Rolling Recession Adds Up to Growth Recession

According to Ed Yardeni, the US economy is doing well even though it has been in a “rolling recession,” hitting different industries at different times, since the start of 2022. So rather than a hard landing, a “rolling recession” provides a soft landing, aka a “growth recession,” and, potentially, no recession in 2023.

The rolling recession is rolling through the single-family housing industry. It is rolling through the retail industry that is scrambling to dissolve merchandise to clear unintended bloated inventories. It continues to roll through the auto industry, which, finally, seems to have the parts needed to boost production; but higher interest rates depress the demand for auto loans and autos.

The housing market index (HMI) fell to 33 in November from 38 a month earlier and the peak of 90 in November 2020, measuring the pulse of the single-family housing market through a monthly survey of NAHB members. The index of mortgage applications for new purchases is at the lowest since 2000, declining 41.6% year-over-year though the week of November 10. Single-family housing starts are down 8.6% since February. October’s auto sales remain relatively weak at 15.4 million units, with January’s 15.2 million units, even though the auto industry’s supply-chain problems are abating by most accounts.

Demand for commercial and industrial (C&I) loans are booming. Total C&I loans rose 15.4% year-over-year in October. C&I loan growth is highly correlated with the value of business inventories, which rose to a record high partly because of unintended inventory accumulation and rapidly rising prices.

New Growth Recession Forecast

There was no growth in real GDP during the first half of 2022, confirming the notion of a growth recession. Growth was down slightly during Q1 and Q2. Growth in Q3 reflected an import trade adjustment.

The Atlanta Fed’s GDP current tracking model’s latest estimate as of November 17 is that real GDP was up 4.2% (saar) during the 4th quarter. The GDP now reflects fourth quarter real residential investment growth of -11.7%, but strength in real consumers spending, nonresidential fixed investment and government spending.

Growth in Retail Sales Growth Remains Diverse

The growth in total retail sales in October from September increased 1.3% month-over-month and 8.3% year-over-year.

The varying patterns of growth at retail demonstrate the nature of a rolling recession as well as consumer preferences. The recovery in auto parts and maintenance of older cars lifted retails sales. Food and gas sales lead inflation but are forecast to decline sharply in coming months (see below). Building material sales reflected increased remodeling of homes owned with low mortgage rates.

The flat and weak components of retail sales growth reflect a move away from apparel, sporting goods and electronics and appliances.

Table I

Retail Sales Growth, October 2022

Food Prices to Slow Dramatically

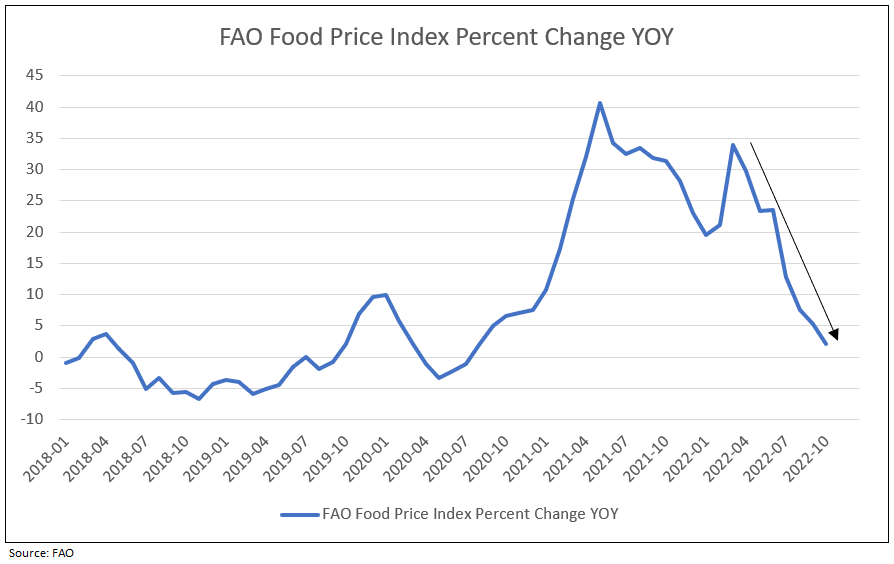

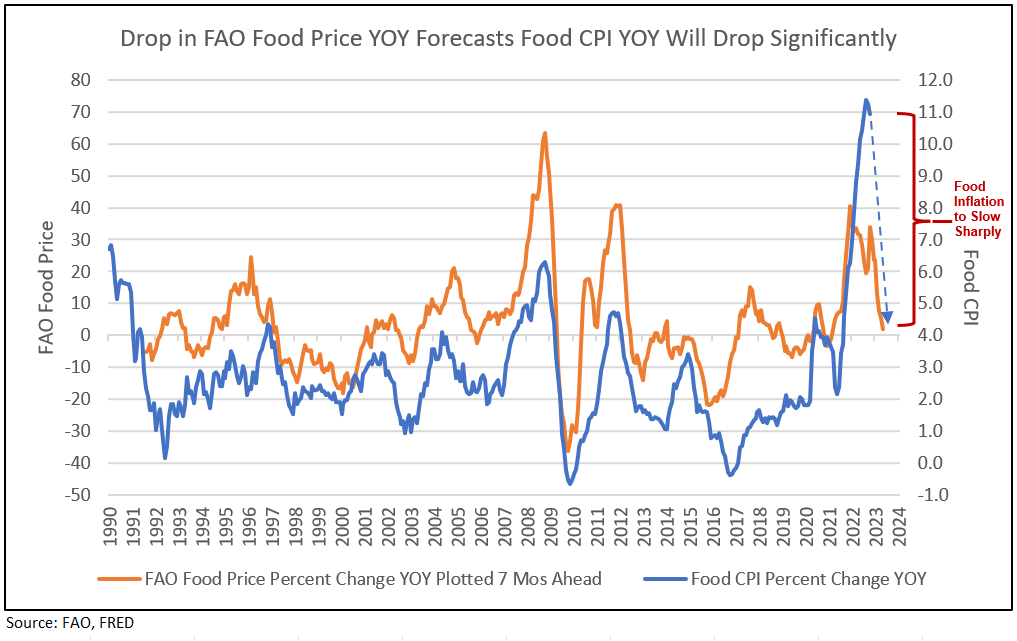

Even food CPI is set to rollover. The FAO (of UN) Food Price Index has been negative for 7 consecutive months, and year-over-year is now down to +2% from +40%, a massive deceleration. As FAO leads food CPI, the implication is that food CPI will slow dramatically from +11% to +4% in coming months1 (see Charts I & II).

Chart I

Food Inflation: Food Prices Decelerate

Chart II

Growth in FAO Food Price Index Advanced 7 Months Since 1991

Sharp Decline in Gas Prices

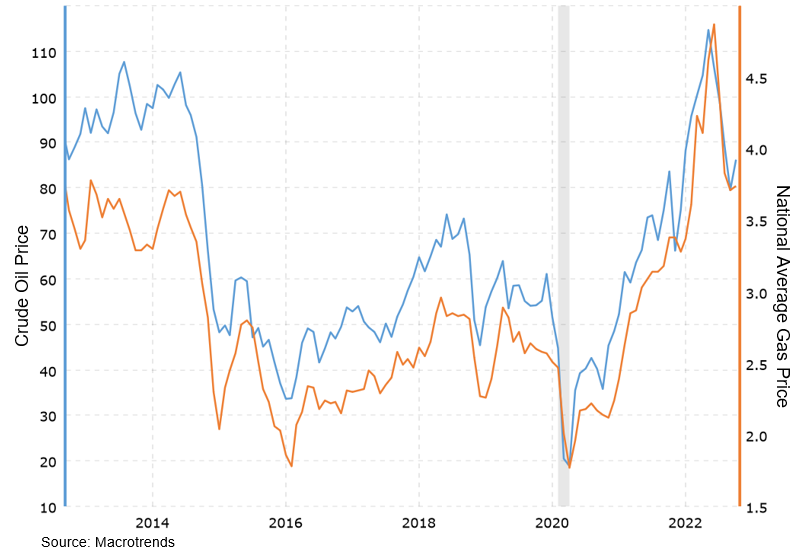

Crude oil peaked in May 2022 at $114.67, sharply declined in September to $79.49, and again in November to $79 (see Chart III). The national average gasoline price also peaked, hitting $4.87. and declined to $3.71.

The price of crude is forecast to decline to $70 or below, reducing gasoline prices below $3.50 in early 2023. Year-over-year gasoline price growth, therefore, will be negative for most of 2023, when comparing the lower forecast prices for 2023 to the peak price highs of 2022.

Chart III

Crude Oil vs Gasoline Prices

The 2023 Outlook

As industries get past 2022 problems like excessive inventories or employees, the year 2023 can exhibit recovery. Other sectors of current strength can moderate in 2023. On balance, strength offset weakness and the rolling recession or soft landing continues into 2023.

The significant decline in food and gas prices in 2023, coupled with the decline in CPI shelter inflation to 2% (as IDCFP previously forecast), reduces reported CPI to levels below wage growth. Real wage growth supports continued growth in the economy. Goldman Sach’s Chief Economist, Jan Hatzius, draws the same conclusion, forecasting real disposable income to grow 3% in 2023.

1 Tom Lee’s Fundstrat

Let IDC provide you the value and financial history of your favorite bank stock. For you to better understand our process of valuation, we offer a free, one-time analysis of one of the 202 banks in our bank analysis database. Simply send your request with the bank stock symbol to info@idcfp.com.

To inquire about IDC’s valuation products and services, please contact jer@idcfp.com or info@idcfp.com or call 262-844-8357.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director