Sticky Inflation Persists

Reported PPI Raised Estimate for Core PCE Ex Housing Inflation to 4.7%, up from 4.6% in March

The majority of the Personal Consumption Expenditures (PCE) inflation is derived from the Consumer Price Index (CPI) data and the Producer Price Index (PPI). Additional components come from the Import Price Index (IPI) and from the PCE release later in May.

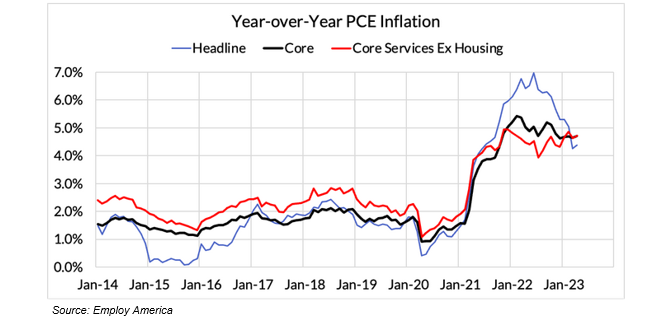

The CPI release on May 9 was encouraging with the month-the-month increase in CPI Core Services Ex Housing up only 0.12%. The PPI release on May 10 upset the CPI optimism with its revisions to PCE inflation, raising the Core Services Ex Housing monthly increase to 0.42%.

The Fed will not see a clear path to 2% until later in 2023. The stock market lacks visibility. The Fed may still raise the Fed funds rate again in June.

Key Takeaways1

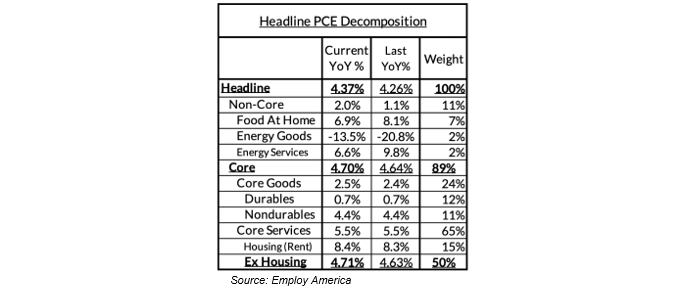

- Headline PCE is expected to increase from 4.26% year-over-year in March to 4.37% in April. The headline PCE inflation from the previous CPI reading on May 10 of 0.14% was raised by PPI to 0.30%.

- Core PCE is also expected to increase from 4.64% year-over-year in March to 4.70% in April. Core PCE from the previous CPI reading on May 10 of 0.20% was raised by PPI to 0.38%.

- Core Services Ex Housing PCE (CSXHP) increased from 4.63% year-over-year in March to 4.71% in April. CSXHP from the previous CPI reading on May 10 of 0.12% was raised by PPI to 0.42%. Typically, when core PCE is running at 2%, CSXHP is at 2.68%. The current run rate is effectively 203 basis points over the required 2.68% (195 basis points as of March). Sticky inflation persists.

Table I

Chart I

1 April Core-Cast Post-PPI: Disinflationary Inflection Point Delayed, Employ America, May 11, 2023

To view all our products and services please visit our website www.idcfp.com. For more information on banks with brokered CDs outstanding, and the amount of these CDs, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director