A Contrarian View on Inflation

It appears that PCE inflation is encouraging, with the core PCE price index at +2.9% year-over-year in December, the lowest since March 2021 and aiming for the Fed’s 2% target. But, after being stuck at 3.5% over the past six months annualized, core services accelerated to 4.0% in December, while housing inflation continues to be stuck at 5.7% over the past six months annualized.

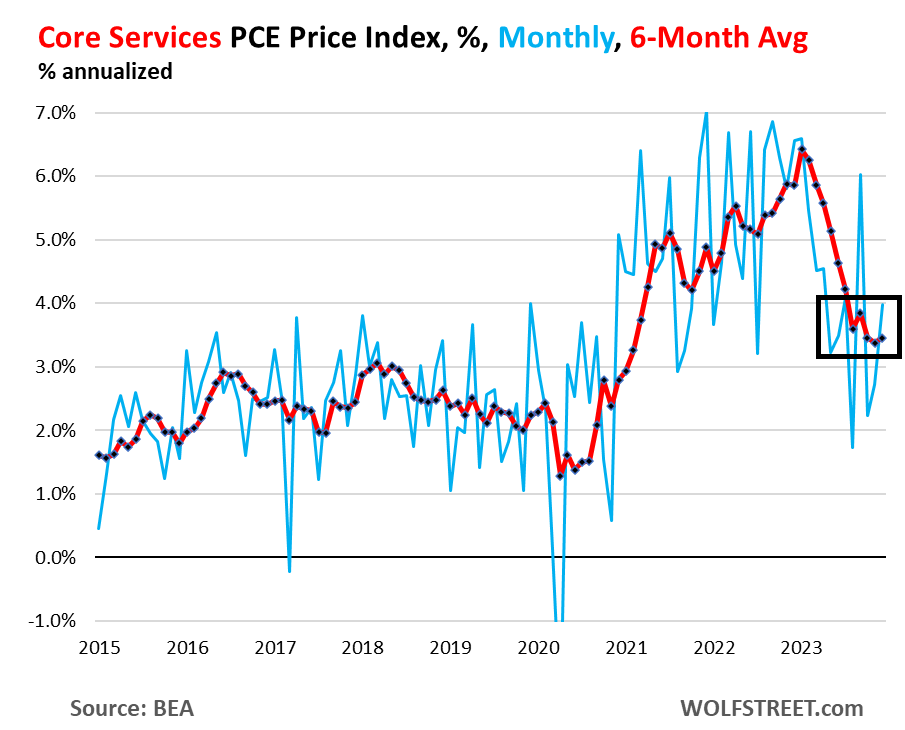

Core Services PCE Price Index

Core services is where the majority of consumers spend their money, and a key economic indicator. The Fed has shown a lack of urgency to cut rates as they watch and wait to see what will happen with core services month-over-month. 1

The core services PCE price index rose by 0.33% in December from November, which was the second acceleration in a row, and equal to a 4.0% annualized increase. Following a sharp deceleration through early 2023, the six-month moving average also accelerated to 3.5% (see Chart I).1

Chart I

The cooling in the year-over-year PCE inflation has been due to plunging energy and durable goods prices, food inflation, and favorable “base effects” compared to a year ago. To put that into perspective, however, those plunging prices will not continue at a sustained rate, food prices are coming down from very high levels, and those favorable base effects will get timed out this year. 1

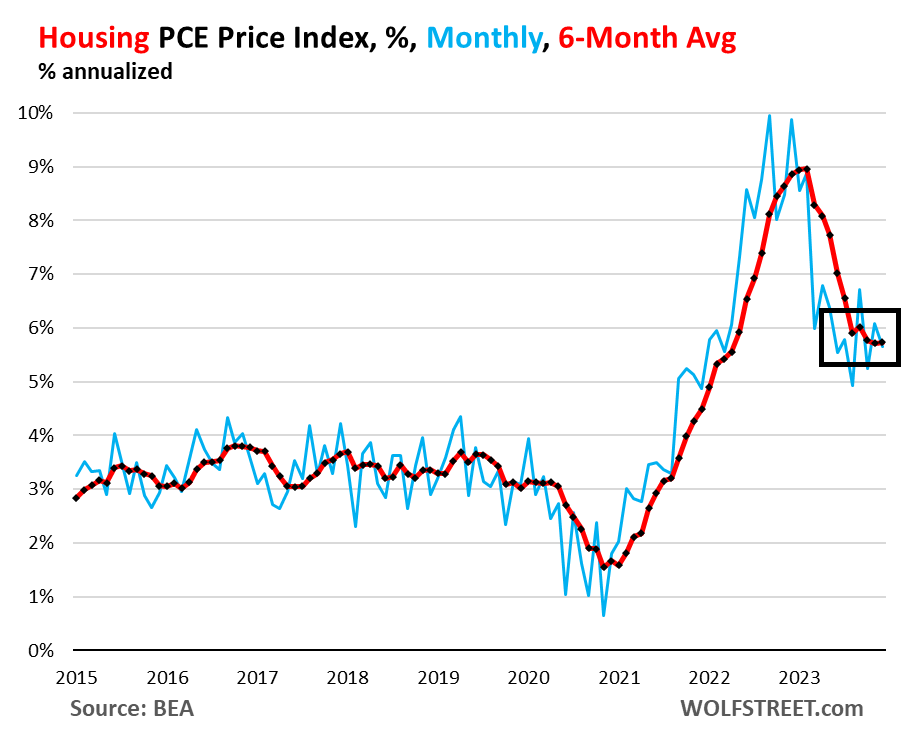

Housing Inflation

Housing is the largest component of core services and is broad, including factors for rent in both tenant and owner-occupied units, group housing and farm dwellings. 1

The fervent inflation rate for housing in 2012-2022 is no more. The PCE price index for housing has sustained in the range of 0.46% since last March, and seems to be stuck at 5.7% for both an annualized and six-month average (see Chart II). While the increases are less steep, the rate remains at a persistent level.1

Chart II

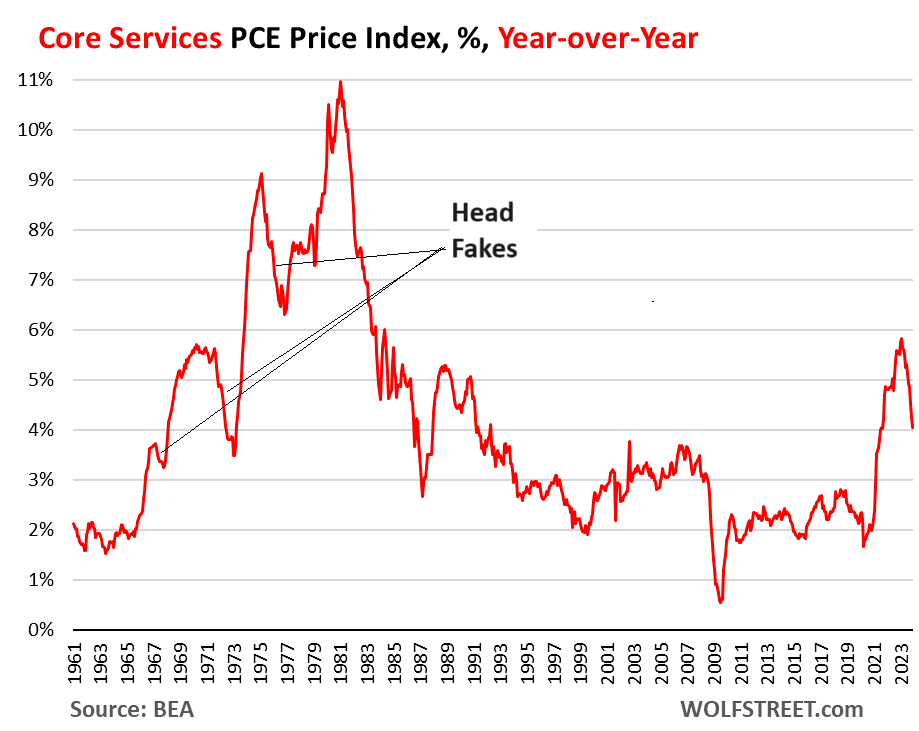

Confusing Head-Fakes1

In the past, services inflation has dealt some unexpected and sudden directional shifts or “head-fakes.” The last time we saw this surge of inflation was in the 70’s and 80’s, when, repeatedly, we thought inflation was under control, but then the rate shifted direction, creating multiple head-fakes before the actual peak in the core services PCE price index of 11% in 1981 (see Chart III).1

Chart III

Visit our website to learn more about IDC’s financial institutions rankings.

1 - On the Surface, PCE is Encouraging, But Beneath It, Core Services Accelerated... Wolf Street 01/26/2024

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director