Employ America’s June Core-Cast* Post-PPI Analysis

We have found Employ America to be the best and most reliable source in the analysis and forecast of inflation. Below is a summary of their recent newsletter discussing the trajectory of 2023 Core PCE.

*Core-Cast is Employ America’s nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below in Table II give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.1

Will The Fed Be Dogmatic or Data-Dependent?1

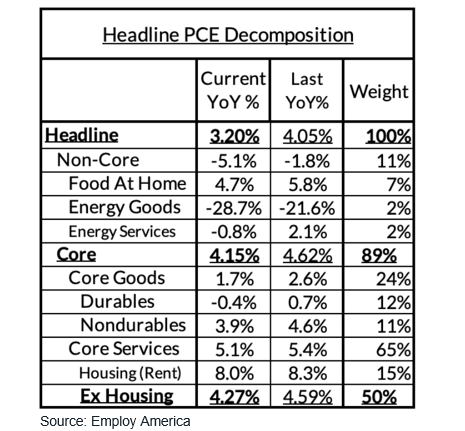

Table I

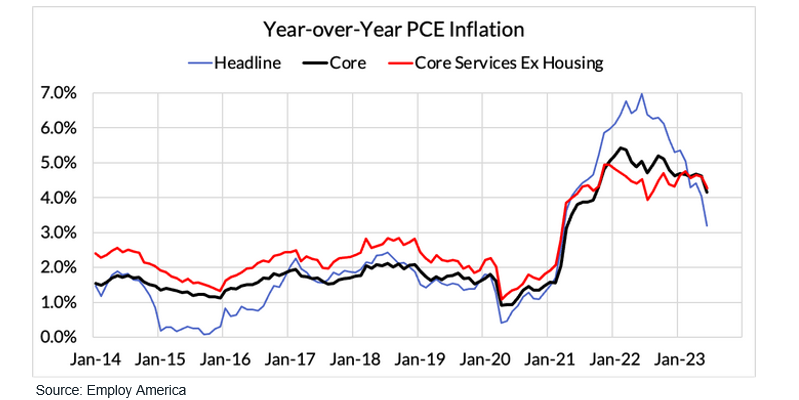

Chart I

June PPI largely confirms June CPI implications for Core PCE. Monthly Core and Core Services Ex Housing PCE is likely to be close to the Fed's 2% PCE inflation goals. 1

Airfare PPI did not show the same downside as CPI (-0.5% vs -8.1%), healthcare services showed surprising downside, while vehicle insurance PPI spiked. The FOMC blackout period ended July 13, and was the last chance for Fed officials to publicly express any new perspective on the data before the July FOMC meeting. One more bit of PCE inflation information in the blackout period: import price data on airfares. 1

The Fed seems very keen to hike in July, but we would note that the data is starting to show signs of underperforming what the Fed penciled in for inflation not just in June but even March too (when the Fed penciled in no additional hikes from here). At this point, a dogmatic July hike looks more likely than a data-dependent hold. 1

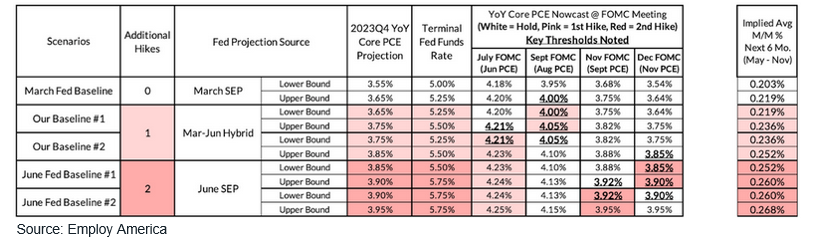

Table II

In Table II, the outlook for zero, one or two additional hikes and the terminal rate in Fed funds is dependent on the monthly increase in Core PCE over the next six months. A monthly rate of 0.20% to 0.22% indicates the Fed is on hold. A 0.22% to 0.25% monthly increase would call for one more 25 basis point hike. A monthly gain of 0.25% or greater forecasts two hikes.

The Fed’s determination for a Core PCE of 2% from the current 4.15% is the “last and hardest mile.” Core PCE Ex Housing needs to run at 0.23% or less monthly rate coupled with a significant deceleration in OER and Rent inflation.

1 June Core-Cast Post-PPI; Will the Fed Be Dogmatic or Data-Dependent?, Employ America, July 13, 2023

To view all our products and services please visit our website www.idcfp.com. For more information, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director