Fed Funds Rate Hikes and Two-Year Yields Over 3% Forecast Significant Increases in Brokered CDs

Brokered CDs Reaching New Highs in 2022

Yields of the 2-year T-Note over 3% and anticipated increases in the Fed funds rate, together, forecast substantial increases in brokered CDs of $250,000 or less.

IDC Financial Publishing (IDCFP) has attempted over time to estimate brokered CDs for individual banks. The unknown in the equation has historically been the level of sweep accounts in brokered deposits. As of September 30, 2021, bank reports, sweep accounts for individual banks were available on the call reports.

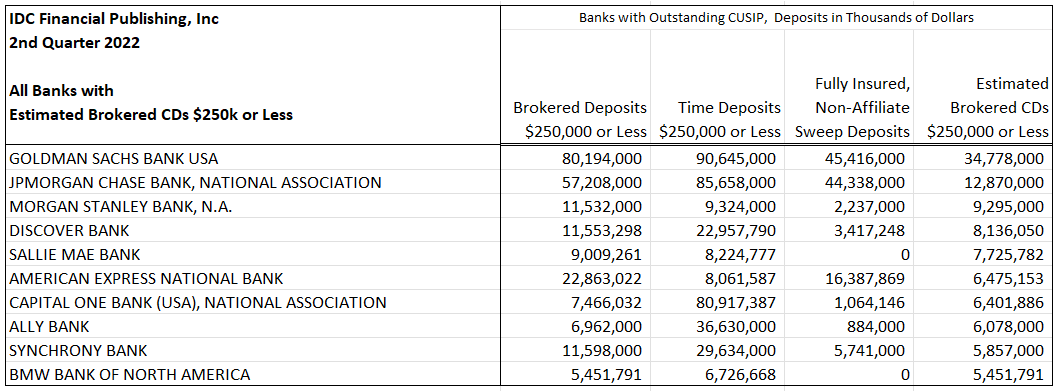

As of June 30, 2022, the total brokered CDs $250,000 or less as a sum of all banks was $199.6 billion compared to DTC value of $224.3 billion. IDCFP calculates the estimate, as demonstrated in Table I, by subtracting from the brokered deposits of $250,000 or less the fully insured, non-affiliate sweep deposits, capped at the value of time deposits of $250,000 or less for banks with an outstanding CUSIP number for brokered CD issuance. IDCFP concludes the estimates for individual banks’ brokered CDs is reasonably accurate and available on request for your own marketing or other research needs.

DTC Brokered CDs of $250,000 or less peaked in June 2019 at $433.3 billion and declined to $395.6 billion by December 31, 2019. The significant decline in 2020 was due to Covid and the actions of the Federal Reserve Bank to increase liquidity by adding Treasuries and mortgages to its balance sheet.

The average rate of decline in DTC reported brokered CDs was $15.2 billion a month in the last three quarters of 2020, and then fell to $8.4 billion a month in the first half of 2021, then narrowed to $3.5 billion a month in 2021Q3, and then $2.8 billion a month in the fourth quarter of 2021. From year-end 2021 to the end of February 2022 balances declined $3.2 billion a month. However, DTC balances rose from $169.4 billion in February 2022 to $224.3 billion in June, and to $248.5 billion in July, and most recently to $281.5 billion in August, a month-over-month increase of 13.3%.

IDCFP estimates with tapering of the Fed’s balance sheet in 2022 and a major increase in the fed funds rate, brokered CDs outstanding are forecast to increase by $161 billion ($40 billion per month) for the remainder of 2022. A further increase of $100 billion a year is expected in 2023 and 2024.

The economy remains in recovery in 2022, following a peak in core inflation. Diminished impact from the Covid Omicron variant in early 2022 and an end to the supply chain bottlenecks later this year indicate a continued economic recovery and loan growth for banks. Therefore, brokered CDs outstanding are expected to bottom in 2022, then reach $442 billion by the end of this year and $643 billion by year-end 2024 (see Chart I).

Chart I

Brokered CDs $250,000 or Less Estimated to Reach New High in 2022 and Grow to $648 Billion by 2024

IDCFP has estimates of brokered CDs $250,000 or less outstanding for each issuing bank, available on request. See below a sample list of banks.

Table I

To view all our products and services please visit our website www.idcfp.com. For more information on banks with brokered CDs outstanding, and the amount of these CDs, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director