The Worst Monthly Spike in Core Services in 22 Years

Inflation in “core services” has been a hot topic for the Fed for over a year. It’s where consumers spend the majority of their money now, compared to in 2022 where the focus was in goods and services. Core services is all services except energy services, and it spiked massively in January.

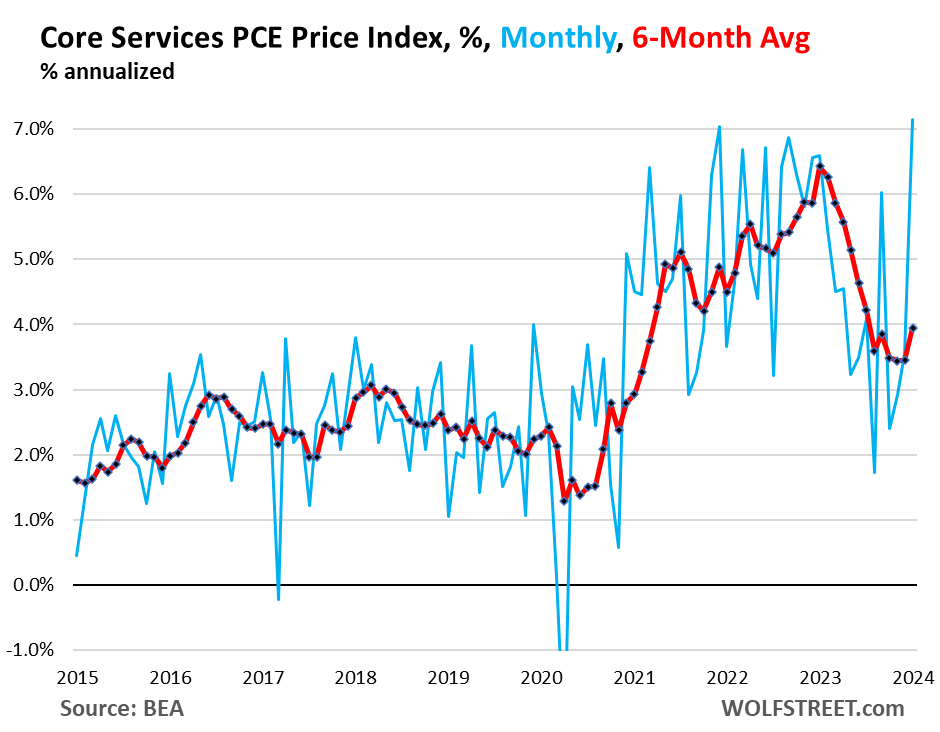

The core services PCE price index spiked to 7.15% annualized in January from December, the worst month-t0-month jump in 22 years (blue line, Chart I). The six-month moving average which usually smooths out month-to-month volatility, also accelerated to 3.95% annualized after being stuck at a level of 3.5% for three months in row (red line, Chart I). This is according to data released last week by the Bureau of Economic Analysis and is primarily due to both non-housing measures and housing inflation.

Chart I

Fed is Hesitant to Cut Rates

This trend seen since June of 2023 with core services inflation was confirmed recently by core services CPI (services minus energy services) from January that jumped by 0.6% from December, or 8.2% annualized. The three-month moving average also jumped by 0.5%. As a result, the Fed has communicated they are in no hurry to cut rates, and may even be entertaining rate hikes again. Fed governor Michelle Bowman said last week that she was “willing to raise the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed.”

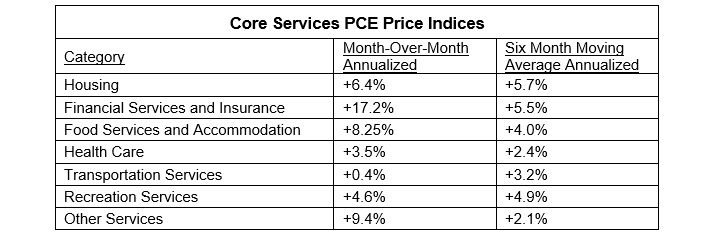

Categories of Core Services Inflation

Core services are grouped into seven PCE price indices. These categories are where the majority of consumers do their spending and can be very volatile month-over-month. Focusing on the six-month moving average allows for some of that volatility to be ironed out and better reflects the actual trends.

Table I

No Head-Fakes This Time

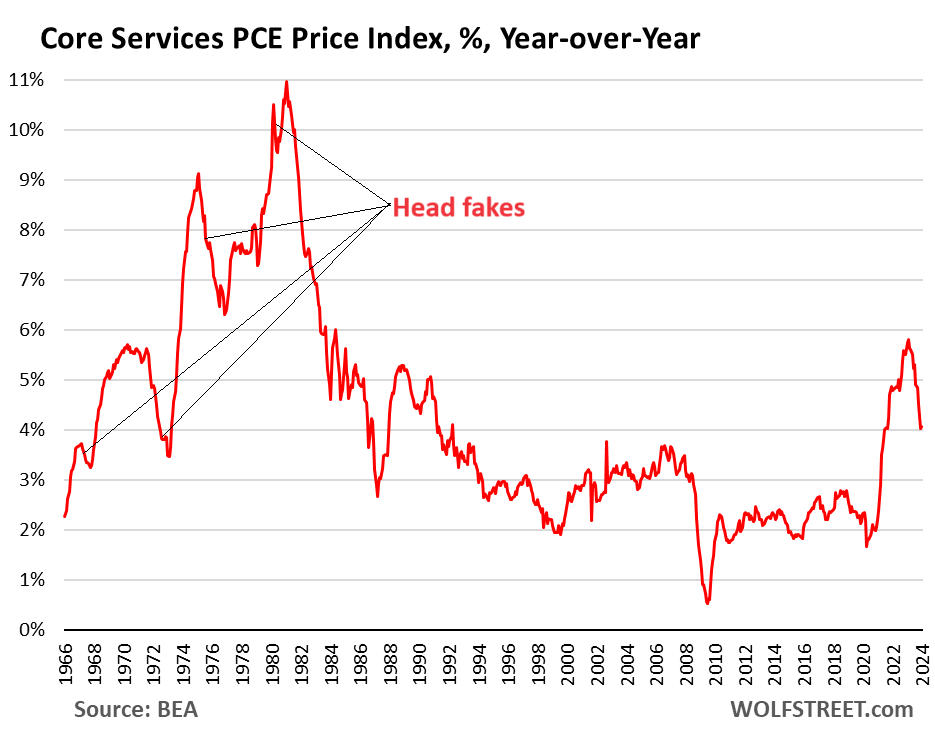

Inflation in core services has been tough to beat in the past. Just when the Fed thought interest rates had beaten inflation and eased rates, it turned out to be a “head-fake” and the Fed jacked up rates even higher (see Chart II). The Fed seems keenly aware of this and, therefore, continues with its wait-and-see approach.

Chart II

1 - Worst Monthly Spike of "Core Services" PCE Inflation in 22 Years,... Wolf Street, 2/29/2024

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.