Crypto Bank Silvergate Issues Warning

Silvergate Capital, a small bank holding company that owns crypto bank Silvergate Bank, is monitored and ranked by IDC Financial Publishing (IDCFP). Silvergate disclosed the following on March 1 after hours in an SEC filing:

- That it would restate its financial statements for 2022.

- That the shocker net loss of $1.05 billion for Q4, disclosed on January 17, would be an even bigger loss.

- That it was unable to file its annual report (10-K) by the deadline, March 1, and even after the 15-day extension, because it “requires additional time to perform analysis, record journal entries related to subsequent events and to complete management’s evaluation of internal controls over financial reporting.”

- That it sold even more securities, with even bigger losses to repay its loans from the Federal Home Loan Bank of San Francisco.

- That “these additional losses will negatively impact the regulatory capital ratios” and “could result in the Company and the Bank being less than well-capitalized.”

- That it “is evaluating the impact that these subsequent events have on its ability to continue as a going concern” for the next 12 months.

- And that it “is currently in the process of reevaluating its businesses and strategies in light of the business and regulatory challenges it currently faces.”

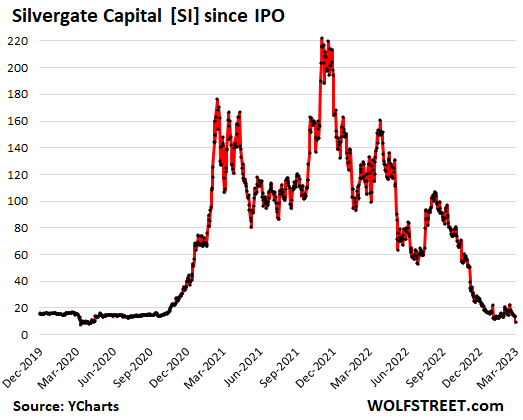

Silvergate Capital Corporation (SI) common stock traded down 57% to 5.27 on March 2 from the previous day, down significantly from the previous highs of 24.71 in 2023 and 239.26 in 2021. IDCFP gave Silvergate Capital Corporation a rank of 117, or below investment grade, based on data filed for the fourth quarter 2022, before revisions (see Chart I).

Chart I

The Warning Signs

Silvergate Bank owned by the Silvergate Capital, experienced deteriorating negative balance sheet cash flow, as a percent of tangible equity capital, over the last 7 quarters (see Table I). Continuous negative balance sheet cash flow drains capital and creates risk to solvency given capital ratios are close to regulatory limits.

Balance sheet cash flow equals the operating cash flow less financial cash flow, determined by changes in the balance sheet. If one is one more negative than the other, or both are negative, then balance sheet cash flow is negative.

Table I

Balance Sheet Cash Flow Percent Tier I Capital for Silvergate Bank

2022Q4 |

-286.6% |

2022Q3 |

-56.9% |

2022Q2 |

-40.2% |

2022Q1 |

-24.1% |

2021Q4 |

-10.5% |

2021Q3 |

-7.1% |

2021Q2 |

-1.6% |

1 Crypto Bank Silvergate Issues “Going Concern” Warning,..., Wolf Street, March 1, 2023

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director