Unrealized Losses on Securities Held by Banks Increased Over 20% in the Third Quarter

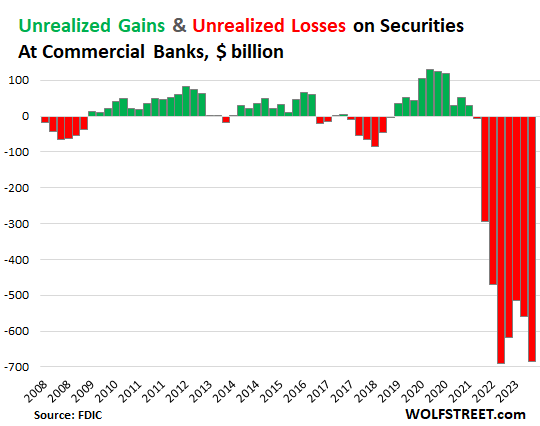

Predictably, in times of higher interest rates, unrealized losses occur. As yields rose in 2023Q3, the market prices of the bonds fell, and unrealized losses accumulated. According to the FDIC’s quarterly bank data release from last week, those losses jumped by $126 billion (22%) from the previous quarter to $684 billion (see Chart I).

There are two accounting methods that encompass unrealized losses. One is unrealized losses on held to maturity (HTM) securities, which jumped $81 billion from the previous quarter to $391 billion. The second is unrealized losses on available-for-sale (AFS) securities, which jumped $45 billion to reach $293 billion. 1

Chart I

Unrealized losses on securities held by banks are technically temporary, because at maturity banks are paid face value, in 7 or 10 or 25 years. Banks don’t have to assign market value to these securities, but carry them at the purchase price. That difference between the market value and the purchase price is the unrealized gain or loss that banks must disclose in quarterly financial filings. As a result, depositors have reacted and pulled their money, leading to the failure of banks like Silicon Valley Bank, Signature Bank and first Republic. 1

The current loss rate of $684 billion is still lower than the record from 2022Q3, but that’s likely because the FDIC took over 3 regional banks earlier in 2023, sold their assets and securities at something close to market value, and ate those paper losses. 1

The $391 billion in HTM in unrealized losses is 17.5% of total bank equity or $2.24 trillion, and 18% of Tier I capital or $2.14 trillion. 1

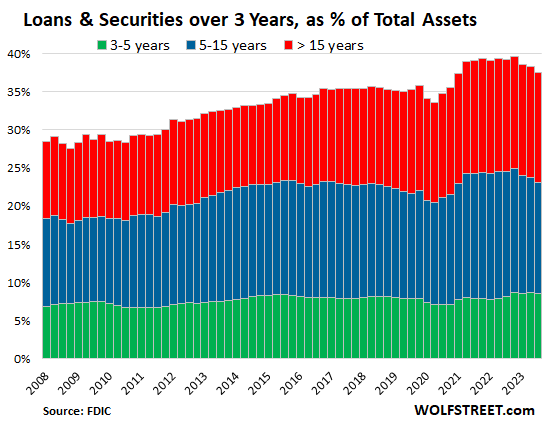

Loans and securities with a remaining maturity of over 15 years equals 14.4% of total assets, the lowest since Q1 2021. Those with a remaining maturity of 5-15 years equals 14.5% of total assets, the lowest since Q4 2020. Lastly, loans and securities with an outstanding maturity of 3-5 years equals 8.6% of total assets, remaining roughly stable (see Chart II). 1

Chart II

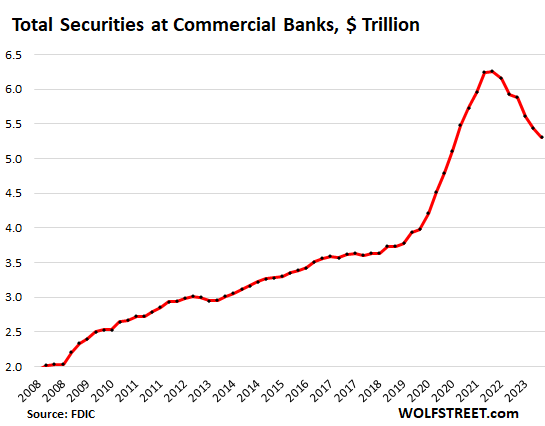

The total pile of securities held by all commercial banks fell to $5.3 trillion at the end of 2023Q3, down by nearly $1 trillion from the peak in 20221, when the Fed’s rate hikes began (see Chart III). They include both securities valued at market price and at purchase price. 1

Factors that make up this decline include the securities of the collapsed banks that the FDIC sold, which are no longer part of this, plus banks have written down AFS securities to market value, and lastly, banks may have sold some securities. 1

The $684 billion in unrealized losses above amount to about 13% of the total securities held by banks. 1

Chart III

Chart III also shows how banks binged on securities, at the worst possible time just when yields were at historic lows, stimulated by the Fed’s forward guidance at the time of no rate hikes for years to come. “We’re not even thinking about thinking about hiking,” Powell infamously said less than a year before kicking off the fastest rate hikes in 40 years and the biggest Quantitative Tightening (QT) ever.1

Treasury Note and Bond Yields Decline in Early December

The 10-year T-Note yield fell from 5.1% to 4.2%. In future articles, we will focus on an expected range of the 10-year T Note yield between 4% and 5%, based on expected growth in nominal GDP (inflation plus real GDP growth).

1 – “Unrealized Losses” on Securities Held by Banks Jump by 22% to $684 Billion in Q3,, Wolf Street, 11/30/2023

To view all our products and services please visit our website www.idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director