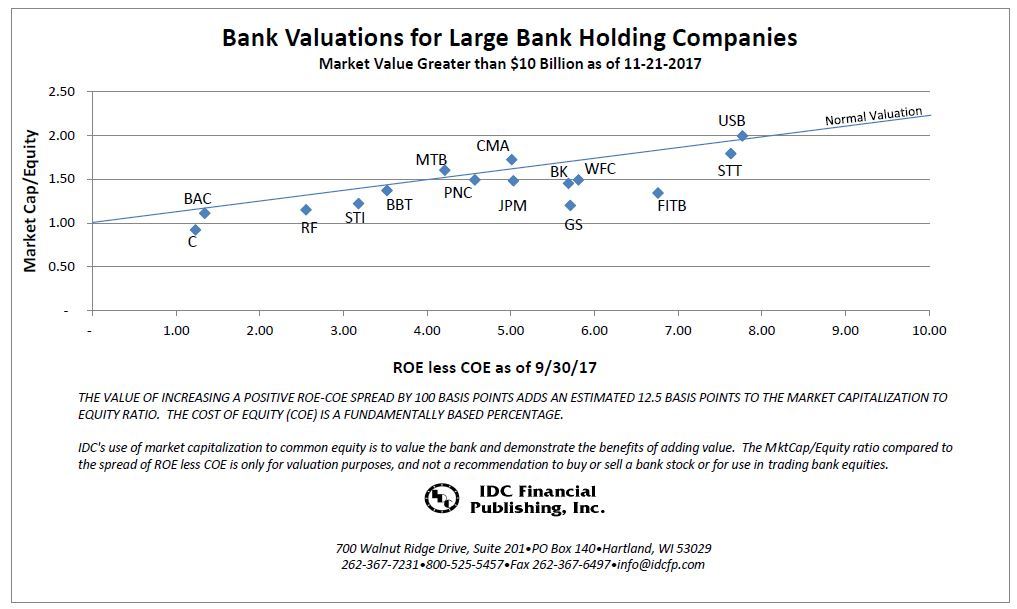

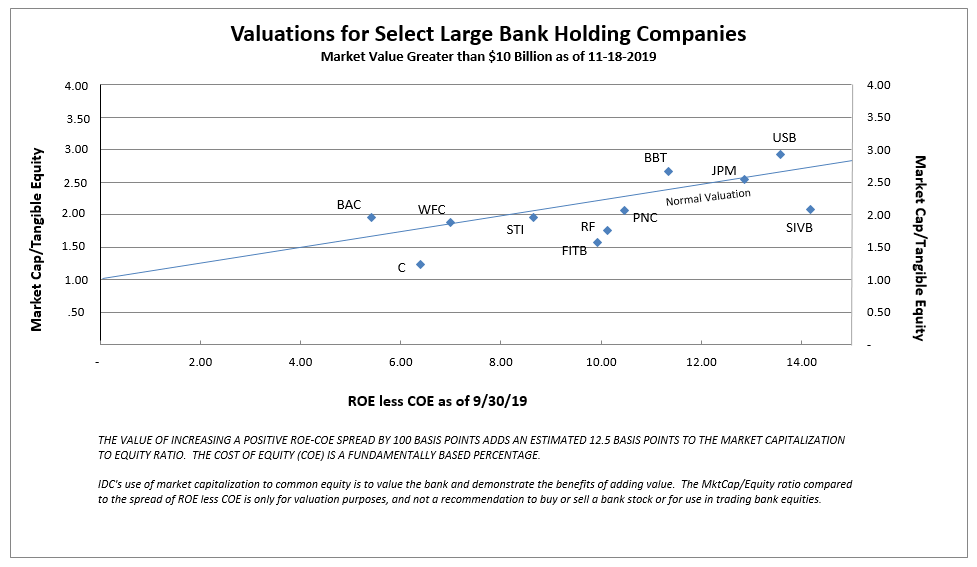

The history of bank stock valuation, provided by appreciation potential of bank stocks from 2012 to 2021, demonstrates its accuracy. The major bull market in bank stocks began on December 12, 2012, and lasted to February 15, 2018, with the KBW Large Bank Index appreciating 130.5% over that 5-year, 2-month period, or 17.4% a year.

For the average bank stock, numbering 153 in 2012 to 182 in early 2018, the average capitalization weighted 12-month appreciation potential, based on IDC’s valuation, began at 82.5%, was 82.3% in June 2016, and ended in 2017Q4 with a negative 3.6% appreciation potential, an indication of full valuation. A second valuation measure, current price to current TBVPS versus forecast price to forecast TBVPS (columns 11 & 12 in Table I), provided a favorable spread from 2012 to 2017, but by year-end 2017 current price to current TBVPS exceeded forecast price to forecast TBVPS, indicating full valuation.

The current bank stock bull market began on October 29, 2020, with a 30% appreciation potential for the average bank stock. Despite an 69% appreciation in the KBW Large Bank Index from October 25, 2020, to March 16, 2022, another 51% appreciation potential in the BKX is forecast over the next 12 months. The current bull market could well offer the same or greater opportunity seen in the last bank stock bull market from 2012 to 2018.

Method for Forecasting Price Appreciation Potential for a Bank Stock

Under normal bank financial conditions (pre-COVID), the key component of the NOPAT ROE forecast was the operating return (ROEA). Forecast ROEA a year ahead equaled the greater of the annualized last quarter or last four quarters of ROEA. Cost of debt (COD) was set equal to the latest annualized quarter value. The resulting leverage spread (ROEA less COD) was then multiplied times the latest reported leverage multiplier, providing return on financial leverage (ROFL). The forecast NOPAT ROE equaled the ROFL plus ROEA. Finally, the forecast NOPAT ROE less the cost of equity capital (COE), based on 3% long U.S. T-Bond yield, determined the forecast price to forecast TBVPS (see Chart I). Given the forecast of TBVPS was the greater of 1-year or annualized latest quarter growth, the forecast price-to-TBVPS times the forecast TBVPS provided a target price or appreciation potential.

Beginning in the second quarter of 2020, however, the method of forecasting changed due to the significant decline in reported operating returns (ROEA) due to COVID. From 2020Q2 to 2021Q4, the forecast one-year ahead ROEA was estimated as the mid-point between the current quarter value and the ROEA for 2019Q4, given the ROEA for the last reported quarter was less than 90% of 2019Q4 value. For those banks with ROEA 90% or greater as a percent of reported ROEA in 2019Q4, the forecast was based on the ROEA reported for the most recent quarter. This method allowed for cyclical recovery in the operating return or, if above secular trend, a continuation of that trend.

Cost of debt (COD) was increased for the expected increase in the Fed funds rate. The resulting forecast leverage spread times the latest reported leverage multiplier provides the forecast ROFL. Adding forecast ROEA and forecast ROFL equals forecast NOPAT ROE. The forecast NOPAT ROE less the cost of equity capital (COE) provides the price-to-book estimate and appreciation potential (see Chart I).

Accuracy of Valuation Line in History

The following charts published by IDCFP in late 2017 (Chart II) and late 2019 (Chart III) highlight valuation data from the previous quarters, during periods of peaks in bank bull markets. Market capitalization to equity represented the price to tangible book value. The valuation line in history demonstrates the accuracy of this method using the normal valuation line to forecast price-to-book value given the spread of NOPAT ROE less COE.

Chart II

Chart III

Diagram I

Let IDC provide you the value and financial history of your favorite bank stock. For you to better understand our process of valuation, we offer a free, one-time analysis of one of the 202 banks in our bank analysis database. Simply send your request with the bank stock symbol to info@idcfp.com.

To inquire about IDC’s valuation products and services, please contact jer@idcfp.com or info@idcfp.com or call 262-844-8357.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director