A Different Approach to Forecasting the Economy

Employ America’s Assessment of Supply-Side Improvements

Key Takeaways1

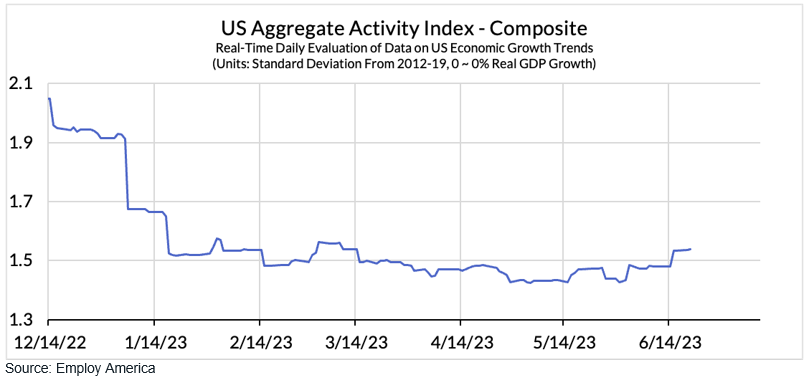

Employ America’s U.S. economic index, which represents growth rates, had been declining since December 2021, consistent with economic deceleration. Given the growth pace in 2021, a slowdown was inevitable. The activity index reached a low of 1.4% in May, rising above 1.5% in May (see Chart I).

Chart I

From early February to early June 2023 activity indicators signaled that the slowdown was stabilizing along a non-recessionary positive-growth trajectory.

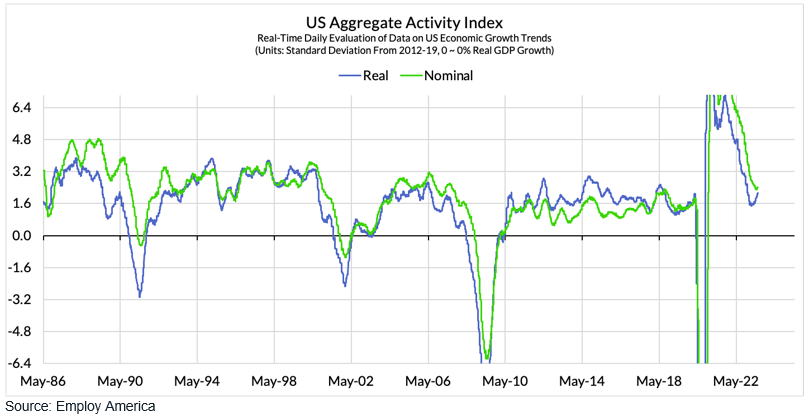

Most recently, evidence indicates the aggregate slowdown has largely concluded (see Charts I & II).

Chart II

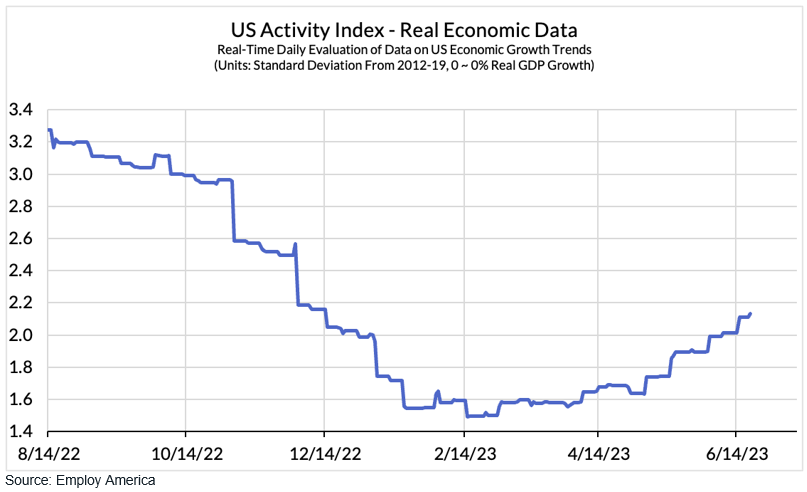

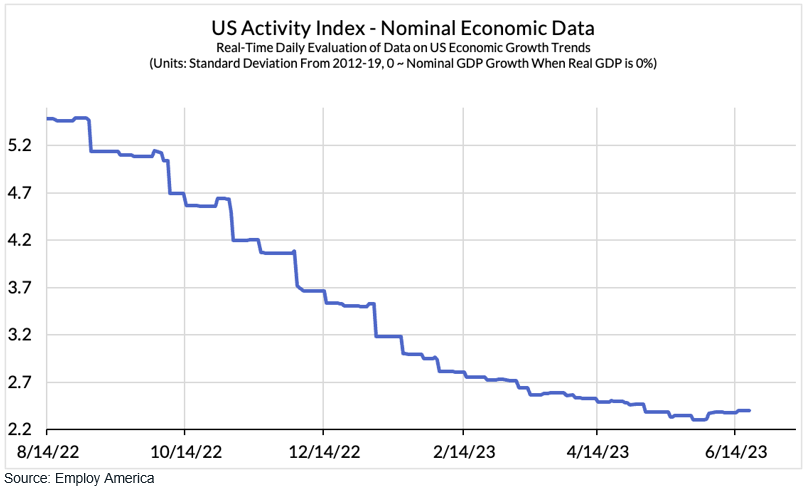

The pace of nominal spending is still decelerating, but the pace of real, inflation-adjusted economic activity is proving more resilient. Such outcomes are consistent with falling inflation and higher productivity growth, all else being equal (see Charts III & IV).

Chart III

Chart IV

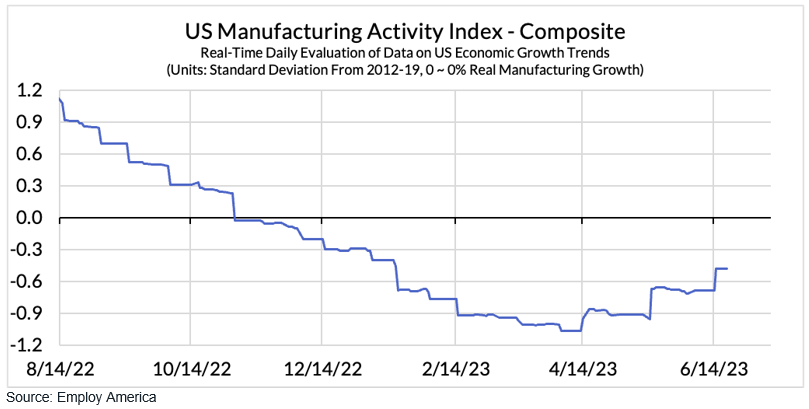

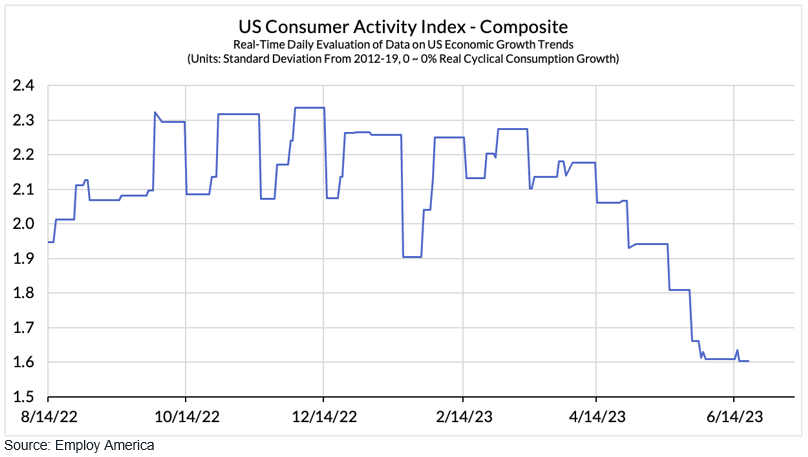

The sectoral composition of economic growth is also encouraging. The consumer and the services sectors are still cooling from elevated growth rates, thereby putting less direct pressure on PCE inflation (see Chart VII). Meanwhile, growth tied to fixed investment in structures and equipment – namely construction and manufacturing – is improving from deeper contradictory readings in late 2022 and early 2023.

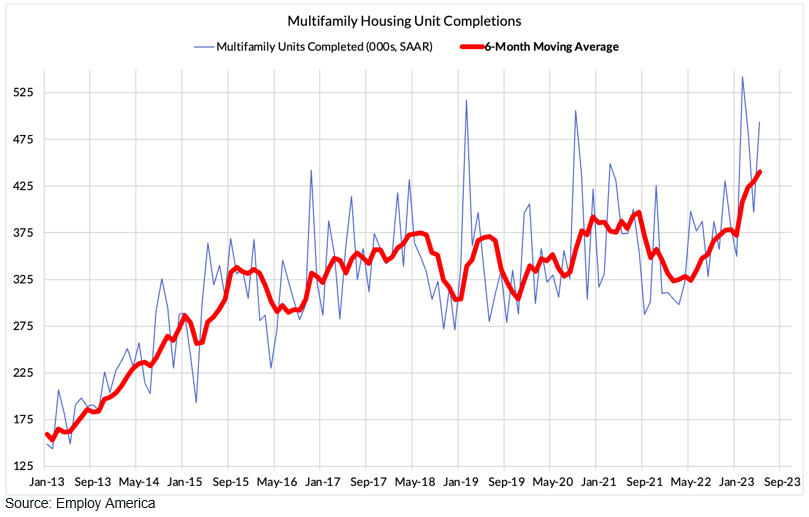

Multifamily housing construction and completions are especially encouraging for the trajectory of rent inflation in 2024. Meanwhile, for consumer-facing sectors that previously saw prices overshoot and real consumption contract as a result (e.g., food and food services), there is now higher prospect for real consumption to start expanding as the inflationary demand-destruction process ends (see Chart V, VI and VIII).

Chart V

Chart VI

Chart VII

Chart VIII

1 Activity Update: What Supply-Side Healing Looks Like: Nominal Deceleration Without Real Deceleration, Employ America, June 20, 2023

To view all our products and services please visit our website www.idcfp.com. For more information, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director