Can 2% Inflation Be Achieved Without Causing a Recession?

An Executive Summary of Employ America’s June Core-Cast and Why It Can

- Core PCE and Core Services Ex Housing are at 2% for this month. While this reading is only from one month, it's the start of a necessary condition. Inflation must run at or below 2% for consecutive months if year-over-year inflation is to reach the 2% level. Right now, inflation is decelerating ahead of schedule. It’s possible for the developments seen today to revert in future months, but the expectation is that the next two months will be softer for core inflation than in June.1

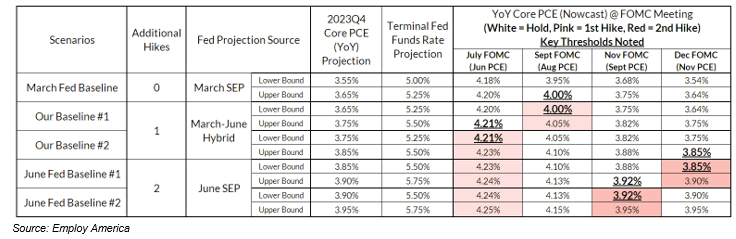

- The Last Mile of Disinflation – Will it be the Hardest? In the Fed’s and broader discussions of inflation, "the last mile will be the hardest" rhetoric has been prevalent. Rent and motor vehicles are only part of the inflation overshoot, and not likely not the only segments of core inflation with capacity for deceleration over the coming months, especially if energy and other input costs are relatively stable. Other inflationary causes also could dissipate and even reverse, including food services, other core goods, and demand for in-person services. While it's possible the last mile of disinflation will indeed be the hardest, below is a table of alternative scenarios and the feasibility of each materializing.1

Table I

Core PCE inflation is now tracking down faster than what the Fed would have assumed in their March projections.1

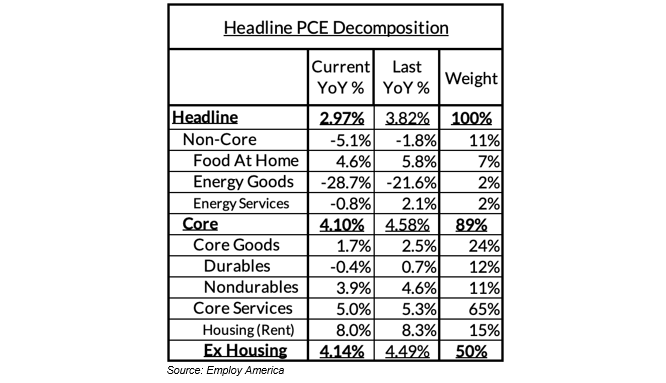

Table II

- Headline PCE declined, from 3.82%* year-over-year in May to 2.97% in June This is a 0.16% monthly increase. *The latest revisions push year-over-year readings for May marginally from 3.85% to 3.82%.1

- Core PCE declined, from 4.58%* year-over-year in May to 4.10% in June. This is a 0.17% monthly increase. *The latest revisions push year-over-year readings for May from 4.62% to 4.58%. Monthly annualized core PCE was precisely 2.00%!1

- Core Services Ex Housing PCE (CSXHP) declined, from 4.49%* year-over-year in May to 4.14% in June. This is a 0.22% monthly increase. *Latest revisions push down May year-over-year readings from 4.54% to 4.49%. When core PCE is running at 2%, CSXHP typically runs at 2.68%. The current overshoot is effectively 146 basis points (196 basis points as of the May PCE release). Monthly annualized CSXHP is 267 basis points, 1 basis point below what transpires when PCE is at 2%.1

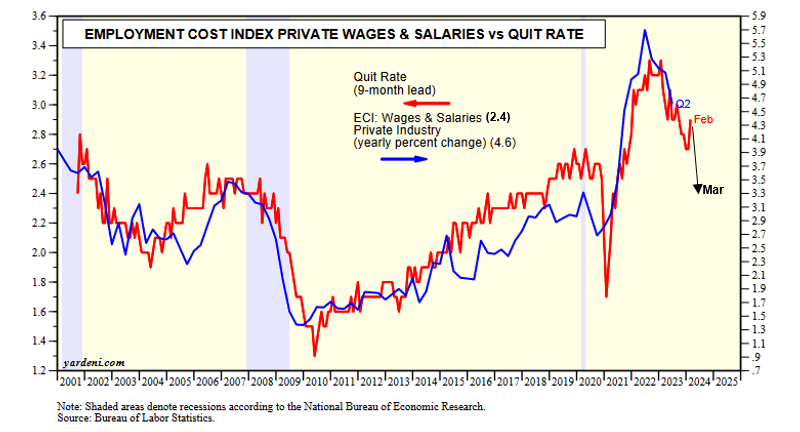

Quit Rate Falls

Wages and salary growth decelerated to 4.6% in the second quarter. Future deceleration to 3% is required over time to meet overall inflation targets. The quit rate plotted 9 months forward correlates to wage and salary growth.

Quit rate fell to 2.4% a new cycle low in June. Plotted in March 2024, the 2.4% quit rate forecasts a 3.3% growth in wages and salaries, close to the 3.0% target.

Chart I2

1 - June Core-Cast Post-PCE: Proof-of-Concept That 2% Inflation Can Be Achieved Without Recession, Employ America, July 28, 2023

2 – Yardeni Research

To view all our products and services please visit our website www.idcfp.com. For more information on banks with brokered CDs outstanding, and the amount of these CDs, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director