A Dramatic Slowing in Labor Costs Reduces Core Services Ex Housing Inflation

Since November, the Fed has been talking about inflation as the story of three categories: goods, housing, and non-housing services (NHS). The latter category, core NHS, comprises around half of core PCE expenditures.1

Comments from Jerome Powell, Fed Chairman

“Finally, we come to core services other than housing. This spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half of the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation. Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.” -Jerome Powell, November 30th, 2022.

A New Wage Measure for Core Non-Housing Services

In February, the Council of Economic Advisors released a measure of average hourly earnings (AHE) in core NHS industries.

Policymakers, economists, and forecasters often track “core” inflation (price growth excluding food and energy) because it tends be a better predictor of future overall inflation than overall inflation itself. It has also been useful to further break down core inflation into three components: core goods, housing services, and core non-housing services, or NHS.2

Core goods inflation—think clothing, appliances, cars, and electronics—has been cooling over the last year as COVID-related global supply chain disruptions have eased. Housing inflation meanwhile reflects growth in both new and existing rents with a lag; market data on new rents suggests there have been declines in rental growth recently that many analysts expect to show up as lower inflation later this year. 2

The last category, NHS inflation, has garnered considerable interest of late. Because non-housing services are more labor intensive than the other categories, some surmise that the tight labor market may be playing a meaningful a role in this part of inflation. 2

Several prominent wage measures like average hourly earnings (AHE) in the Establishment Survey and the Employment Cost Index (ECI) have seen slowing nominal growth but positive inflation-adjusted growth in recent months. However, neither of these measures are ideal for probing the potential relationship between NHS inflation and the labor market. The AHE is sensitive to compositional effects: the skews in average wages that can arise from hiring and firing. Even measures that do control for compositional effects, like ECI, are broad-based and do not focus on the industries that are the most relevant for wages in the NHS portion of the economy. 2

CEA has constructed a wage measure specific to NHS industries, called “NHS AHE,” which addresses both limitations. NHS AHE is a weighted average of the hourly wage in 175 detailed nonfarm payroll sectors from the monthly Establishment Survey, weighted by each sector’s share of 2019 labor costs in final demand consumption of services excluding food, energy, and housing. Because the weights are based on NHS labor costs, the index better reflects the dynamics of wages serving as inputs into NHS production than commonly-cited wage measures like AHE and ECI. And because the weights are fixed to 2019 levels, the index is less sensitive to compositional shifts than unadjusted average measures like AHE. 2

Dramatic Slowing of Labor Costs

CEA economist Ernie Tedeschi's measure of "Core Services Ex Housing" (CSXH) wage growth is continuing to show material deceleration. This measure re-weights industry-level wage data according to each industry's contribution to consumed output. Tedeschi's own analysis shows that among wage measures that forecast CSXH PCE inflation out-of-sample, this measure of wages is superior. Average hourly earnings, the Employment Cost Index, and the Atlanta Fed Wage Growth Tracker are all inferior in terms of forecasting relevance.3

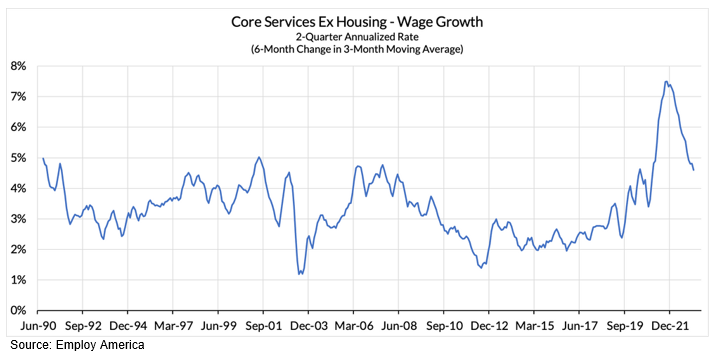

The data shows two clear facts: (1) labor cost pressures surged around the reopening process subsequent to the pandemic but also (2) have been decelerating for over a year now. Smoothed near-term growth rates show that CSXH wage growth is now running at the same growth rate as it did 2006-07 and 2000-01 (see Chart I). 3

Chart I

Smoothed Growth

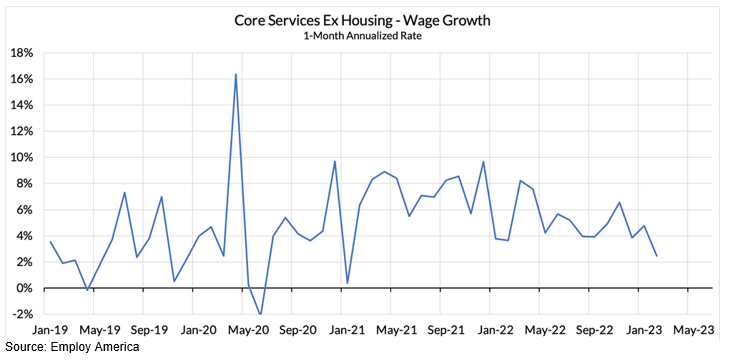

More strikingly, the near-term or 1-month annualized data has reflected more deceleration than what is captured in the above "smoothed" measure (see Charts I & II). 3

Chart II

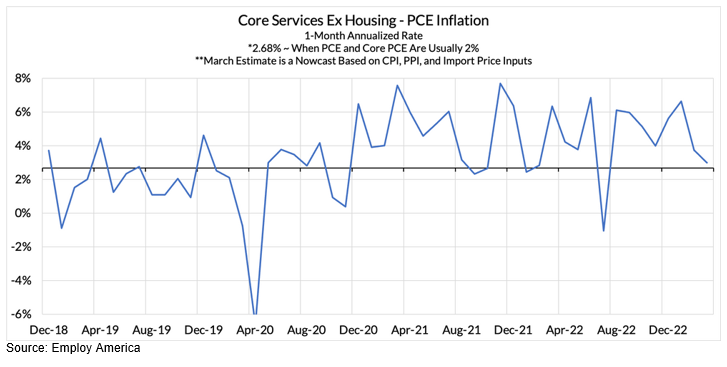

For whatever it's worth, the data available through March CPI, PPI & Import Prices shows that the 1-month annualized change in CSXH PCE inflation is also slowing now (vulnerable to revision when PCE comes out later this month) (see Chart III). 3

Chart III

New Wage Measure’s Impact on Core Services Ex Housing PCE

If we focus on the domestic labor that contributes to CSXH PCE output, we see that wage growth is no longer running hot. Labor cost pressures on CSXH PCE inflation are diminishing. Within the Fed's preferred framing of inflation dynamics, this wage deceleration dynamic should firmly diminish the case for further rate hikes to tame inflation. As it stands now, the Fed still has yet to appropriately acknowledge this labor cost dynamic. 3

IDCFP thanks Employ America for their ongoing and insightful analysis of these and other topics related to financial and labor markets.

1 - Signs of Slowing: Measuring Wages in Core Non-Housing Services, Employ America, April 18, 2023

2 - A New Wage Measure for Core Non-Housing Services, The White House website, February 08, 2023

3 - Causal Theme: By the Fed's "Core Services Ex Housing" Logic, The Fed's Inflation Narrative Is Due For Revision, Employ America, April 17, 2023

To view all our products and services please visit our website www.idcfp.com. For more information on banks with brokered CDs outstanding, and the amount of these CDs, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director