Credit Unions Continue to Grow in Numbers, Identify More Targets in Banks

Credit unions have grown to become a major factor in the U.S. economy, with assets that have grown at nearly twice the pace of banks over the past decade. Credit unions are owned by their members and are designed to offer lower borrowing costs and higher deposit rates. In addition, the median large credit union (greater than $50 million in assets) earned a return on equity (shares and reserves) of 7.7% and experienced 15% loan growth over the past year.

IDC Financial Publishing (IDCFP) focuses on 2,498 credit unions with $50 million or more in assets to determine the risks to the financial system. These larger institutions are using their strength to compete aggressively for business. The group of 2,365 credit unions with assets less than $50 million remain important to the industry, but are not a major risk factor in a potential economic downturn or the overall health of our financial system.

Reduced Risk in Large Credit Unions

IDCFP calculated the CAMEL rating of 4,863 credit unions in the fourth quarter of 2021. The 2,498 large credit unions account for 98% of total credit union assets and remain a potential risk factor in a future major economic downturn.

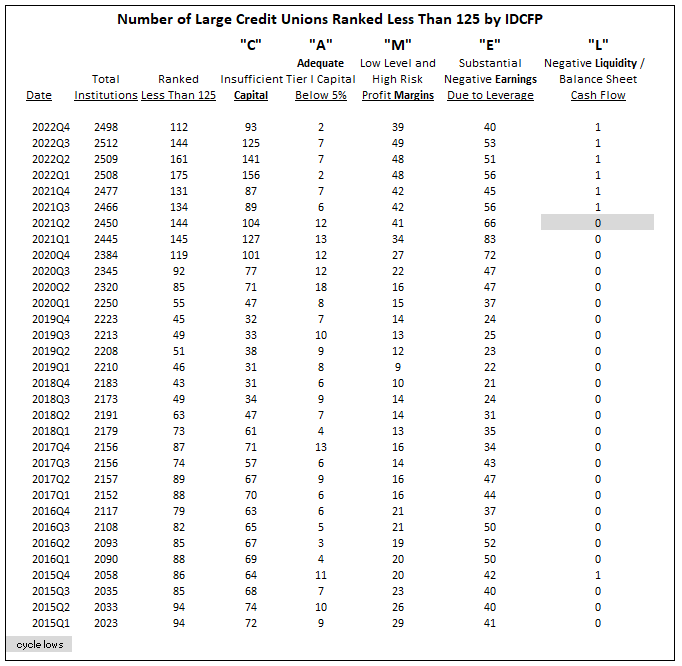

To determine this risk, we separate the credit unions ranked under 125, which is below-investment-grade and the industry standard. As of the end of the fourth quarter 2022, 112 large credit unions were ranked below 125 by IDCFP, down from 144 the previous quarter, and a high of 175 in the first quarter of 2022. This peak in institutions seen in early 2022 was followed by a reduction of risk, in that the total number is declining, along with most categories of CAMEL. Only institutions with negative liquidity remained the same at 1 (see Table I). To forecast risk in the credit union industry, the total number of institutions, along with all components of CAMEL, must reach a low and subsequently climb in number.

Table I

The Risk Illustrated by IDCFP in 2005 to 2007 Forecast the 2008/2009 Credit Union Crisis

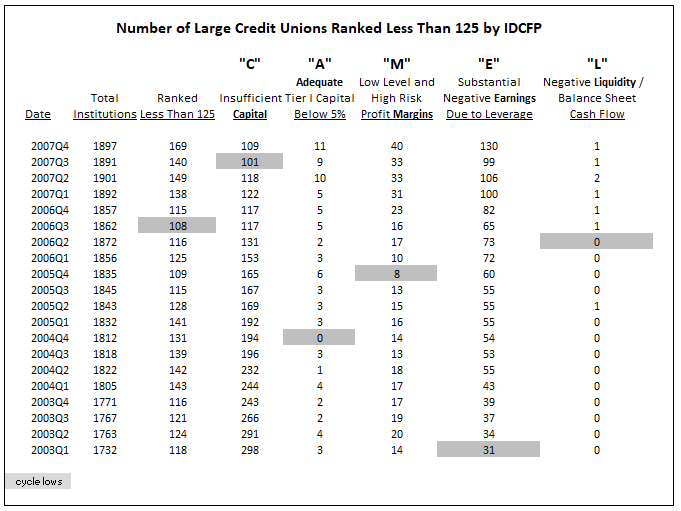

IDC successfully indicated a risk alert for the credit union industry as early as the fourth quarter of 2006, over a year prior to the financial and economic collapse of 2008 and 2009. Out of the 1,862 large credit unions in the third quarter of 2006, 108 were ranked below 125, or less than investment grade. The increase to 115 in the fourth quarter signaled the major risk alert for credit unions.

The “C” in CAMEL bottomed at 117 in the third quarter of 2006, but then recycled when it hit a low of 101 in the third quarter of 2007. The “A” low of zero was in the first quarter of 2005, the “M” low of 8 was in the fourth quarter of 2005, the “E” low of 31 was much earlier, in the first quarter of 2003, and the “L” component of CAMEL was zero in the second quarter of 2006.

In summary, IDCFP’s risk alert for the financial downturn of large credit unions, as well as, the entire credit union industry, was evident in the fourth quarter of 2006, successfully forecasting the financial problem to occur in 2008 and 2009 (see Table II).

Table II

Credit Unions Identify More Potential Targets in Banks

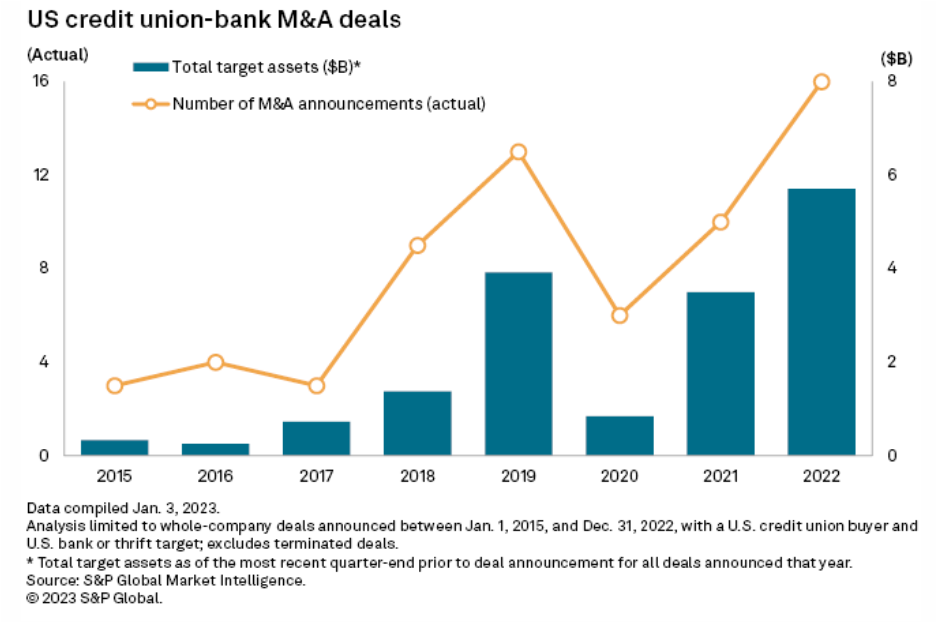

In 2022, economic uncertainty and rising interest rates resulted in a slowdown in banks’ mergers and acquisitions deals. Credit unions, however, were not deterred by these factors, breaking previous yearly records in 2022 in both the number, with 16 bank acquisitions, and the value, with sales of $356.5 million (see Chart I).1

Chart I

The momentum is expected to continue in 2023, as credit unions are getting more strategic with outreach, proactively building relationships with banks. In addition, without shareholders to answer to, credit unions are less hindered and more willing to take on initial securities losses.1

Those losses in securities and other comprehensive income are also hindering sellers from coming to the market, however, concerned they will not get the best price. It remains a sellers’ market, as buyers continue to outnumber sellers, and sellers know banks are attractive targets for geographic expansion and can provide commercial banking expertise.1

1 Credit unions getting more strategic to seek out bank targets, S&P Global, Jan. 9, 2023

To view our products and services please visit our website. For more information about our CAMEL ratings, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director