IDC's Track Record as a Financial Institution Rating Agency

IDC's rating methodology and track record are the reasons IDC is considered the nation’s prime source of financial institutions quality rankings. Users of IDC’s ratings have witnessed a superior degree of success in predicting bank failure.

Non-recurring or unusual circumstances can affect an institutions rating. Financial institutions or other clients with knowledge of such circumstances are encouraged to contact IDC. Institutions are constantly monitored and adjustments to ratings can be made where appropriate. IDC’s goal is to provide the best measure of safety and soundness of an institution to our clients.

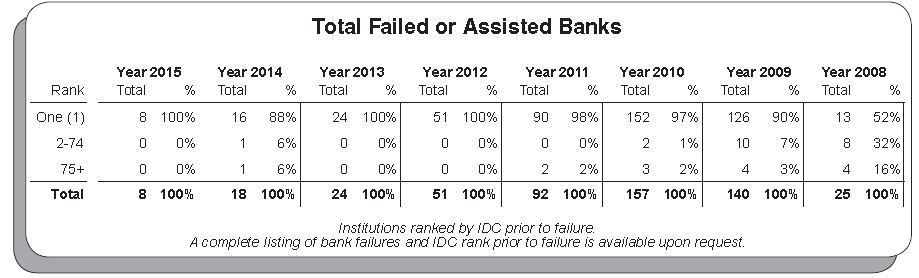

From January 1, 1990 through December 31, 2015 Federal Regulators closed 1,466 banks and savings banks that failed.

Ranks range from 1-300 and fall into the following groups: 200-300 “Superior”, 165-199 “Excellent”, 125-164 “Average”, 75-124 “Below Average”, 2-74 “Lowest Ratios”, 1 “Rank of One”.

· Since 1989, bank and savings bank failures, excluding failed banks due to fraud, small failed banks under $5 million in assets, and bank holding company failures, totaled 1,409 banks. Of this total, 99% were ranked less than 75 (Lowest Ratios) immediately prior to failure. Of the 1,409 banks, 90% were ranked less than 125 (Below Average) one year prior to failure and 72% were ranked less than 125 two years prior to failure. As of December 31, 2015, bank failures in 2014 through 2015 totaled twenty-six; twenty-four of which had a rank of 1 prior to failure.

· Fraud was indicated in 11 failed banks.

· Nine small banks, that failed, had less than $5 million in assets.

· In 1990 through 1992, holding companies were absorbing losses of subsidiaries, resulting in failure. Holding Company failures, National Bancshares Corporation in San Antonio, Texas (rank of 1 for 29 months), First City Bancorporation in Beaumont, Texas (rank of 1 for 17 months) and Bank of New England Corp. in Massachusetts (rank of 1 for 12 months) accounted for 34 subsidiary bank failures. These 3 holding companies were ranked 1 (lowest rank) in IDC’s Bank Financial Quarterly many months prior to failure.

· In 2008, holding companies were again absorbing losses of subsidiaries, resulting in failure. First National Bank Holding Company of Scottsdale, Arizona with a rank of 1 as of March 31, 2008 and its subsidiaries, First Heritage Bank of Newport Beach, California (rank of 179), and First National Bank of Nevada (rank of 124) failed on July 25, 2008 with Mutual of Omaha Bank of Omaha, Nebraska acquiring all deposits. A second holding company, Columbian Financial Corporation of Overland Park, Kansas (ranked 2) and its subsidiary bank Columbian B&TC of, Topeka, Kansas (rank of 60) failed on August 25, 2008 with Citizens bank and Trust of Chillicothe, Missouri acquiring the insured deposits.

A complete list of bank failures and IDC’s corresponding rating immediately prior to failure can be obtained by calling us at 800-525-5457 or via email to info@idcfp.com.

IDC is going ONLINE! IDC Financial Publishing, Inc. is excited about the launch of its online platform for presenting the IDC Rank of Financial Ratios and the CAMEL Analysis. Over 13,000 institutions will be readily available with rank, financial ratios, and commentary… all with a CAMEL Analysis. www.idcfp.com