Understanding CECL

Cushioning for Losses1

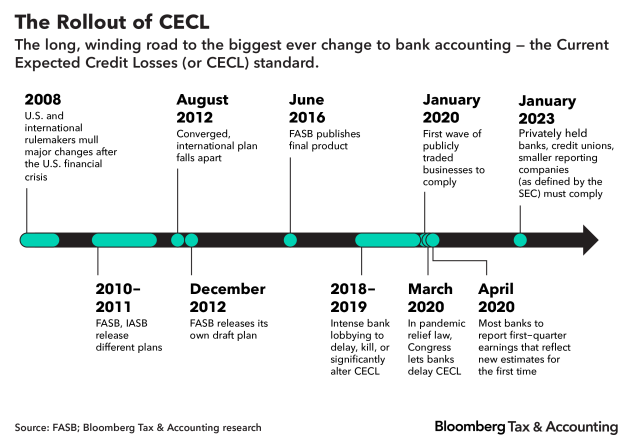

Current Expected Credit Loss (CECL) was developed in response to 2008 financial crisis, when bank balance sheets looked rosy despite looming losses. CECL requires businesses to look to the future and own up to potential future losses and set aside reserves to cover those losses when they have enough cushion to do so, versus when they’re cash-strapped and stressed.

“The four biggest consumer banks set aside almost $18 billion in reserves when Covid-19 shut businesses down, a move that shrank their net income and earnings per share, even though they didn’t actually feel the losses yet. Banks of all sizes did the same.” 1

Then, as Covid-19 cases declined and vaccines rolled out, banks released some of those reserves in late 2020, which padded earnings.

In that sense, CECL appears to have worked. But many banks say the standard forced them to book outsize losses, tie up money in reserves, and inject extra unpredictability into financial reporting amid global uncertainty.

How CECL Works:

An example Illustrated by Fifth Third Bank

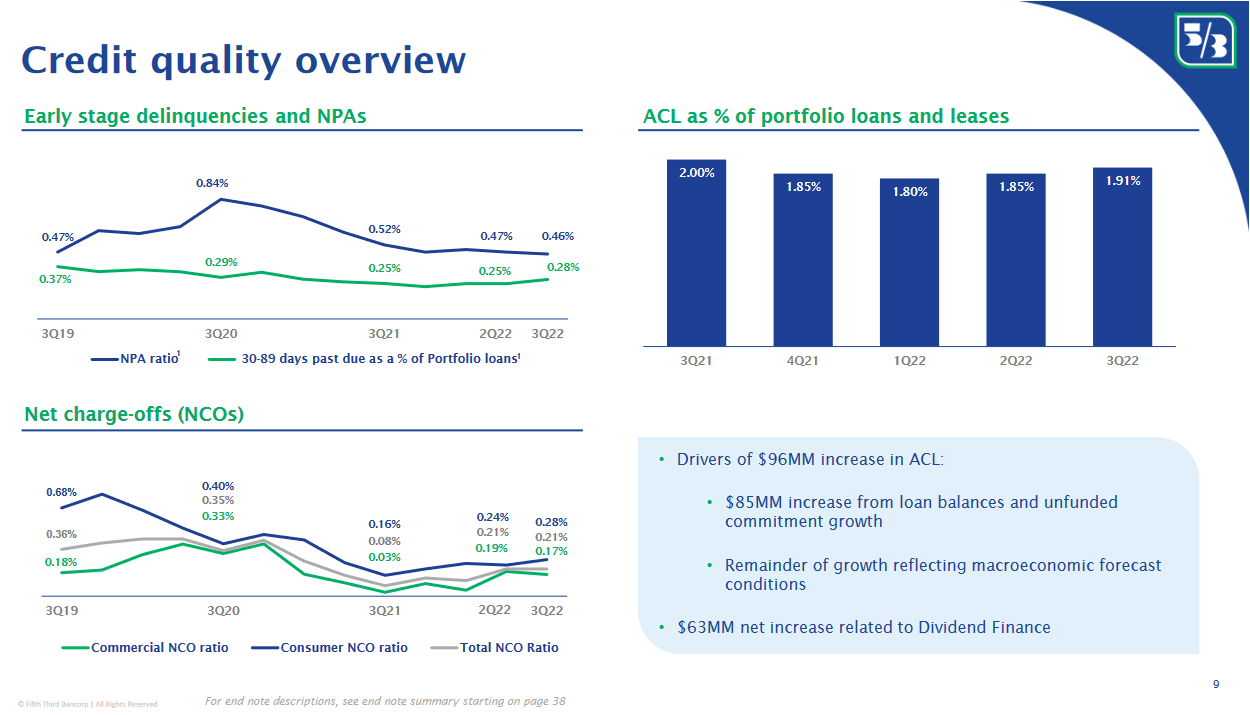

Since 2019, through Covid-19 and recovery, the Fifth Third 30-89 day past due as a percentage of the loan portfolio remained in the limited range, around 0.28%. Total net charge-offs (NCOs) averaged around the 2022Q3 level of 0.21% (see Chart I).

The total allowance for credit losses (ACL) as a percentage of the portfolio of loans and losses varied narrowly around the third quarter value of 1.91%. The ACL as a percentage of portfolio loans and losses equals 9.1 quarters of the charge-off rate of 0.21%.

Chart I

Fifth Third Bank Credit Quality Overview2

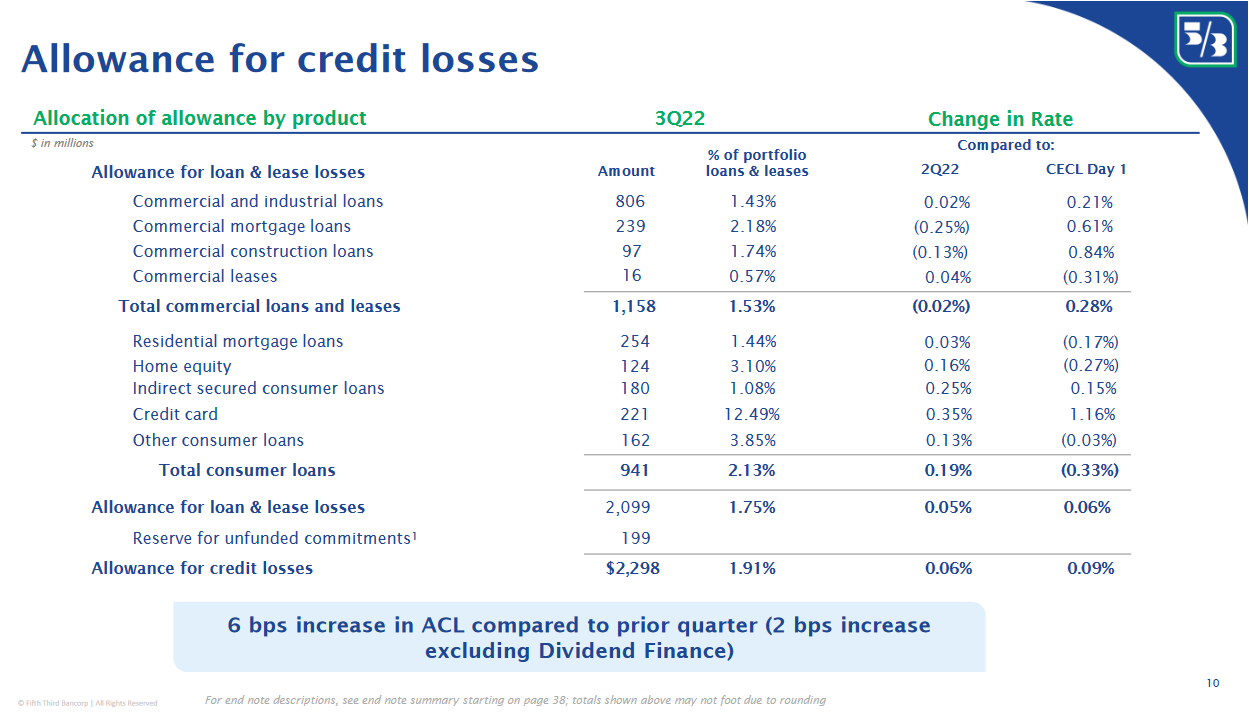

Changes in Allowances for Credit Losses (ACL) Compared to CECL Day 1 Changes

CECL Day 1 is the estimated credit loss for each loan at origination. The quarterly change in CECL Day 1 is reflected by loan category of loans paid off, written off and new loans added to the portfolio, and the net affective change summed up by loan type and total ACL.

Table I compares the basis point change in the ACL between the third and second quarter as a percentage of the portfolio of loans and losses. That change is compared to the increase or decrease in CECL Day 1.

As an example, the quarterly ACL for commercial mortgage loans fell 0.25%, reflecting an improved loss experience, while the CECL Day 1 increased 0.61%. On the other hand, ACL for home equity loans increased in the third quarter 0.16% while the CECL Day 1 change fell 0.27%. The total ACL advanced 0.05% in the third quarter while the net of CECL Day 1 change rose 0.06%, illustrating the balance between the two measures (see Table I).

Table I

Example of Change in the Allowance for Credit Losses Compared to Changes in CECL Day 1 for Fifth Third Bank2

Negative Impact of CECL at Year-End3

The FASB may need to study the credit loss accounting standard for better tailoring in relation to acquisitions because it causes buyers of other banks or loans to initially book an earnings loss, practitioners said.

The current CECL standard takes effect in less than three months for private banks and credit unions.

“It’s a massive undertaking…particularly for lenders,” Michael Lundberg, RSM US LLP’s Industry Audit Policy Leader and National Director Financial Institutions, said on Aug. 25, 2022. RSM is an audit, tax, consulting firm focused on the middle market.3

“It also can have a direct impact on reported earnings,” he said. “If you buy a portfolio or another bank or credit union, then you record loss reserves on all those loans that you buy all at once. Depending on the size of the transaction, you can actually wipe out earnings for the quarter. So, if Bank or Credit Union A buys Bank or Credit Union B and it’s a large transaction, the loss reserves that get recorded as part of that transaction have an enormous impact on earnings and could drive it to a loss.” 3

The FASB issued the guidance as Accounting Standards Update (ASU) No. 2016-13, Topic 326, Financial Instruments – Credit Losses, in June 2016, in response to the 2007-2008 global financial crisis. The crisis was blamed in part on accounting rules that did not allow banks to report loan losses in a timely manner. The old rules were aimed at capturing all probable loss events or ones that have already occurred. Under the new CECL model, all loss events, even those with a remote chance of occurring, are captured. Also, attempting to estimate the severity of potential recession in 2023 is difficult.

Amid Current Economic Uncertainty, the Rules of CECL Hold Up

The adoption of CECL came amid a significant amount of global turmoil and economic uncertainty. The guidance first took effect in 2020 for large public companies and was adopted by many on time though they were granted a legislative deferral.

“The rules are holding up under today’s economic climate,” Lundberg said in context of his clients. “Early on there was a lot of concern about the economic impacts of the pandemic and so we saw loss expectations rise dramatically,” he said. “With a little bit more time, a little bit more information, the support from the Federal stimulus package, lenders realized that this is going to be more manageable than they thought initially, and so at a macro level they pulled back on those reserves. I do think the standard is generally achieving the objectives that FASB set out to do.”3

Currently, the standard is under the FASB’s post-implementation review (PIR), its process to determine whether the rules worked as intended. According to the board, the provisions were designed to be scalable and flexible to fit entities of all sizes, but “FASB still gets peppered with questions regularly,” a board spokesperson said. 3

Two Main Adoption Challenges – Compiling Data and Model Validation

Based on what FASB has seen so far, private banks and credit unions are on track to adopt the rules on time, with some choosing to outsource or get third-party support. Generally, banks and credit unions are faced with two main adoption challenges: compiling data so that it is usable and reliable; and model validation.

Smaller banks and credit unions may have acquired the loan but not the data behind it, so the challenge is identifying historical trends without access to the data, according to Charles Soranno, a managing director in the Business Performance Improvement Practice at Protiviti Inc.

The model for CECL for some is a new concept, with the primary challenge in modeling being the model selection. Specifically, determining the methodology to use in the model selection and then determining whether to build the model in-house or rely on a third-party vendor. Regardless, there is required understanding of the control implications that need to be followed, Soranno explained.

Soranno stressed that companies that have not yet adopted the rules need to start collecting the data they might use now. “Even if they are not subject to a robust public company audit process, or internal audit process, management is going to want to be comfortable that the models are performing as designed,” he said. Time is needed to feed the model and evaluate the results, and we are less than three months from the effective date. 3

NCUA Releases Simplified CECL Tool for Credit Unions4

NCUA released a new tool in September to help small credit unions comply with the current expected credit loss (CECL) standard. The standard goes into effect for most credit unions Jan. 1, 2023. Credit Union National Association (CUNA) called on NCUA to provide guidance to credit unions on CECL implementation, when NCUA first proposed its transition methodology.

The Simplified CECL Tool is intended for use by credit unions with under $100 million in assets. However, it could be used by larger credit unions based on the discretion of their management and auditors.

The NCUA has recognized credit unions need time to evaluate which CECL methodology is appropriate for their size and complexity. The Simplified CECL Tool was updated at quarter-end Sept. 30, 2022 and will again be updated on Dec. 31, 2022 to allow credit unions to test and calibrate the tool. It will continue to be updated each quarter.

The tool uses the Weighted Average Remaining Maturity (WARM) methodology to estimate the CECL. The tool requires a credit union’s its charter number, total assets, and loan portfolio balances.

The loan portfolio categories in the tool mirror the categories in NCUA’s Call Report. For each loan portfolio category, the tool calculates the credit union’s net charge-off rate from its Call Report data and provides the industry-based WARM factor.

The tool also allows the credit union to make qualitative adjustments for current conditions and reasonable forecasts, as required by CECL. The Simplified CECL Tool, along with FAQs, a user guide, and information on the model used, is available on the NCUA website, CECL Resource Center.4

1 Loan-Loss Accounting Rule Worked in 2020, But Banks Hate It, Bloomberg Tax, 05/20/2021

2 Fifth Third Bancorp 3Q22 Earnings Presentation, 10/20/2022

3 Negative Impact of Credit Loss Accounting Standard on Buyers’ Earnings Biggest Concern About Rules, Thomas Reuters, 08/31/2022

4 NCUA Releeases Simplified CECL Tool for Small Credit Unions, CUNA, 09/14/2022

To view all our products and services please visit our website www.idcfp.com. For more information, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director