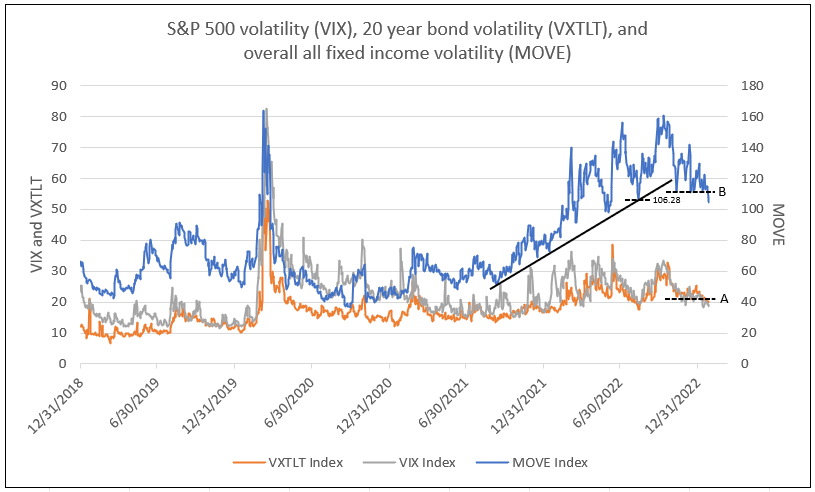

Volatility Far More Important than EPS Growth for 2023 Stock Returns as MOVE Declines Below Resistance Level

Chart I

For a strong stock market in early 2023, VIX must decline below 20, toward 15. VIX is currently at 18.73. Since fixed income volatility controls the VIX, volatility on the 20-year Treasury ETF (VXTLT) must also decline below 21, which occurred on January 26. VXTLT is currently 19.87 (See A, Chart I).

Most importantly for a bull stock market, Bank of America ICE fixed income volatility (MOVE index, the best indicator of future stock volatility) must decline below 111. MOVE fell to 104.28 on January 26 (See B, Chart I). A decline below the two resistance levels of 111 and 106.28 forecasts an index of 80 to as low as 60, a change in Fed policy, and a year-end S&P 500 target of 4,800.

The decline of VXTLT and MOVE below respective resistance levels confirms a decline in VIX and a resumption of the bull market. Alternatively, without confirmation of fixed income volatility and a decline in VXTLT and MOVE below the resistance levels, would suggest the increase in the stock market is merely a rally in a bear market.

To inquire about any of IDC’s valuation products and services, please contact jer@idcfp.com or info@idcfp.com or call 262-844-8357.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director