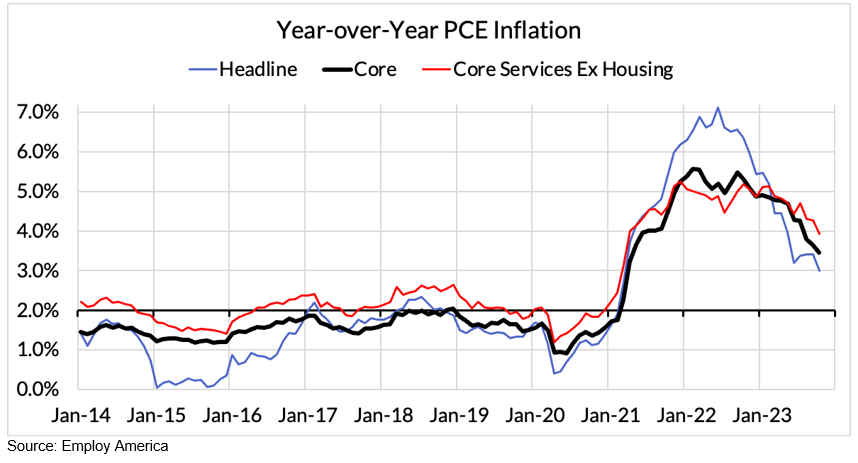

Decline in Super Core (PCE Core Inflation Less Housing) Forecasts Decline in 10-Year T-Note Yields

Real GDP growth plus inflation forecasts the 10-year T-Note yield. Core PCE is at 3.46% currently with the expectation of 2.3% to 2.5% in 2024. Combined with a 2% real GDP growth forecast, the 10-year T-Note yield is set to decline to 4.11% in December 2023.

Table I

Chart I

Table II

Welcome news about the dis-inflationary pace came at the end of November after some surprising downside revisions. The segments of core PCE most vulnerable to revision (professional, financial, and transportation services) showed more favorable signs with the Fed’s latest release.1

- Year-over-year Core PCE readings will finish 2023Q4 around 3.4%, possibly even falling to 3.3%. That is 30-40 basis points below the Fed's September projection.1

- 3–6-month annualized rates of Core PCE are between 2.3-2.5%, uniformly below the Fed's 2024Q4 projections (2.6%). Given the likely deceleration in rent, along with further supply-chain-driven disinflation (spanning goods and services), the Fed's 2024Q4 projections look high relative to reasonable baseline scenarios. This may serve as an additional motivation for easing policy sooner, as early as May 2024 at the FOMC meeting.1

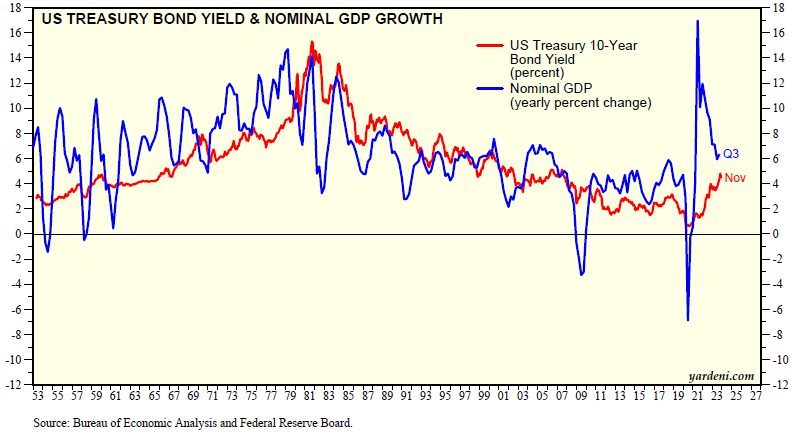

History of U.S. 10-Year T-Note Yield and Nominal GDP Growth (Real GDP Growth Plus Core PCE Inflation)

A strong economy with 3% real GDP growth and expectation of 2% inflation forecasts the 10-year T-Note yield at 5%, while a 2% real growth rate and 2%-plus inflation forecasts a 4%-plus T-Note yield (see Chart II).

Chart II

Drops in the T-Note yield to 4.11% implies 2% real GDP growth and 2%-plus core inflation with a soft landing. Those with a bearish outlook see 2% real growth in a soft landing with 3% core inflation and 5% nominal growth, or T-Note yield at 5%.

In a mild recession, real GDP declines to below 2% with inflation at 2% and the 10-year yield holds at 4%. A drop in the 10-year T-Note yield below 4% forecasts a decline in real growth in GDP below 2%, and both nominal and real negative GDP growth in a major recession.

1 - October Core-Cast Post-PCE: The Good News Keeps Coming In And Accelerates The Potential Timeline For Cuts, Employ America, 11/30/2023

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director