Banks Feel Pressure with Rebound in Rates

U.S. banks are poised for a rebound in unrealized losses on their bond and loan portfolios, after a surge in market interest rates.1

Unrealized losses on bonds and loans held by U.S. banks are expected to have grown in the second and third quarter of 2023, potentially reanimating the banking issue that made investors nervous earlier this year.

Unrealized losses "should be pretty close to back to where we were at the end of 2022 for the vast majority of banks," said Richard Sbaschnig, an analyst at the investment research firm CFRA. "It still feels like there's some liquidity pressure on the banks."

Lower debt prices reduce the value of trillions of dollars in assets that banks hold, regardless of whether they intend to sell the bonds or loans. Investors at the start of this year grew uneasy with the magnitude of these unrealized losses, which topped $600 billion following the Fed's campaign to sharply raise interest rates in 2022.

In some cases, the losses were equal to or greater than banks' equity, or the buffer they hold to absorb such hits. That led to a crisis that brought down three regional banks earlier this year. But the ensuing volatility gave banks a reprieve: Investors seeking safety bought Treasury debt, lowering benchmark yields and helping raise prices across debt markets, including those for banks' fixed-rate assets.

The end in the relative calm of the just-ended second quarter, though, has lowered the market values of many bank assets as yields on Treasury debt rose.

Two-year Treasury yields finished the quarter at 4.88%, up from 4.06% on March 31, and rose to a high of 5.07% as of July 6. Ten-year Treasurys were yielding 3.82%, up from 3.49% on March 31, and rose to 4.08% as of July 6. Values of fixed-rate bonds decline as yields increase. Mortgage rates rose last quarter, too, as did yields on government-sponsored mortgage bonds.

"Based on the higher yield requirements by investors, you'll see lower prices and lower fair values on securities and on loans, too," said Frank Wilary, principal at Wilary Winn, an advisory firm that helps banks and credit unions determine fair-value measurements for their financial reports.

A resurgence of unrealized losses could raise fresh concerns about banks' health. Many lenders also could face deposit outflows and earnings pressure.

U.S. banks' unrealized losses on investment securities were $515.5 billion as of March 31, according to the Federal Deposit Insurance Corp. That was down from $617.8 billion at the end of 2022 and their Sept. 30 peak of $689.9 billion. More than half of such losses each quarter were on bonds classified as "held-to-maturity," and so not included on banks' balance sheets under the accounting rules. The remaining portion of unrealized losses on securities not classified as “held-to-maturity” are “held-for-sale” losses. At the end of 2021, unrealized losses on bond holdings were negligible system-wide.

IDCFP Ranks Reflect “Hold to Maturity” Risk

IDC Financial Publishing (IDCFP) reduced ranks of financial ratios for the “held-to-maturity” losses beginning in May 2023. The “held-to-maturity” liquidity risk equals insured deposits and borrowings greater than assets available for liquidation multiplied by the ratio of “held-to-maturity” security losses times tangible common equity. Only about 30 banks were impacted, based on the first quarter 2023 bank filing’s data.

IDCFP Ranks Reflect “Available for Sale” Risk

The ”available-for-sale” liquidity risk adjusts Tier I capital. As of 2015, small and medium sized banks could elect to opt-out of other components of Accumulated Other Comprehensive Income (AOCI) but include in Tier I capital losses on “available-for-sale” securities. In 2019, thirty large regional banks earned the same status.

IDCFP adjusts the Tier I capital ratio by reducing, from Tier I capital, the losses on “available-for-sale” securities (AOCI), given the opt-out election. Adjusted Tier I capital ratio below 5% reduces the quality of capital category designated for the bank, and will result in a rank reduction in August 2023.

Bank Liquidity Programs2

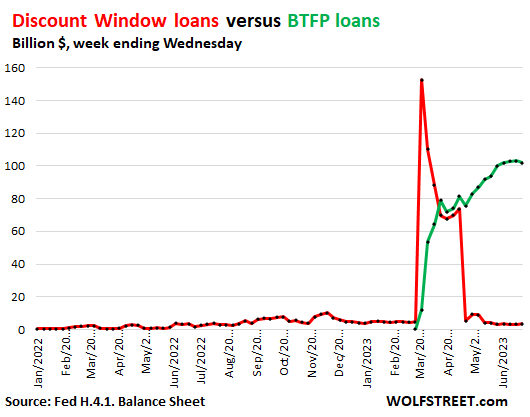

The Discount Window equals $3 billion, down from $153 billion in March. Since the last rate hike, the Fed charges banks 5.25% to borrow at the Discount Window (“Primary Credit”). In addition, banks have to post collateral at “fair market value.” This is expensive money for banks that should normally be able to borrow for less from depositors without having to post collateral, so they pay it off as soon as they can.2

Bank Term Funding Program (BTFP) equals $102 billion. BTFP declined by $1 billion within the week, the first decline since May. Banks can borrow for up to one year, at a fixed rate, pegged to the one-year overnight index swap rate plus 10 basis points. Banks have to post collateral, but valued “at par.” Still expensive money, but less expensive than at the Discount Window. It appears banks paid off the Discount Window loans with proceeds from BTFP loans.2

Both facilities combined equals $105 billion, down from $165 billion in mid-March. Chart I shows Discount Window loans (red), versus BTFP loans (green).2

Chart I

1 Rebound in Rates Puts Pressure on Banks, Wall Street Journal, July 5, 2023

2 Fed's Balance Sheet Drops $667 Billion..., Wolf Street, July 6, 2023

To view all our products and services please visit our website www.idcfp.com. For more information, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director