Negative Balance Sheet Cash Flow Creates Risk to Banks and Credit Unions

Balance sheet cash flow equals the operating cash flow less financial cash flow, determined by changes in the balance sheet. If one is more negative than the other, or both are negative, then balance sheet cash flow is negative.

Rise in the Number of Banks with Negative BSCF Demonstrates Risk

The number of banks with continuous quarter-to-quarter negative balance sheet cash flow (BSCF) peaked at over 200 in 2002 and 2003 and declined to a cycle low in the fourth quarter of 2004 at 137. Subsequently the number of banks with negative BSCF rose to over 400 in 2008 and peaked at 523 for the fourth quarter of 2009. For comparative reasons, the bank number count from 2002 to 2011 does not include saving and loans reporting to OTS.

The number of banks with negative BSCF for four or more quarters receded to a low of 75 in 2015, to 67 in 2018, and to a final low of 60 for year-end 2021. In the year 2022, the number accelerated to 237 by year-end (see Chart I).

Chart I

Negative balance sheet cash flow (BSCF) percent Tier I capital at 10% can result in a reduction in an IDCFP rank equal to the percent of negative BSCF. For example, if BSCF is -10%, this results in a 10-point reduction, or if BSCF is -80%, and 80-point reduction in the IDCFP rank for this component, given certain other conditions are met.

A rank reduction due to negative BSCF can result from high loan delinquency, or from four or more quarters of continuous quarter-to-quarter negative BSCF % of Tier I Capital. Asset write-offs or write downs without reduction in corresponding capital or liabilities on the balance sheet creates negative operating and/or financial BSCF. The rank reduction is capped at a maximum of a negative 100 points, or BCSF at -150%, and results in a rank reduction of 100.

Beginning with the first quarter of 2023 data, published in mid-May 2023, IDCFP will reduce the bank rank on financial ratios with four or more consecutive negative quarter-to-quarter changes in BSCF percent Tier I capital, by the amount of negative year-to-year change in BSCF percent Tier I for the most recent year period, capped at -50 for four quarters of negative BSCF and -100 for five or more quarters.

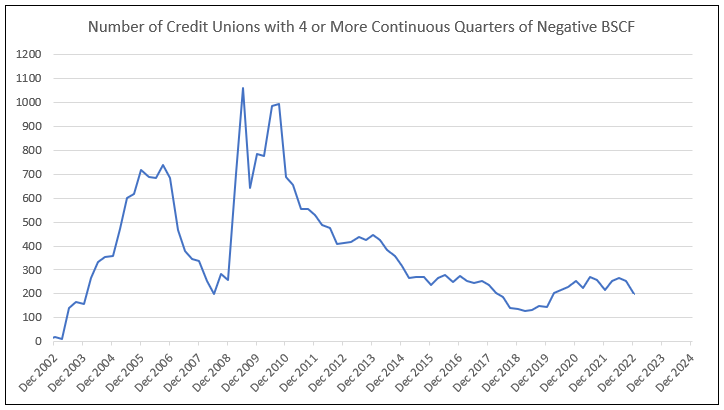

Rise in the Number of Credit Unions with Negative BSCF Demonstrates Risk

The number of credit unions with four or more quarters of negative BSCF accelerated from 21 at the end of 2002 to 740 by the third quarter of 2006. That number temporarily declined to 198 in 2008, but the advent of the financial crisis that same year increased the number of credit unions with negative BSCF to 1,061 by the second quarter of 2009 and remained at a high level through 2010.

The subsequent economic recovery reduced the number of credit unions with four or more consecutive quarters of negative BSCF to 133 by the second quarter of 2019. That number rose again during the pandemic to 256 in the fourth quarter of 2020 and again peaked recently to 265 in the second quarter of 2022 (see Chart II).

Beginning with the first quarter of 2023 data, published in early June 2023, IDCFP will reduce the credit union rank on financial ratios with four or more consecutive negative quarter-to-quarter changes in BSCF percent net worth, by the amount of negative year-to-year change in BSCF percent net worth for the most recent year period, capped at -50 for four quarters and -100 for five or more quarters.

Chart II

An Example of a Failed Bank with Negative BSCF

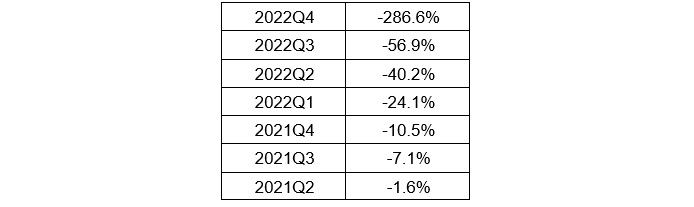

Silvergate Bank had negative quarter-to-quarter change in BSCF for seven consecutive quarters. As of December 31, 2022, BSCF measured over the one-year period was -287% of its Tier I capital.

Silvergate Bank owned by the Silvergate Capital, experienced deteriorating negative balance sheet cash flow, as a percent of tangible equity capital, since 2021Q2 (see Table I). Continuous negative balance sheet cash flow drains capital and creates risk to solvency given capital ratios are close to regulatory limits.

Table I

Balance Sheet Cash Flow Percent Tier I Capital for Silvergate Bank Year-to-Year Comparison

To view all our products and services please visit our website www.idcfp.com. For more information on banks with brokered CDs outstanding, and the amount of these CDs, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director