The Fed Can End Bank Runs

A year ago, the U.S. faced a frightening reality when there was a run on banks. Fearing collapse, depositors raced to pull their money out, resulting in the shut down of Silicon Valley Bank.

Going forward, this can be prevented if the weaknesses are addressed in the system, including more regulatory transparency, rules for regional banks exceeding $100 million in assets, and more diverse stress tests for institutions.1

In the current age of online banking, app usage and social media, the threat of banks runs remains large. Uninsured deposits can disappear at a much faster pace than what liquidity rules are supposed to ensure – that banks have enough cash on-hand to survive 30 days.

A response could be to tighten the rules for banks, and increase the liquid assets banks must hold to assume for more runoffs. The problem with this is the higher cost and lower lending capacity for banks, resulting in a weaker overall system. 1

A Better Way

The Fed already backstops banks, ready to provide emergency loans against good collateral. In order to improve on this, the Fed should require banks to pledge enough collateral to cover all runnable liabilities like uninsured deposits and debts coming due in less than a year. The collateral would be valued at market price and include a buffer to protect the Fed from losses.1

This structure could eliminate runs because depositors would be assured banks had enough money to pay everyone no matter what, and therefore less likely to pull their money in the first place. It would also prevent banks from issuing short-term liabilities that they cannot afford to redeem, and reestablish the Fed’s role in emergency lending.1

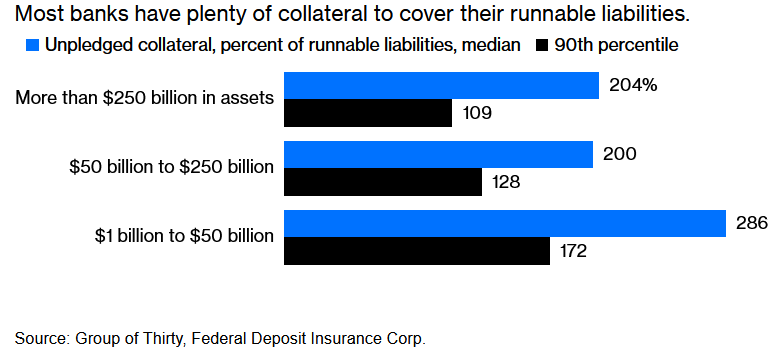

Some banks might oppose a pre-collateralized requirement, but most banks have far more collateral than runnable liabilities and would be able to meet it according to this report and the chart below. Smaller banks typically have insured deposits so they would see little difference with this application, and may even be exempt if they are too small to present a systemic threat.1

Chart I

Banks that rely heavily on uninsured deposits and suffer declines in the value of their collateral would be the primary institutions affected. If this requirement had been in place, SVB would have been forced to address the run risks long before it became a threat.1

Furthermore, liquidity rules would be simplified. Bank would be required to hold enough liquid assets to manage their day-to-day business and rely on the Fed in case of emergency. This is why the Fed was established. Banks don’t have the resources to insure against banking panics on their own.1

Banks Take Advantage of Emergency Lending Program

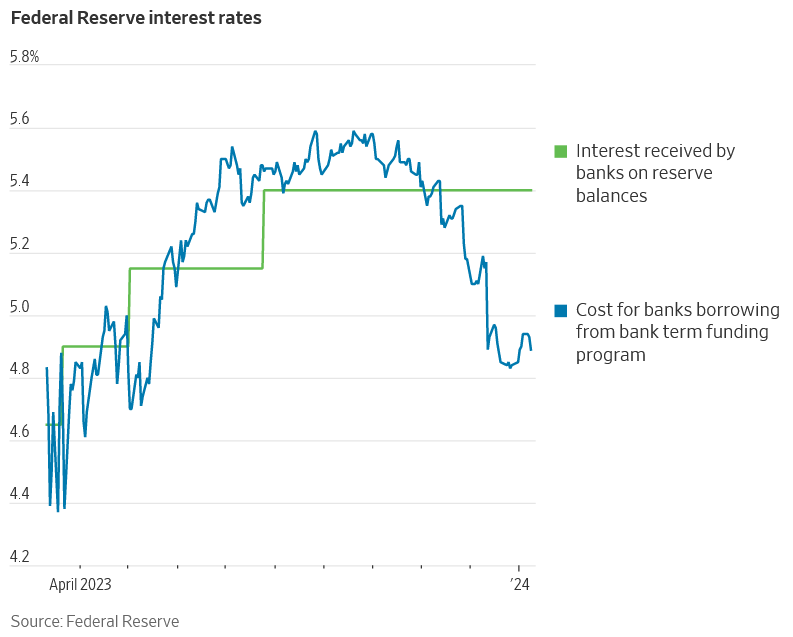

When borrowing costs fell below payment by the Fed costs, banks took advantage. As of last week, lending in the bank term funding program (BTFP) reached a new high and was up 25% since November. Since the program is tied to future interest rate cuts, banks pocket the difference between what they pay to borrow the funds and what they can earn from parking the funds at the central bank in overnight deposits (see Chart II).2

It is important to be careful of solutions to solve holding of losses on securities available for sale and held to maturity. In the case of BTFP, the benefit will eventually shrink and come to an end, and if traders shift their expectations to anticipate fewer cuts, that will raise pricing and reduce the program’s appeal.

Fed officials are forecasting just three rate cuts this year, and strong data has already tempered expectations by investors for central bank easing. The pain of higher deposit costs will continue and shrinking profits in big banks are expected. 2

Chart II

The Importance of IDC’s Ranks

As of the third quarter 2023, IDC Financial Publishing ranked over 400 banks below investment grade. Given the large number of unknowns, risk of instability, and much-needed change in banking industry regulations, IDC’s ranks are imperative to measure banks’ safety and security.

Visit our website to learn more about IDC’s financial institutions rankings.

1 - Bank Runs Are Terrible. The Fed Can Eliminate Them. Bloomberg, 01/10/2024

2 - The Fed Launched a Bank Rescue Program Last Year. Now, Banks Are Gaming It., Wall Street Journal, 1/10/2024

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director