Despite Fed Tightening and Banks Collapsing, Loose Financial Conditions Still Exist

Financial conditions and lending standards have become stricter than they were during the free-money era of Covid when deposits costs were low. The financial stress that spiked briefly during the SVB collapse, subsided again to easier levels but not as easy as during the pandemic.1

One of the products that came out of the 2008 Financial Crisis, the weekly St. Louis Fed Financial Stress Index, measures financial stress in the credit markets and was designed to indicate when another financial crisis might be upon us. It spiked when SVB collapsed in mid-March, but not much and only briefly, and then turned negative again (see Chart I).1

A level of zero indicates normal market conditions. A level above zero indicates above-average market stress. A level below zero indicates below-average market stress. Currently, the level is below zero, at -0.35 per the latest release on May 12. During the SVB collapse, it was above zero for two weeks, when on March 17 it spiked to +1.54, and on March 24, it fell back to +0.34. Then it returned to the negative readings (green line = current level shown in Chart I).1

Chart I

The St. Louis Financial Stress Index tracks 18 variables, including a variety of Treasury yields, corporate bond yields, Treasury spreads, corporate bond spreads, SOFR spreads (which replaced the LIBOR spreads), plus indicators such as the VIX and the Treasury 10-year breakeven inflation rate.1

During the Financial Crisis, just after the Lehman bankruptcy, the index spiked to +9.25. That’s six times what the value was during the SVB collapse (+1.54) last month.

We also saw higher levels from the euro debt crisis in 2011-2012 and the U.S. oil bust that started in 2015. Despite the core PCE price index being at 1.1%, well below the Fed’s 2% target, the Fed kicked off a rate-hike cycle in December 2015. Spooked by the turmoil in oil-and-gas credits, and with inflation below target, the Fed paused for a year, before continuing hikes. (The green line = current level shown in Chart II).1

Chart II

Financial Conditions Less Relaxed

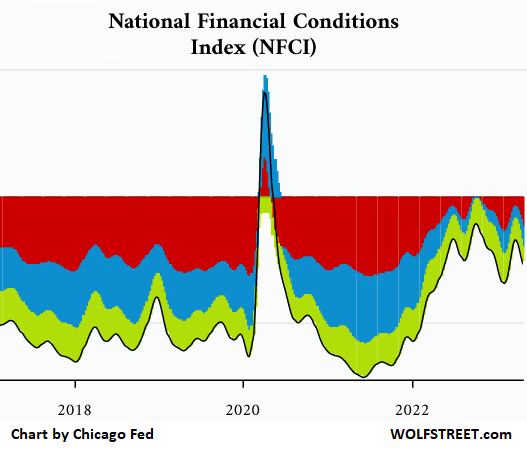

The Chicago Fed’s National Financial Conditions Index (NFCI) showed in its latest reporting that it is experiencing similar loose financial conditions. The index dipped to -0.30 versus -.28 last week, with all three sub-indicators – risk (red), credit (blue), and leverage (green) – contributing to the negative reading. The SVB collapse is seen in the dent on the right. The First Republic collapse didn’t even register (see Chart III).1

Chart III

Despite the rate hikes by the Fed, financial conditions are still looser than the long-term average.

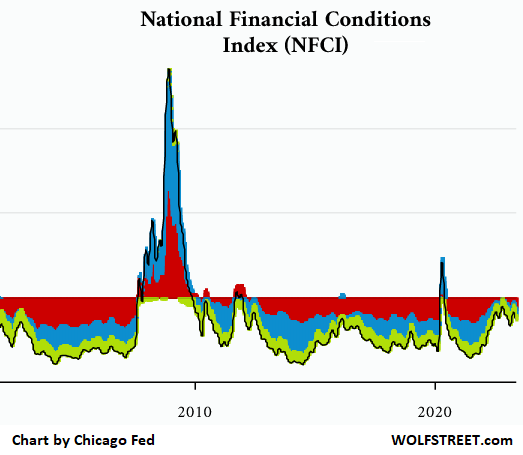

The long-term view In Chart IV shows what happens when financial conditions actually tighten: the 2009 Financial Crisis, the Euro Debt crisis in 2011/2012, the oil bust in 2016, and the spike in March 2020 from the beginning of Covid are all examples.1

Chart IV

Demand Drops for Bank Loans and Lending Standards Tighten

The quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for April 2023 was also released last week with the following insights.

Loan demand is down from businesses and consumers, as a result of rising interest rates and borrowing becoming more expensive. Businesses sought less commercial and industrial loans and CRE loans. There’s less demand for mortgages from consumers since home sales have dropped. Additionally, there is also less consumer demand for auto loans.1

With the exception of consumer mortgages backed by the government, (the majority of loans), it was reported that lending standards have tightened across the board. Loan officers started tightening lending standards in July 2022, but only after having looser lending standards for five consecutive quarters during the free-money era.1

1 - Despite Fed Tightening and Bank Collapse, It's Still an Astoundingly Loose Financial Situation

First Quarter 2023 ranks for all banks are now available! Visit our portal to view ranks.

To view all our products and services please visit our website www.idcfp.com. For more information or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director