The Fed’s Shrinking Balance Sheet is Creating Concern

Following the Fed meeting last week, markets staged a major rally when the Fed gave its clearest signal yet that its tightening campaign is over, projecting more interest rate cuts in 2024. The message sent stocks soaring and pushed the 10-year yield below 4%, and reinforced the Fed’s plan to continue reductions in its balance sheet.1

The Process of Shrinking the Balance Sheet

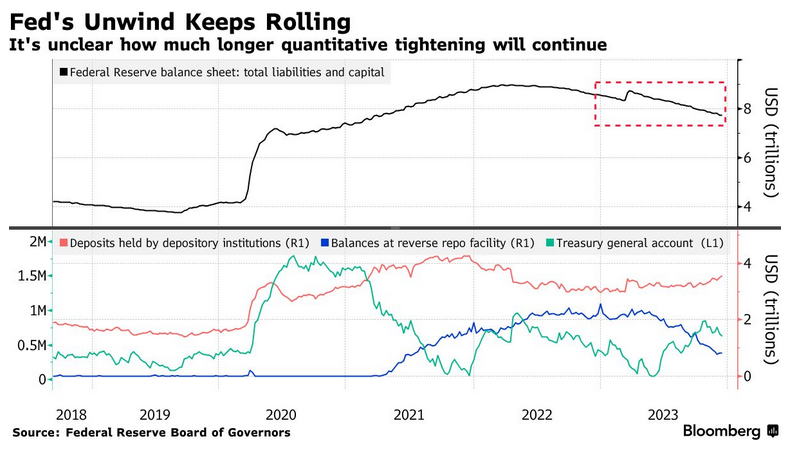

The reduction process, known as quantitative tightening (QT) has recently sparked debate over how quickly the Fed can shrink the balance sheet without causing disruptions in essential parts of the financial system, including the repurchase-agreement market. 1

Recent disruptions, though not as severe, evoked memories of 2019 when the central bank had to intervene. Both episodes shine a light on the increasingly delicate balance between the Fed, banks and institutions that help keep the overnight funding market functioning. Four years ago, the increased government borrowing exacerbated a shortage of bank reserves created when the Fed cut back on Treasury purchases. Today, the level at which reserves become scarce is again in question. 1

Powell stated on December 13 that he was comfortable with the current level of reserves and the central bank would slow or stop reductions to maintain a certain level the Fed considers somewhat above ample, but it’s unclear what thar level is. 1

Chart I

This QT is happening at a time when banks are less in a position to pick up the slack because of post-crisis regulations. In these funding markets, banks, along with other fund sources, make overnight loans collateralized by US Treasuries. Where these rates trade largely depends on the balance between the amount of cash in the market versus securities available, or supply versus demand. As long as the amount of reserves in the system remains abundant, overnight rates are mostly stable. 1

It's doesn’t appear that reserves are scarce, with just under $800 billion in the Fed’s overnight reverse repo agreement facility (RFP) and $3.5 trillion in bank reserves, yet there are signs those cash cushions are being safeguarded and there is less confidence about the actual abundance in the banking system. 1

Fed to Raise Yields on the 10-Year Above 4% at Current Pace

During the pandemic, the Fed bought about $4.6 trillion of Treasuries and mortgage-backed securities to keep long-term rates low and stimulate the economy. That process created a wall of money that needed to get deposited somewhere and lead to excess liquidity in reserves and balances at the RRP. 1

Since 2022 the central bank has been rolling over some of the bonds on its balance sheet at maturity without replacing it with other assets. The government subtracts the sum from the Treasury cash balance kept on deposit with the Fed to pay the maturing bond, effectively disappearing the money. 1

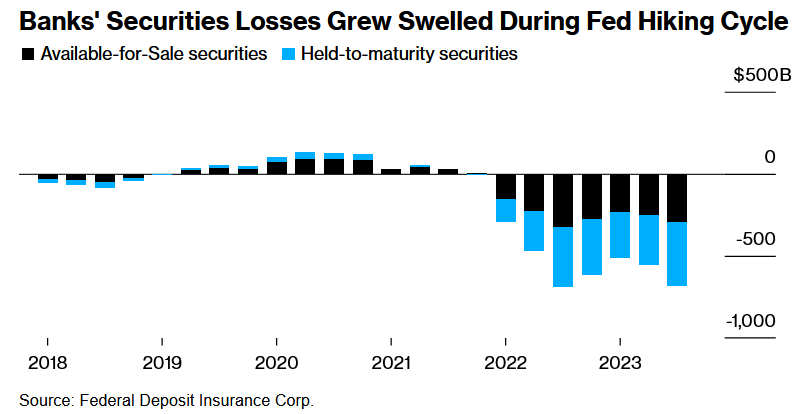

When the Fed started raising interest rates in Match 2022, banks were comfortable, even apathetic, about shedding deposits with the onset of QT since many had accumulated trillions during the pandemic. But, in March 2023, that sentiment was shaken with the failure of banks like Silicon Valley Bank, spurring depositors to pull trillions from the banking system. Customers realized they could earn more yield on their cash elsewhere, and shifted to alternatives like money-market funds. Banks have stabilized, but at a cost of increased rates on certificates of deposit. 1

Chart II

Banks are still holding sizable losses, and attempts to sell securities and raise liquidity will deplete capital and be viewed negatively by the market, so they may want to hold more cash as a buffer. This points out the difference about why banks are demanding liquidity and why they’re demanding more. 1

If the balances at the reverse repo continue declining, the Fed could halt its balance sheet runoff earlier than expected, and could be as early as May or June when Barclays estimates the RRP to be completely empty. Fed policy makers, though, say the central bank is far from reaching the moment when it determines the reserves are at the lowest comfortable point, but they also don’t have an answer to what that point is. This unknown, coupled with the recent Fed-induced rally across Treasuries increases the chance of tremors to the dollar funding markets. 1

A Decline in the 10 Year Yield to 3.5% or Below Forecasts Recession

In a mild recession, real GDP declines to below 2% with inflation at 2% and the 10-year yield holds at 4%. A drop in the 10-year T-Note yield to 3.5% or below forecasts a decline in real growth in GDP below 2%, and both nominal and real negative GDP growth in a major recession.

A recovery in the 10-year yield above 4% indicates supply problems from new debt or a return of core long term inflation.

Sources:

1 - The Fed’s Shrinking Balance Sheet Is Worrying a Key Corner of US Financial Markets, Bloomberg, 12/15/2023

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director