IDC’s 2023Q4 CAMEL Analysis Indicates Mixed Results

The Importance of IDC’s Ranks

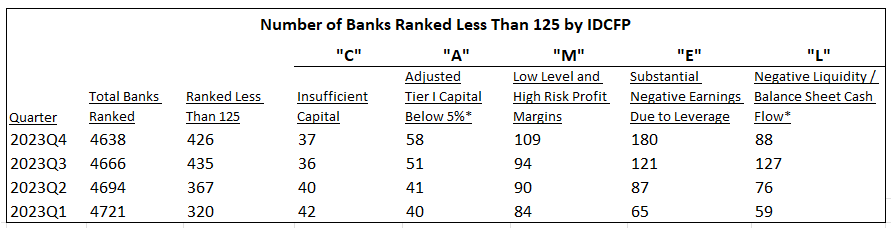

As of the fourth quarter 2023, IDC Financial Publishing (IDCFP) ranked 426 institutions below investment grade (see Table I). The number of banks ranked less than 125 decreased from the previous quarter, as did the total number of banks ranked overall. However, the number of banks in most categories of CAMEL increased in 2023Q4. The only exception is the number of banks with negative liquidity or negative balance sheet cash flow, which fell by 39. Given these trends, our ranks are imperative to measure banks’ safety and security.

Table I

IDCFP’s Reduction in Bank Ranks from Three Risk Ratios

Beginning in 2023Q2, IDCFP has included the following three risk ratios with our longstanding rank evaluation to better reflect the changing risks to a bank. The three additional ratios are a part of the number of at-risk institutions with negative liquidity or balance sheet cash flow (the L in CAMEL).

- Risk to Tier I Capital: Risk associated with the Tier I capital ratio reported below 5%, excluding unrealized losses on securities held for sale (AOCI).

- Negative BSCF: Negative continuous quarter-to-quarter change in Balance Sheet Cash Flow (BSCF) over 4 or more quarters, results in a decrease in the rank equal to the negative BSCF calculated over the last year period.

- Liquidity Risk: Liquidity risk is further identified by the uninsured deposits and borrowings greater than the assets available for liquidation. This percentage is multiplied by the ratio of unrealized losses on securities, held to maturity, to tangible equity capital.

The Warning Signs Before a Financial Crisis

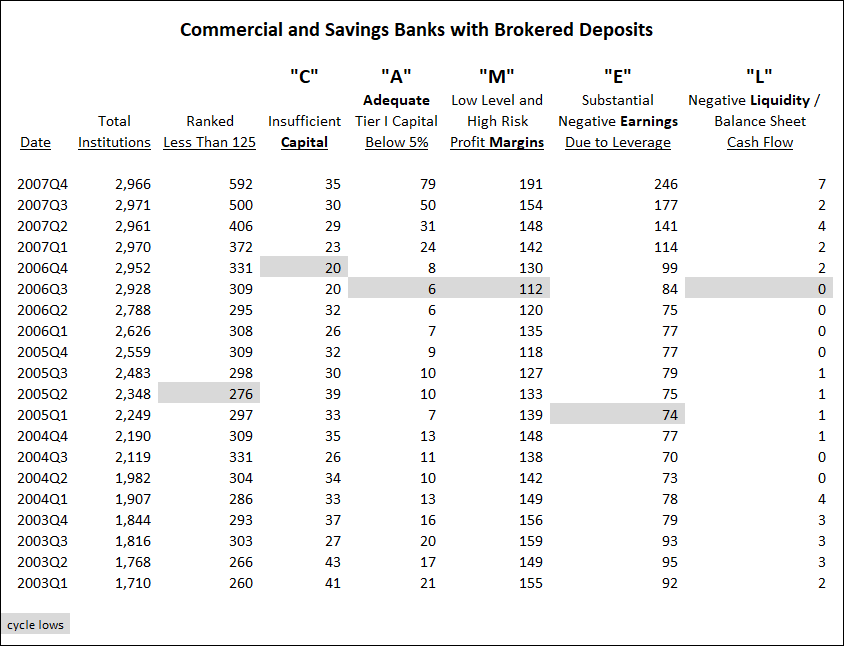

Since 1985, IDCFP has evaluated banks’ safety and soundness The number of at-risk banks with brokered deposits and ranked less than 125 by IDCFP began to rise in 2005, following a low of 276 in the second quarter of 2005.That number continued to rise and accelerated in 2007. This rise in banks ranked below investment grade by IDCFP signaled the financial crisis with a 3-year lead time (see Table III).

Rise in at-risk banks with brokered deposits under each component of the IDCFP’s CAMEL rank also began in 2005. Table III shows how each component of our CAMEL ranks reached cycle lows in the number of banks ranked under 125 and subsequently rose to higher numbers well in advance of the financial crisis.

- The earliest warning came from the E in CAMEL falling to 74 in the first quarter of 2005.

- In the third quarter of 2006, the A, M and L also reached lows.

- In the fourth quarter of 2006, the C in CAMEL reached its low 18 months before the financial crisis.

Table II

There is a great deal of uncertainty and opinion about how the banking industry operates following the fall of SVB bank in 2023. IDC Financial Publishing’s evaluation and bank rating remains critical to bank investors and managers.

Visit our website to learn more about IDC’s financial institutions rankings.

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 orinfo@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director